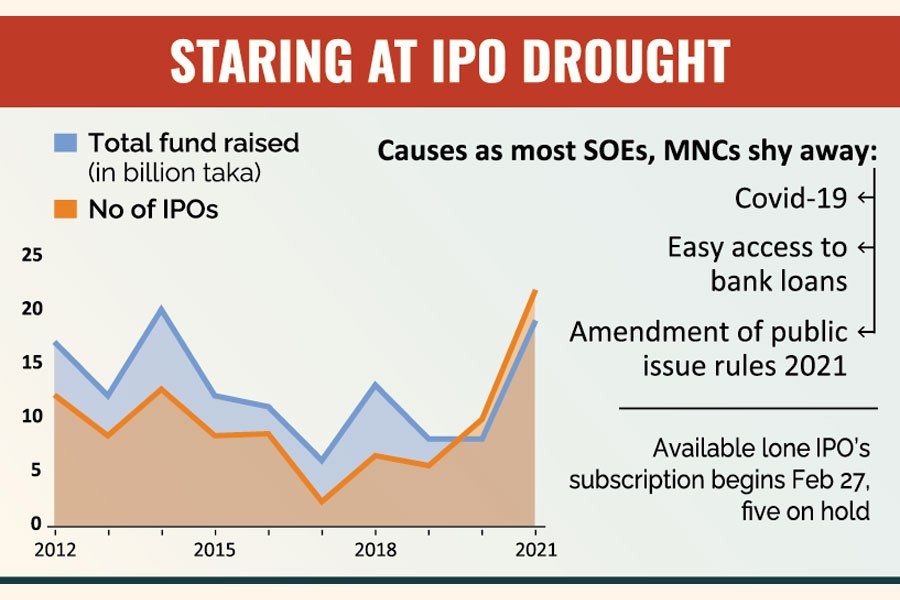

Bangladesh stock-market's IPO pipeline dries up, with no such equity-investment opportunity in sight for the securities regulator to clear soon, as many eligible companies duck securities listings.

Market analysts say the basket of initial public offerings or IPOs is at its driest level after many years, to the deprivation of particularly small investors in stocks.

It is believed that the small investors who run for the IPOs will not get the equity-investment opportunity too soon after the lone JMI Hospital Requisite subscription, beginning February 27, is over.

According to the market-regulator BSEC, only five companies' IPO proposals remained on hold. The issues remained "un-cleared for lack of requisite documents or having deficiencies".

State-owned companies, having special privilege for floating shares through direct-listing method, also have shied away from offloading on the chips-hungry bourses for many years.

However, some of the CEOs working with the country's merchant banks, who usually process IPOs, told the FE that easy funding from banks is one of the reasons for the supply line going dry, apart from the disruptive coronavirus pandemic.

Bangladesh Securities and Exchange Commission or BSEC sources told the FE that pandemic is a key reason as many companies are taking time for preparing their financial statements. Such statements "should be clean and profit-prospective".

Md Moniruzzaman, managing director at IDLC Investments, one of the largest merchant banks of Bangladesh, says: "Actually, we are facing the situation after many years. We had faced the similar situation soon after 2010."

The BSEC issued an order on February 01, 2021 relating to valuation methods of the companies preferring book-building method. It mentions three methods for valuation: net-asset method, yield method and fair-value method.

It tagged five years' earnings to show an issue's worth, he told the FE.

For example, in measuring yield method, it needs to calculate the value of an ordinary share equal to expected rate of earnings divided by normal rate of earnings (10 per cent or more) multiplied by par value or face value of an ordinary share.

He says: "The new provision is somewhat tough or challenging for the companies."

The merchant banker feels that the amendment of the public issue rule 2021 may be challenging for the potential companies.

Khairul Bashar Abu Taher Mohammed at MTB Capital Management, another merchant bank, finds the covid as a reason why some companies booked low turnovers for low sales.

"Banks' easy funding is a barrier, too," he told this correspondent.

The commercial banks have adequate liquidity and they offer funds without considering the equity investment of the companies.

He thinks discouraging such funding may promote the IPOs.

"To my mind, at least 30-per cent equity investment should be capped for getting 70-per cent debt from banks, which may stoke the IPOs."

However, many family-owned businesses of Bangladesh have not been showing interest in market exposure for long as the listing leads to compliance with rules, including disclosures on a regular basis.

Although the listed firms get many direct or indirect incentives, from tax cuts to branding, many argue that IPOs force them to be transparent.

There are many multinational companies in operations in the country that also remained hidebound as the government does not dictate them to come to the market in apprehension of adverse impact on the FDIs.

In the meantime, Md Rezaul Karim, a spokesperson for the BSEC, told the FE that applications for the IPOs usually come on two occasions: after October and after April. Those that are June-ending entities submit after October and the latter after April.

He feels this time covid may hold them back from preparing financial statements for the June-closing companies. Usually such companies mostly come in the market. Banks, insurance and MNCs maintain December as yearend.

Mr Karim, however, says that after getting replies from five companies the subsequent approval and listing will take place soon.

The five pending companies are Islam Oxygen, Asiatic Laboratories, Navana Pharmaceuticals, Global NRB Bank and Meghna General Insurance. Three of them may be listed through book-building method and the two through fixed-price process.

Around 500,000 BO account holders apply for the IPOs. They must have at least Tk 20,000 investment in the secondary market at market price to be eligible for IPO application.

Under the existing pro-rata system of IPO distribution, each applicant gets IPOs.