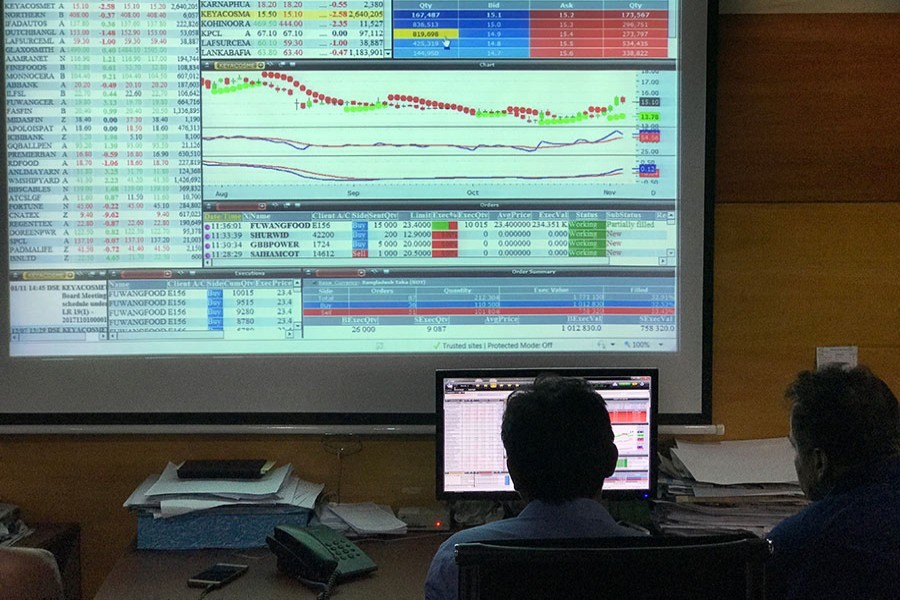

The country's premier bourse witnessed moderate loss both in broad index and turnover as well amid 'nervy' trading.

Selling spree was observed throughout the week as many investors opted to book profit from their holdings, while others preferred sidelines.

The week featured five trading sessions as usual. Of these, three sessions edged marginally higher while two sessions ended lower.

During the week, most of the major sectors witnessed correction while few others played market supportive role.

At the end of the week, the DSE broad index DSEX settled at 5,381.52 which was 0.98 per cent or 53.49 points less than the closing mark of previous week.

The shariah based index DSES declined 1.75 per cent or 22.21 points to close at 1,243.54 on Thursday.

The DS30 index comprising blue chip securities went down by 1.54 per cent or 29.69 points to close at 1,896.07 points.

"The shaky investors liquidated their holdings in large cap sectors especially from fuel & power, engineering, pharmaceuticals & chemicals, cement, textile and financial institution sectors which pushed down the market in last week," said a market review of International Leasing Securities.

It said the bargain hunters took position in food & allied and banking sectors.

Of 348 issues traded, 97 advanced, 223 declined, and 26 were unchanged on the premier bourse DSE. Remaining two securities were not traded in last week.

In last week, the premier bourse DSE featured a total turnover of above Tk 25.50 billion, 34.50 per cent less than the total turnover of previous week.

The daily average turnover stood at above Tk 5.10 billion which was 34.50 per cent less than the daily average turnover observed in previous week.

Another market review of EBL Securities said the premier bourse settled in red zone in last week as investors mostly followed cautious stance ahead of quarterly earnings disclosures.

"During the week, some investors opted to realise gains from their holdings, while many others remained cautious," the EBL Securities said.

It also said some positive news on macro indicators, like stable economic growth and increased inflow of remittance helped the market to escape large fall.

Of major sectors which declined, engineering declined 2.6 per cent, financial institution 1.1 per cent, fuel & power 2.8 per cent, pharmaceuticals & chemicals 1.6 per cent, telecommunication 0.2 per cent, textile 1.5 per cent and travel & leisure 1.9 per cent.

Of the gaining sectors, bank advanced 1.5 per cent, food & allied 2.0 per cent, jute 16.70 per cent, and tannery 1.7 per cent.

Khulna Power Company topped the weekly turnover chart with a value of above Tk 2.10 billion followed by Summit Power Tk 1.78 billion, United Power Generation & Distribution Company Tk 1.25 billion, Dragon Sweater and Spinning Tk 898.93 million, VFS Thread Dyeing Tk 575.25 million, Shasha Denims 562.16 million and Silva Pharmaceuticals Tk 546.63 million.

Of the these companies, the turnover of Khulna Power Company declined 5.50 per cent, Summit Power 12.55 per cent, United Power Generation & Distribution Company 0.68 per cent and Dragon Sweater and Spinning 0.59 per cent compared to their respective turnovers observed in previous week.

Republic Insurance was the number one gainer of last week. The company's share price rose 17.45 per cent to close at Tk 35 each on Thursday.

Northern Jute Manufacturing Compnay was the worst loser after declining 24.68 per cent to close at Tk 519.90 each.

IndoBangla Pharmaceuticals Limited made debut on Thursday and witnessed 343 per cent hike from its offer price of Tk 10 each.