Indo-Bangla Pharmaceuticals endured a 48.5 per cent year-on-year drop in income for the July-September quarter of FY23, caused by a significant decline in sales revenue.

The company has not mentioned the reasons behind the significant deviation in profit and other indicators though listed companies are required to give clarifications in such cases.

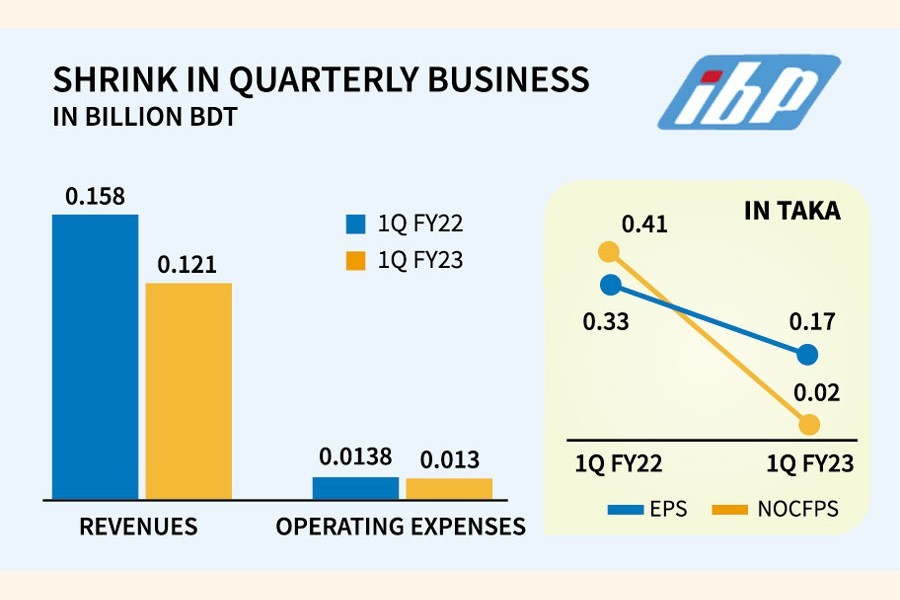

The EPS fell to Tk 0.17 for the quarter from Tk 0.33 a year ago.

The operating net cash flow per share (NOCFPS) has slumped to almost zero in the first quarter of FY23 from Tk 0.41 in the same quarter of last fiscal year.

While disclosing the financial statements for the fiscal 2022 ended in June, the company said the EPS had declined mainly because turnover had dropped by 38.04 per cent compared to the previous year.

"The turnover during the year has decreased due to discontinuation of 9 listed products and changing marketing policy of the company," the company said in a disclosure for the fiscal 2022.

The official concerned of the Indo-Bangla Pharmaceuticals could not be reached for comment despite repeated attempts.

Managing Director of Midway Securities Md. Ashequr Rahman said many pharmaceutical companies felt compelled to change their marketing policies amid changed circumstances.

"That's why, their sales revenues declined. The discontinuation of the company's nine products may be a reason behind the low turnover for the Q1, FY23."

The sales revenue declined 23.47 per cent year-on-year to Tk 121.48 million for Q1 of FY23.

The company's operating profit also plunged 50 per cent to Tk 25.66 million over the period.

For the Q1, 2023 the company has reported a net profit of 19.87 million, 47.86 per cent less than that of the same period in the previous year.

Indo-Bangla Pharmaceuticals, presently a 'B' category company, was listed with the bourses in 2018.

The stock closed at Tk 27.40 on October 13 and later saw a sharp fall until October 31 as the share price declined 33 per cent to Tk 18.40 each.

The price further declined and hit the floor at Tk 17 on November 9. Presently, the shares are being traded at the floor price.

mufazzal.fe@gmail.com