Index Agro Industries foresees a double digit growth this year as well, supported by the increasing demand for eggs, meat and chicken.

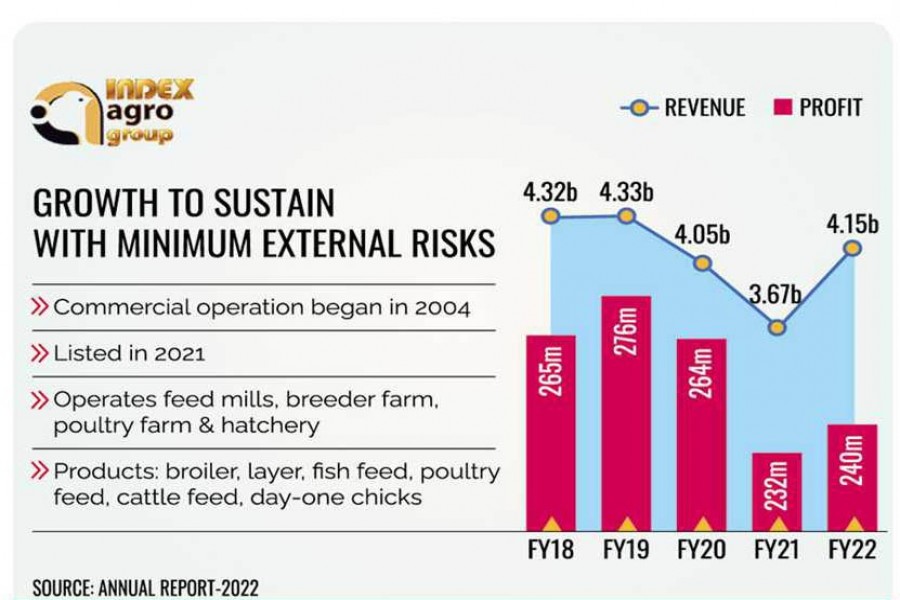

Its revenue rose 13.12 per cent year-on-year to Tk 4.14 billion for the fiscal year 2022. The company expects that the growth will continue despite the global forecasts of further economic hardships in 2023.

Two major factors that will have crucial roles in it are Index Agro's dependency on locally-produced raw materials and that it supplies its products - animal feed and day-old chicks - to the local market.

Therefore, the company is not much vulnerable to external risks, said Company Secretary Abu Jafar Ali.

"We have achieved a satisfactory growth in the fiscal year 2022 despite the economic slowdown and uncertainties caused by the pandemic and Russia-Ukraine war," he said.

Index Agro's profit went 3.45 per cent higher to Tk 240.59 million in the FY22.

Anticipating a higher scope of expansion, the company has recently decided to invest around Tk 140 million to boost its storage capacity by 16,000 tonnes.

The rising consumption of meat and eggs will create a hike in the demand for animal feed.

Quality raw materials are not available round the year, said Mr Jafar Ali, adding that if there were more storage capacity, the company would be able to buy more raw materials in bulk at reasonable prices.

The expansion of the storage capacity will be self financed. The company expects higher profits after the implementation of the plan. Index Agro now has four automatic facilities to store 26,000 tonnes of animal feed at a time.

The company applies latest technology to produce feed for fish and poultry and hatch day-old chicks. It has two breeder farms -- one in Rajendrapur and another in Bogura and a feed mill at Bhaluka in Mymensingh.

Though Index Agro is one of the pioneers in the sector, having been in business for more than two decades, it got listed only in 2021.

Index Agro produces 114,000 tonnes of animal feed and 30 million day-old chicks a year. Its expansion will be supported by the growth of the poultry industry that, according to EBL Securities, is the second largest job creator after the readymade garments industry.

The sector itself shows a promising annual growth at 12-15 per cent. It is moving towards self-reliance from its once-fully-import-dependent status.

Index Agro is striving to take advantage of the growth potential. It raised Tk 500 million from the capital market through IPO under the book-building method in 2021 to purchase machinery and equipment and construction of buildings.

The company used only Tk 45 million from the IPO proceeds as of November 30, 2022. The rest of the fund will be used shortly, said the company secretary.

Before the IPO fund was available, the company purchased machinery and equipment by bank borrowing. About Tk 354.93 million in loans will be repaid from the IPO proceeds as per the prospectus.

After the loan repayment, no interest will be charged and that will increase profitability and benefits to shareholders, said Mr Jafar Ali.

The loan burden is one of the reasons why the company's profit was down 22 per cent year-on-year to Tk 55.82 million for the quarter ended in September 2022.

The cost of production climbed up 18 per cent while interest expenses jumped 40 per cent, stripping away profit during the time, the company secretary said. The revenue was, however, 14 per cent higher to Tk 1.13 billion in the quarter, compared to the previous year.

Higher availability and affordability have driven the poultry meat consumption in Bangladesh. The growing popularity of processed and frozen food is also increasing the demand for eggs and chicken.

The per capita annual consumptions for poultry meat and eggs are expected to grow at 26 per cent and 41 per cent in the next five years.

Against this backdrop, Index Agro has appointed more than 300 dealers across the country to market its products. Its feed comes under the brand name X Feed.