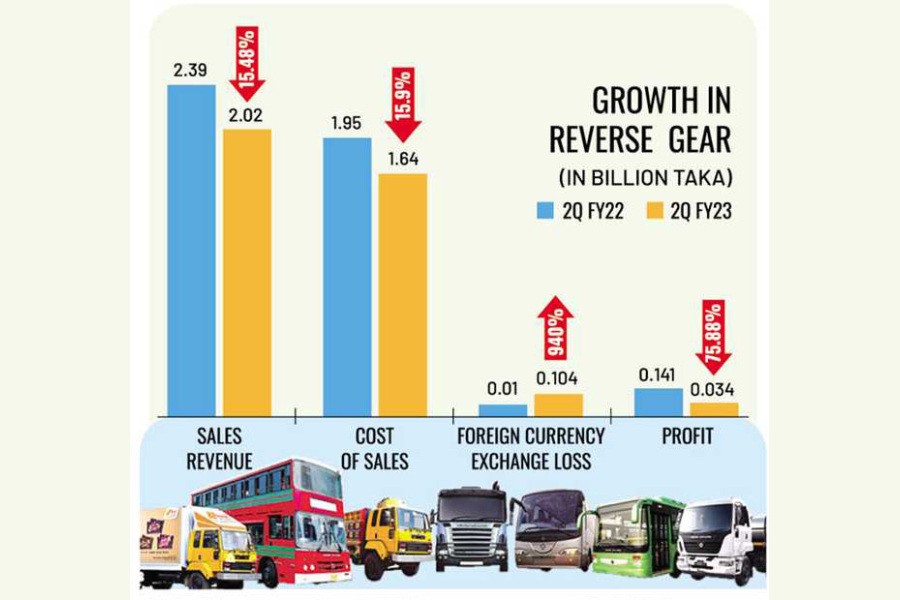

IFAD Autos saw a steep 75.9 per cent year-on-year fall in profit for the second quarter of the FY23, hit hard by revenue fall coupled with escalating foreign exchange loss.

With the first quarter included, the company incurred a loss of Tk 0.65 per share for July-December, FY23 against an EPS of Tk 0.93 for the same period of the previous fiscal year.

Experts said the whopping 940 per cent foreign exchange loss to Tk 0.104 billion had eroded the company's profit amid the unprecedented devaluation of the local currency against the dollar in the three months through December 2022.

The company's realised foreign exchange loss was Tk 187.74 million for Q2, FY23, up from Tk 13.08 million for Q2, FY22. And unrealised foreign exchange loss amounted to Tk 82.78 million for the reporting period.

IFAD Autos also saw the sales of imported vehicles decline significantly, dragging down revenue by 15.48 per cent to Tk 2.02 billion for Q2, FY23.

During the period, the sales of imported vehicles plunged 56 per cent to Tk 528.76 million, compared to the same quarter a year ago.

The company secretary refused to make any comment on the company's quarterly-growth data.

The sales of assembled vehicles rose but marginally during the second quarter of the FY23.

The company's operating cash flow turned negative for July-December, FY23.

It reported a net operating cash flow per share (NOCFPS) of Tk. (2.94) for July-December 2022 as against Tk 1.22 for the same period of 2021.

The share price of IFAD Autos closed at Tk 53 each on September 7 last year and later declined to Tk 46.30 on October 17 and finally closed at Tk 44.10 on Wednesday.