IDLC Finance Limited reported net profit after tax of BDT 558 million in the first quarter of 2019, posting a 1.42 per cent growth from the same period last year.

Earnings per share stood at BDT 1.48 as against BDT 1.46 in the latest quarter against the corresponding period of the last quarter of 2018.

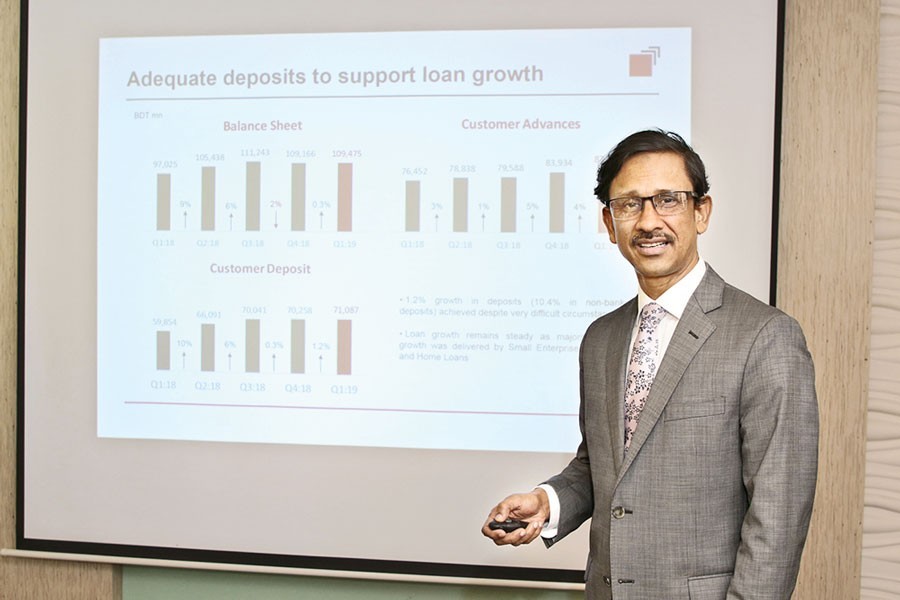

Arif Khan, CEO & Managing Director of IDLC Finance Limited, commented on the performance, "While being cautious given the current liquidity and interest rate scenario, we have maintained both our loan and deposit portfolios, with a 10 per cent growth in non-bank deposits. Overall, term deposits make up 87 per cent of our funding basket. These have been a key factor in enabling us to comfortably manage our liquidity condition amid the lackluster market situation, while still expanding our business."

Mr Arif Khan further added, "The rest of the year is expected to usher in benefits from the adjustments we make to our asset base to better reflect market conditions, securing of medium-term funding at competitive rates and other resource optimisation measures such as customisation of the core banking software. We have also been managing our capital market exposure prudently to maximise shareholder return. Meanwhile, our efforts towards delivering value for the broader society are to continue."

Annualized ROE and ROA have been 16.85 per cent and 2.04 per cent respectively against 17.90 per cent and 2.29 per cent in the equivalent prior period. Book value per share rose from BDT 31.87 in Q1 2018 to BDT 34.15, at the close of Q1 2019.

Since December, 2018 loan assets grew by 4.01% to BDT 87.3bn. The growth was achieved through a combined performance of SME, Consumer and Corporate portfolio; each having risen by 4.0 per cent, 6.0 per cent, and 3.0 per cent, respectively. IDLC Finance Limited's standalone loan book is currently composed of 42 per cent SME, 34 per cent consumer and 24 per cent corporate portfolio. NPL ratio stands at 2.29 per cent, as compared to 2.80 per cent at the end of the same period last year.

Capital market subsidiaries of the company, however, have reported Y-o-Y declines in net income, largely on the back of lower levels of investment income. The company expects to add more to its revenue lines within the medium term through the recent attainment of alternative investments license, received by IDLC Asset Management Limited.