The Dhaka Stock Exchange (DSE) enquired in 2021 and 2022 about the reasons behind the abnormal price hikes of Gemini Sea Food on the prime index.

Not only did the stock demonstrate abnormal rises but also it had steep falls in short spans of time.

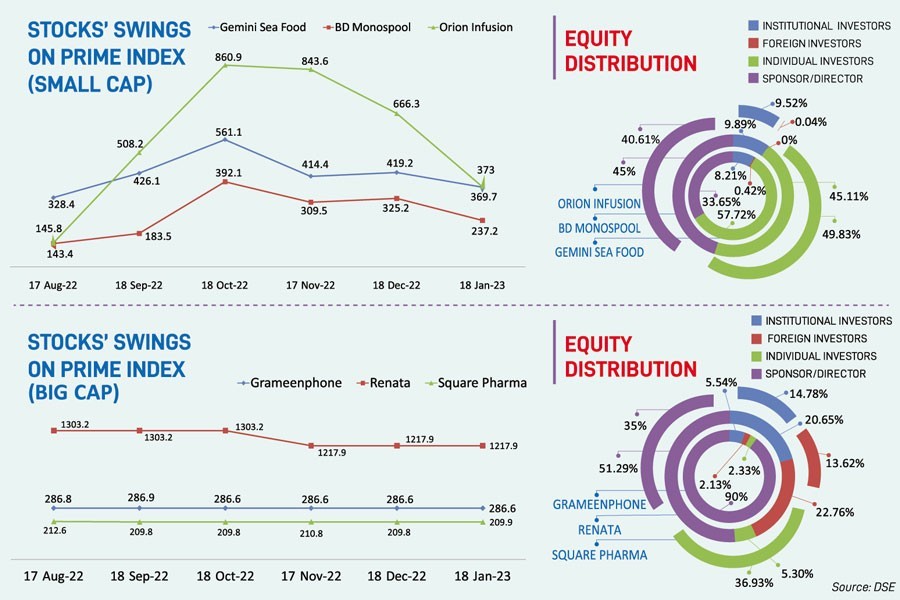

Gemini Sea Food jumped 281 per cent to Tk 538.9 between June 6, 2021 and April 4, 2022. It plunged 44 per cent within the next one month before rising as much as 100 per cent by October. Then it fell again 40 per cent by the end of November last year.

Many other small-cap companies, such as Orion Infusion, Fareast Islami Life Insurance, BDCOM Online, Meghna Pet Industries, and Paper Processing & Packaging, swung as Gemini did even when the market overall was depressed due to bleak economic indicators.

Their frequent and big jumps and declines make the stock market volatile, resulting in quick gains and erosions of market capitalization. Some investors find themselves trapped into such cycles and lose big chunks of their investments while others take advantages of the trend and make money.

The price movement of large-cap companies, such as Square Pharmaceuticals, however, presents a different picture. The company's share price hovered between Tk 209.8 and Tk 225.9 in the 10 months through December last year.

The contrast between the two scenarios demands an explanation.

The answer largely lies with equity distribution and the financial strength of the companies.

The paid-up capital of Gemini Sea Food is Tk 61.05 million while Square Pharma's Tk 8.86 billion.

Individual investors hold 57.72 per cent shares in Gemini and 36.93 per cent in Square Pharmaceuticals. On the other hand, institutions have a higher stake in Square Pharma -- 14.78 per cent -- than in Gemini -- 8.21 per cent.

Foreign investors have not shown any interest in investing in Gemini while they hold 13.62 per cent stake in Square Pharmaceuticals.

Institutional investors deploy resources for analyses and take positions in listed securities based on their understanding from the researches. Foreign investors are further ahead, scrutinizing the market and financial performance of stocks before putting money in them.

Both institutions and foreign investors prefer large-cap companies because they have reliable business models and follow global corporate practices. They also do not buy and sell off holdings frequently.

That is why the companies, where institutions and foreign investors hold major stakes, exhibit less price volatility.

On the other hand, general investors are often influenced by rumours and speculations and so make frequent transactions compared to institutional and foreign investors.

Large-cap companies having a large institutional base are not subject to day-to-day trading, which is why they endure less volatility compared to small-cap stocks, said Md. Moniruzzaman, managing director of IDLC Investments.

Market operators cite another reason behind the unsteady behavior of small-cap stocks. They say manipulators can influence the market prices of such companies by purchasing or selling large volumes of shares within their investment capacity.

But their investment capacity would prove negligible to influence big stocks. That is the reason why Square Pharmaceuticals, British American Tobacco Bangladesh Company (BATBC), Grameenphone, Renata, Berger Paints Bangladesh, LafargeHolcim Bangladesh, BRAC Bank, and United Power Generation & Distribution Company have hardly shown any abnormal price hikes and falls.

Foreign investors hold 22.75 per cent stake in Renata, 33.64 per cent in BRAC Bank, and 6 per cent in BATBC.

Individual investors hold large stakes in small-cap companies. For example, general investors and institutions hold 49.83 per cent and 9.52 per cent in Orion Infusion, 60.13 per cent and 4.87 per cent in Paper Processing & Packaging, 55.95 per cent and 14.05 per cent in BDCOM Online.

Mohammad Rezaul Karim, spokesperson of the Bangladesh Securities and Exchange Commission (BSEC), said the commission had introduced a separate platform for small-cap companies taking into account the price volatility and manipulation involving such stocks.

"Now there is no scope of such companies being listed on the exchanges' main board," said Mr. Karim. The regulator asked small-cap companies, which had earlier been listed on the main board, to increase their capital base, he added.

On several occasions, the BSEC said one of the major problems of the country's capital market was that it was mainly driven by retail investors.

Around 80 per cent of daily transactions are done by individual investors. Hence, expanding the role of institutions or foreign investors is a big challenge for the market.