The government's revenue earnings from the capital market declined 7.61 per cent or Tk 312.70 million in the just concluded fiscal year (FY 2017-18) compared to the previous FY.

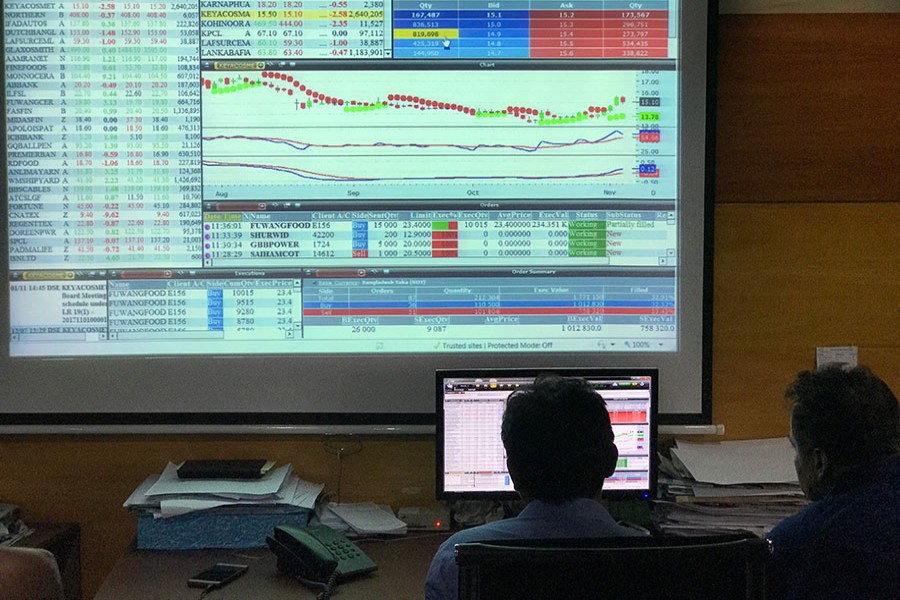

The earnings declined mainly due to reduced turnover value registered by both the stock exchanges.

The government bagged revenue worth more than Tk 3.79 billion from the Dhaka and Chittagong stock exchanges, and Central Depository Bangladesh Limited (CDBL) in FY 2017-18.

Officials at the Dhaka Stock Exchange (DSE) said the revenue from the capital market would rise a little more as the exchange is yet to submit its own corporate tax.

The revenues come from brokerage commission charge on share transactions, sales and transfer of shares by sponsor-directors, and dividend income.

It also comes from maintenance fee of BO (beneficiary owner's) accounts and corporate tax paid by stock exchanges and the depository organisation-CDBL.

The greater amount of revenue comes from brokerage commission charged on transaction of shares by general investors.

According to DSE officials, the government's revenue declined marginally in FY 2017-18 as the turnover value declined during the period.

The daily average turnover was Tk 6.46 billion on the premier bourse in the outgoing fiscal year, down 14.43 per cent over the previous FY.

Of total revenue realised in the FY 2017-18, Tk 2.37 billion came from the DSE, Tk 553.7 million from the Chittagong Stock Exchange (CSE) and Tk 870 million from the CDBL.

The revenue worth Tk 570 million came from BO account maintenance fees. A BO account holder has to deposit Tk 450 per year as the maintenance fee.

Of Tk 450, Tk 200 goes to the public exchequer, Tk 100 to the depository participants, Tk 50 to the securities regulator and the remaining Tk 100 to the CDBL.

According to CDBL, the number of active BO accounts is above 2.71 million as of July 16, 2018.

The government's revenue earnings displayed a mixed trend in the last eight FYs.

During the period from fiscal year 2010-11 to 2017-18, the highest amount of revenue came in the FY 2010-11 following the bullish trend of the capital market.

The lowest amount of revenue came in the FY 2012-13 as the market continued a declining trend after 2010-11 stock market debacle.