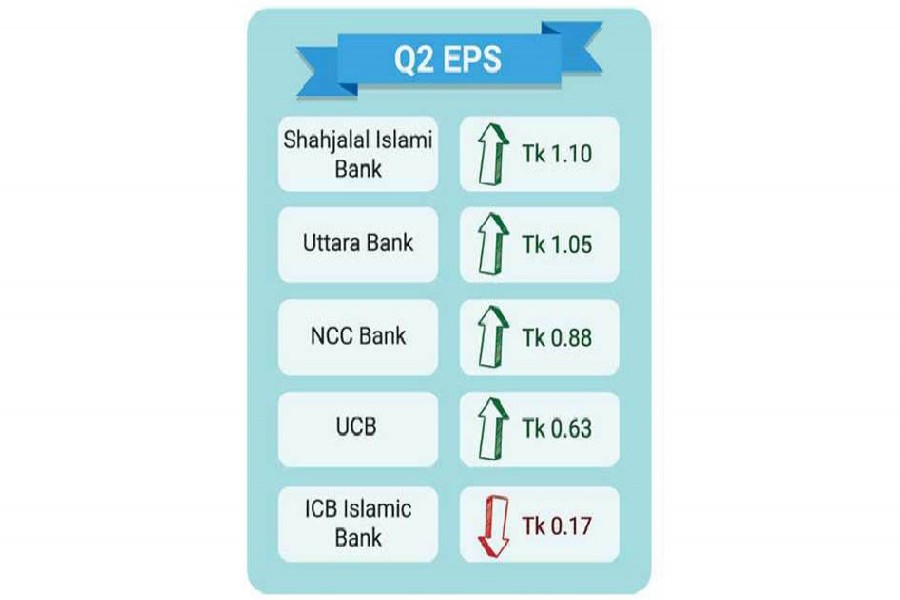

Four listed banks have witnessed substantial growth in EPS (earnings per share) for April-June (Q2), 2021 compared to the same period of the previous year riding on operating income, among others.

The banks are Uttara Bank, NCC Bank, United Commercial Bank and Shahjalal Islami Bank.

The EPS of these banks rose ranging between 72 per cent and 320 per cent for Q2, 2021 compared to Q2, 2020, according to quarterly disclosures posted on the website of Dhaka Stock Exchange (DSE).

The loss of ICB Islamic Bank has also declined for Q2, 2021 compared to the loss incurred for same period of the previous year.

Uttara Bank has reported its consolidated EPS of Tk. 1.05 for April-June 2021 against Tk. 0.25 for April-June 2020.

The company's consolidated EPS was Tk. 1.79 for January-June 2021 as against Tk. 1.44 for January-June 2020.

It has also reported consolidated NOCFPS of Tk. 2.23 for January-June 2021 as against Tk. 10.76 for January-June 2020.

Uttara Bank's consolidated NAV per share was Tk. 31.62 as on June 30, 2021 and Tk. 28.69 as on June 30, 2020.

NCC Bank has reported its consolidated EPS of Tk. 0.88 for April-June 2021 against Tk. 0.35 for April-June 2020.

Its consolidated EPS was Tk. 1.43 for January-June 2021 as against Tk. 1.17 for January-June 2020.

The consolidated NOCFPS of NCC Bank was Tk. 3.50 for January-June 2021 as against Tk. (1.03), a negative value, for January-June 2020.

The bank's consolidated NAV per share stood at Tk. 23.30 as on June 30, 2021 and Tk. 21.84 as on June 30, 2020.

The United Commercial Bank (UCB) has reported its consolidated EPS of Tk. 0.63 for April-June 2021 against Tk. 0.40 for April-June 2020.

The bank's consolidated EPS was Tk. 1.02 for January-June 2021 as against Tk. 0.72 for January-June 2020.

The UCB's consolidated NOCFPS was Tk. (8.15), a negative value, for January-June 2021 as against Tk. (9.85), a negative value, for January-June 2020.

The bank's consolidated NAV per share was Tk. 30.35 as on June 30, 2021 and Tk. 28.02 as on June 30, 2020.

The Shahjalal Islami Bank has also witnessed a robust growth in EPS for April-June, 2021 compared to same period of the previous year.

The bank has reported its consolidated EPS of Tk. 1.10 for April-June 2021 against Tk. 0.42 for April-June 2020.

Its consolidated EPS was Tk. 1.72 for January-June 2021 as against Tk. 1.00 for January-June 2020.

The company's consolidated NOCFPS was Tk. 1.22 for January-June 2021 as against Tk. 4.79 for January-June 2020.

The consolidated NAV per share was Tk. 18.52 as on June 30, 2021 and Tk. 17.06 as on June 30, 2020.

In a disclosure, the Shahjalal Islami Bank said its EPS rose substantially for Q 2, 2021 compare to the same period of last year due to increase of other operating income as well as decrease of provision expense.

"The NOCFPS decreased compare to the same period of last year due to decrease in deposit from customers as well as increase of investment to customer during the period," the disclosure said.

ICB Islamic Bank has posted a loss of Tk 0.17 per share for April-June 2021 against the loss of Tk 0.23 per share for April-June 2020.

The bank reported a loss of Tk 0.32 per share for January-June 2021 against the loss of Tk 0.32 per share for January-June 2020.

The bank's NOCFPS was Tk. 0.67 for January-June 2021 as against Tk. (0.44), a negative value, for January-June 2020.

The bank's NAV per share was Tk. (17.86), a negative value, as on June 30, 2021 and Tk. (17.43), a negative value, as on June 30, 2020.