The stock market had a tough ride this year due to the war in Ukraine that intensified economic uncertainties and caused inflation to go a 12-year record high while floor prices turned most stocks illiquid, denting investors' confidence.

The year, however, had begun with much optimism for the continuation of the previous year's bullish trend as the economy started to rebound from the pandemic-induced shocks.

Then the Russia-Ukraine war made things upside down. The severity of the impacts was obvious in the last half of the year, with fuel and commodity prices going through the roof.

Economic adversities induced a bearish sentiment in the market and the key index dropped to 5,980 on July 28 forcing the securities regulator to reinstate the floor price restriction to avert freefall of the market indices.

Owing to the stock price movement restriction, both foreign and local investors felt discouraged to put fresh bets on stocks.

Though the market has been saved from a plunge, the DSEX, the key index of the Dhaka Stock Exchange lost 550 points or 8.14 per cent year-on-year to close the year at 6207. The index soared 1354 points or 25 per cent in 2021.

Though the regulator recently eased the price restriction for 169 stocks, it has little influence on the market due to the 1 per cent lower circuit breaker put in place to stop major price corrections on any given day. Besides, these stocks are mostly low-cap and junk stocks.

In losing market capitalization, the blue-chip index DS30, which groups 30 prominent companies, suffered most as it shed 337 points or 13 per cent to 2,195.

Foreign investors played a big role by pulling out of the market.

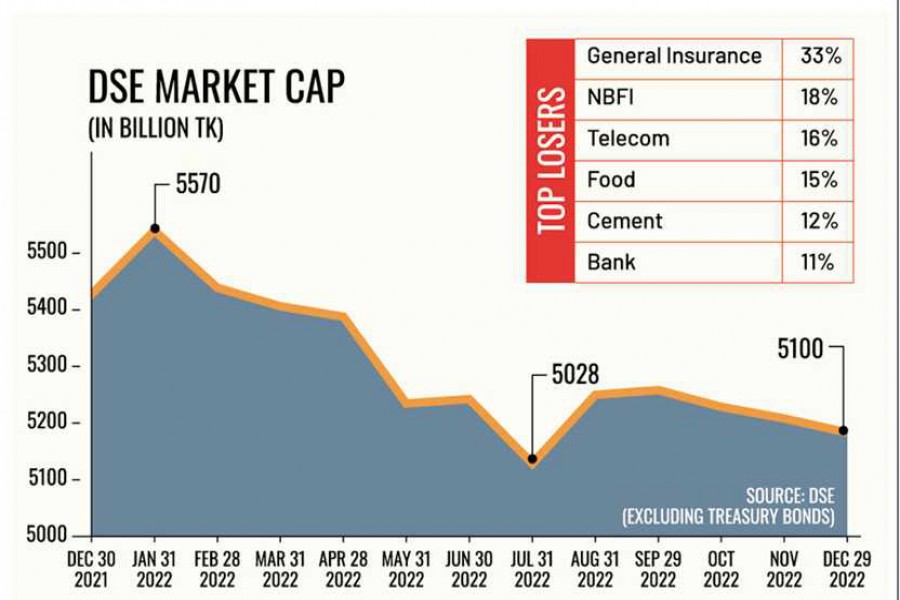

As much as Tk 322 billion, or 6 per cent, of the market capitalization got wiped off this year to Tk 5,100 billion on Thursday.

The treasury bonds are excluded from the calculation as the trading of such securities began in October this year.

A lack of fresh funds going into stocks and the illiquid existing investments plunged the daily average turnover by 35 per cent to Tk 9.61 billion in 2022, from Tk 14.75 last year.

Market experts are not optimistic about a strong recovery in 2023 on the back of weak economic indicators.

"Year 2023 will also not be a good year for the stock market. There is an anticipation that the interest rates and inflation will spike further," said Prof Abu Ahmed, former chairman of the economics department at the University of Dhaka.

He said there is no immediate remedy for the current depressed market if the economic situation stays as it is and the price restriction is not withdrawn for all listed securities.

"The market recovery in the next year will depend on the stability in the foreign exchange market, a recovery of the global economy as well as political stability in the country," said Mr Ahmed.

Despite challenges, the market may get some ground in the coming year riding on some policy changes, said Md. Sajedul Islam, managing director of Shyamol Equity Management.

The time extension for negative equity adjustment of brokerage firms and merchant banks will bring a positive outcome for the market, he said.

The stock market regulator has extended the time to adjust the negative equity of the intermediaries until December 2023.

The skyrocketing fuel bill that contributed to the surge in operating expenses of the companies and the global energy crisis has alarmed inflation-hit people, prompting them to tighten their purse strings. The company listed on the market bore the fallouts.

The well-performing companies suffered due to the floor price while the low performers and junk stocks were flying high largely over speculations.

Small-cap jute, travel & leisure and paper & printing sectors posted record gains.

The securities regulator -- Bangladesh Securities and Exchange Commission was busy keeping the key index up instead of ensuring good governance and restoring confidence in 2022.

The general insurance sector suffered most, losing 33 per cent market-cap during the year amid a mounting selling pressure as investors tried to secure gains made the year earlier.

Almost all the general insurers saw their price double in 2021 riding on speculations.

The scam-hit non-bank financial institutions are the second highest loser in 2022, having lost 18 per cent value in equity, followed by telecom losing 16 per cent, food 15 per cent.

The NBFIs embroiled in financial irregularities are under pressure for long due to the rising amount of bad loans and lower interest rates.

The liquidity flow in the financial sector dried up in 2022, compared to the previous year, said Mominul Islam, chairman of the Bangladesh Leasing and Finance Companies Association, a platform of non-bank financial institutions.

The NBFIs had suffered significantly because of the interest rate cap at 7 per cent since July 2022, he said, adding that if the liquidity situation improved and interest rate-cap withdrawn, the sector will rebound in the next year.

The stock market is one of the major sources of income for financial institutions, so its downturn impacted the profit growth as well as their share prices.

Among the 23 listed NBFIs, trading of the Peoples Leasing & Financial Services remained suspended since July 2019 while eight traded below the face value of Tk 10 each.

Telecom sector lost 16 per cent mainly for the price fall of the largest market-cap stock Grameenphone that itself lost 18 per cent during the year.

The GP shares started to decline after the telecom regulator banned the sale of new SIM cards by the country's top mobile operator in June this year citing the "poor quality" of the mobile carrier's services.

The capital market is expected to remain shaky in 2023 and volatility is likely to persist due to concerns over the global recessionary outlook and the revised GDP growth forecast of Bangladesh for FY23, said EBL Securities in its yearly analysis.

The prime index, DSEX, may hover around 5,500-6,500 points while the average daily turnover is expected to oscillate between Tk 6.0 billion to Tk 8.0 billion.

Investors are likely to remain watchful amidst the possibility of a persistent inflationary pressure, upward adjustments in interest rate cap and liquidity crisis in the money market.

The soaring energy prices and input costs are likely to affect the top-line growth and profitability of the major manufacturing companies, EBL Securities said.

A decline in discretionary spending in the economy may have an adverse effect on the capital-intensive sectors such as construction, electronics and automobiles.

However, companies with sound fundamentals and the pharma sector, along with well-governed banks and NBFIs may stand out in 2023, while cement, engineering and textile sector may suffer the most.

The anticipation of a gradual economic recovery makes it likely that the stock market will get back some of its strength in the later part of the year, the EBL Securities said