The daily trade turnover on the Dhaka Stock Exchange (DSE) tumbled to a 29-month low on Thursday despite the fact that the securities regulator partially relaxed floor prices.

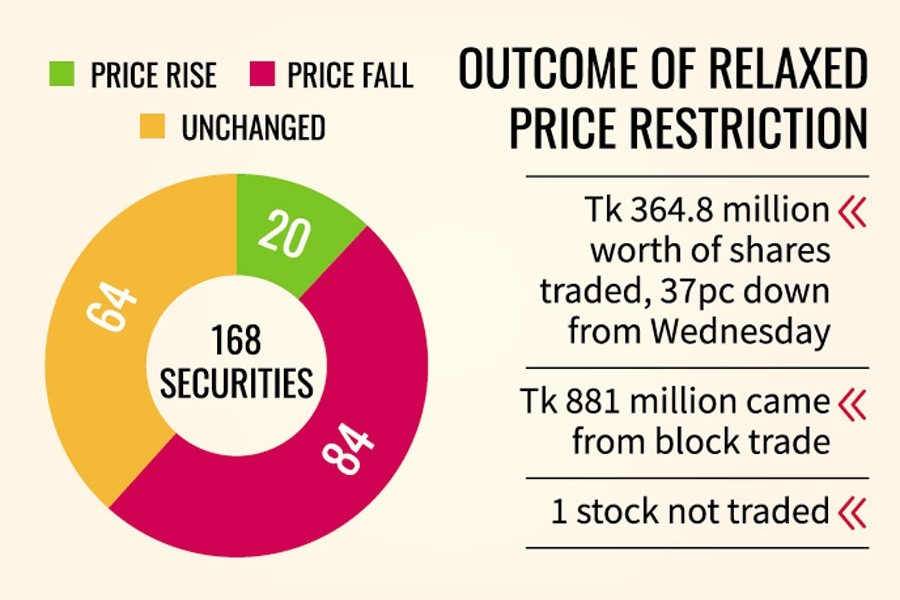

The Bangladesh Securities and Exchange Commission (BSEC) withdrew floor prices of 169 securities but allowed them to fall only by 1 per cent in a day.

The measure was expected to facilitate trading of the shares, thus increasing activities in the stock market. Instead, fewer transactions took place.

The daily turnover dropped to the pandemic level and stood at Tk 2.28 billion on the premier bourse on Thursday, slumping further by 31 per cent over the previous day.

It had been the lowest single-day transaction since July 16, 2020, when the turnover totalled a record Tk 2.26 billion.

Of the total turnover, block transactions accounted for Tk 881 million.

"The withdrawal of floor prices from certain scrips put further strain on the ailing market, while the 1 per cent lower circuit breaker has yet to attract investors' participation at the current prices," said EBL Securities.

Just the removal of the floor price does not make a difference in the current market situation as investors are not interested in these securities, said Prof Abu Ahmed, a former chairman of the economics department at the University of Dhaka.

"If you cannot sell shares, how can you buy shares in the illiquid market!" he said.

He underscored the need for full withdrawal of the price restriction as the sellers could not sell shares in the absence of buyers for long.

Among the 169 companies, a majority remained stuck at their earlier prices, while some other stocks dropped as the regulator put in place 1 per cent lower circuit breaker.

For example, among the 36 mutual funds, only three traded on Thursday, with Prime Finance First Mutual Fund, CAPM IBBL Islamic Mutual Fund, and Reliance One The First Scheme of Reliance Insurance Mutual Fund suffering losses.

Textile companies that were stuck at the floor for long also fell. Only Union Capital's share price soared 8.97 per cent to close at Tk 8.40.

The country's stock market has been suffering a severe liquidity crisis as investors could not participate in trading due to the price limit set on shares by the regulator to halt the free fall of the price indices.

However, DSEX, the prime index of the DSE, ended slightly higher, snapping a six-day losing streak. DSEX went up by 3.39 points to close at 6,202, after losing 73 points in the past six days.

The market managed to stay afloat after six straight sessions riding on the price appreciation of selective issues, while the majority extended their losing streak after the regulator withdrew the floor price restriction on 169 issues, said the EBL Securities.

Of the issues traded, 156 remained unchanged while 101 declined and 52 advanced on the DSE trading floor.

The risk-averse investors followed 'wait and see' approach due to the lack of clear direction amid partial floor price withdrawal, according to International Leasing Securities.

The ongoing depressed market situation, liquidity crunch and the lack of institutional participation altogether eroded investors' confidence, which, in turn, had a dampening effect on the market, said a stockbroker.