Country’s both bourses slipped back into the red on Monday, breaking a four-day gaining streak, as risk-averse investors sold shares to pocket profits.

DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 88 points or 1.59 per cent to settle at 5,433, after gaining 181 points in the past four straight sessions.

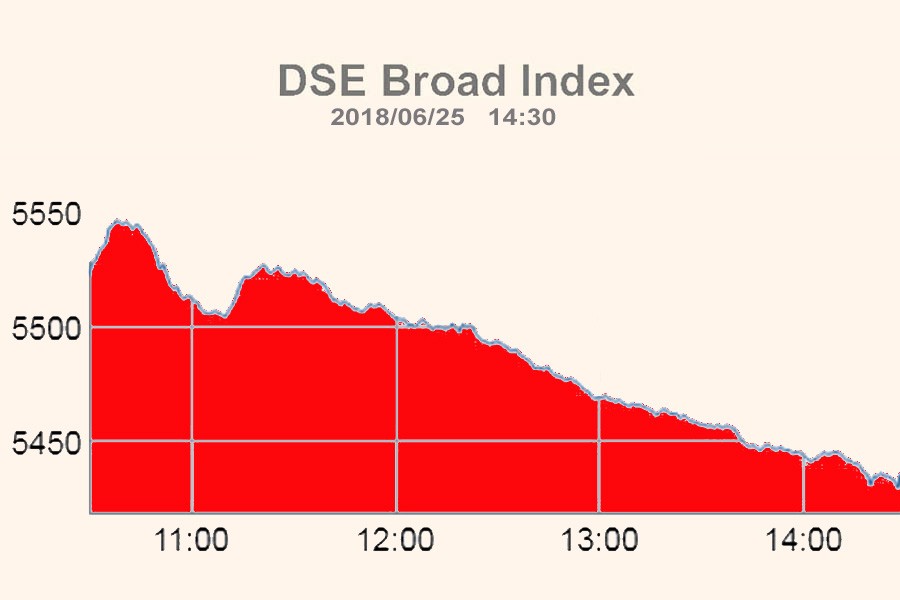

The market opened on a mixed trend and key index of the DSE went down steadily after first 20 minutes of trading, eventually ended more than 88 points lower.

Market insiders said the bourse ended lower as investors booked profit on large-cap stocks like Grameenphone and Square Pharma, United Power.

Two other indices of the DSE also ended lower. The DS30 index, comprising blue chips, fell sharply by 33 points to finish at 1977 and the DSE Shariah index lost 15 points to close at 1,263.

Bearish trend also reflected on the trading activities as total turnover on the DSE amounting to Tk 6.86 billion, which was 3.52 per cent lower than the previous day’s Tk 7.11 billion.

Prices of 71 per cent traded issues declined as 241 issues closed lower, 61 ended higher and 38 remained unchanged on the DSE trading floor.

Beximco was the most traded stocks on the DSE turnover chart with 8.74 million shares worth Tk 241 million changing hands, closely followed by Monno Ceramic Industries, Grameenphone, Queen South Textile and Alif Industries.

Ratanpur Steels Re-rolling Mills was the day’s best performer, posting a gain of 9.89 per cent while the Standard Insurance was the worst loser, losing 8.87 per cent.

The port city bourse also ended lower with its CSE All Share Price Index–CASPI—losing 248 points to settle at 16,734.

CSCX, the Selective Categories Index of the CSE, also fell 155 points to finish at 10,116.

The losers beat the gainers as 165 issues closed lower, 57 ended higher and 28 issues remained unchanged on the CSE.

The CSE traded 20.13 million shares and mutual fund units worth more than Tk 841 million in turnover.