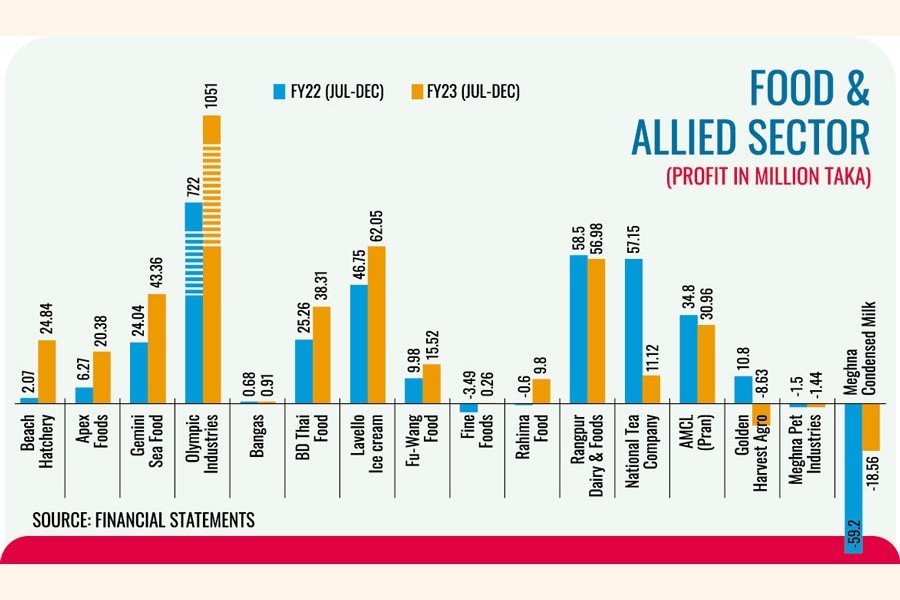

A majority of listed food makers gained double-digit profit growth year-on-year in the first half of the ongoing financial year even when inflation is sky high and all other indicators portray a turbulent economic situation.

Companies' export earnings, the type of products sold, the brand image and increased prices of finished goods were major factors that helped generate higher profits even when people had to tighten their belt to cope with rising expenditures.

Olympic Industries, which owns some of the best-selling biscuit and bakery brands, saw its earnings jump by a remarkable 46 per cent to Tk 1.05 billion in July-December 2022, compared to the same period last year.

In fact, the latest six-month's profit was equivalent to the annual profit of the previous fiscal year.

The biscuit maker's sales revenue also grew 32 per cent year-on-year to Tk 13.67 billion in the six months through December 2022 as both local sales and exports rose.

Having been manufacturing confectionary items, as well as dry cell batteries, Olympic Industries reported a 14 per cent export growth to Tk 144.4 million in the first half of the FY23.

"The growing demand for branded biscuits as well as increased prices of finished goods helped boost revenue and profit," said Company Secretary Md Nazimuddin.

The cost of inputs, including oil, sugar and flour, rose significantly and so "there was no way but to increase the prices of the products rationally," he said.

Similarly, 9 other companies showed double-digit growth year-on-year in the first half of the FY23.

Among the 21 stocks listed under the food and allied sector, 16 have been studied.

Biscuit manufacturers and shrimp exporters had impressive growth in sales and profit while milk, juice and tea companies' profit slumped, according to the disclosures by the companies.

Two companies Rahima Food and Fine Foods returned to profit while Golden Harvest Agro Industries went into the red in July-December 2022.

Cost was rising for every business but the impact was not even across the sector, said Salim Afzal Shawon, head of research at BRAC EPL Stockbrokerage, a top tier brokerage firm.

"Part of the differences stemmed from differences in business nature. For basic consumer products such as biscuits, makers were able to pass on large part of the cost pressure via price hike and product downsizing."

To tap into the growing market, Olympic Industries is looking to invest Tk 280 million for expanding its bakery business, which will help increase production by 200 tonnes of snacks per month.

Its peer firm - Bangas -- also posted an impressive 75 per cent growth in profit to Tk 0.53 million in the second quarter (Q2) of the FY23.

The fast-moving consumer goods company manufacturing chips, biscuits, and bread recorded a 34 per cent year-on-year profit growth to Tk 0.91 million in the first half of the FY23.

The local biscuit industry has been thriving, riding on surging demand for packaged snacks among the growing middle-income group of consumers, industry people say.

Businesses of fish processors and shrimp exporters also earned much higher in FY23 compared to FY22.

Beach Hatchery's profit leapt 12 times year-on-year to Tk 24.84 million in July-Dec 2022.

The company suffered losses in the past six years until FY21 as its shrimp business was severely hampered by the construction of the marine drive road.

When losses were piling high, the company in 2019 started cultivating local fish varieties such as Tilapia, Koi, Pangas, and Pabda. It deployed intensive culture methods in a project in Teknaf upazila of Cox's Bazar.

Company Secretary Md Nur Islam attributed the huge profit to the high demand for local varieties of fish. A large part of the produce is mostly consumed near the production areas crowded by Rohingya refugees.

Presently, Beach Hatchery is farming fish in 45 out of its 110 ponds. "We are gradually trying to make the rest of the ponds ready for farming fish," said Mr Islam.

Gemini Sea Food, the pioneer certified organic shrimp exporter, also saw a significant profit growth. The frozen fish exporter's income almost doubled to Tk 43.32 million in the six months to December last year, backed by reduced cost and higher exports.

The company exports to the USA, UK, Germany, Denmark, the Netherlands, Belgium and Russia.

Fu-Wang Food's profit went 55 per cent higher, as the new directors, nominated by Minori Bangladesh, a subsidiary of the Japanese agro company Minori Co Ltd, started upgrading the factory and strengthen its marketing channel.

Another shrimp exporter, Apex Foods posted 225 per cent growth in profit year-on-year to Tk 20.38 million in the first half of the FY23.

Agricultural Marketing Company's (Pran) profit, however, dropped 11 per cent to Tk 56.98 million during the period.

As consumers went for cost cutting, the consumption of products, which could be deferred or lowered, slowed down. "As a result, beverages, personal care, and other discretionary consumer products had to go through squeezed margins," said Mr Shawon.

Unilever Consumer Care, a concern of Unilever group, posted 15 per cent higher profit to Tk 187.2 million in July-September 2022, though sales revenue dropped 4.77 per cent to Tk 1.08 billion during the first and second quarters.

Despite a significant increase in raw and packaging material prices, profit rose due to recent business development, reduction of operating expenses, and a one-off benefit of Tk 400 million, said the multinational company.

National Tea Company's profit plunged 80 per cent to Tk 11.12 million in July-December 2022.

Industry specific factors, such as seasonality when it comes to sales of ice cream, and labor unrest in tea gardens, impacted profitability, Mr Shawon added.

Cigarette maker British American Tobacco Bangladesh was excluded from this analysis of the food industry. Zeal Bangla Sugar Mills and Shyampur Sugar Mills were left out as the state-run companies have been incurring losses for many years.