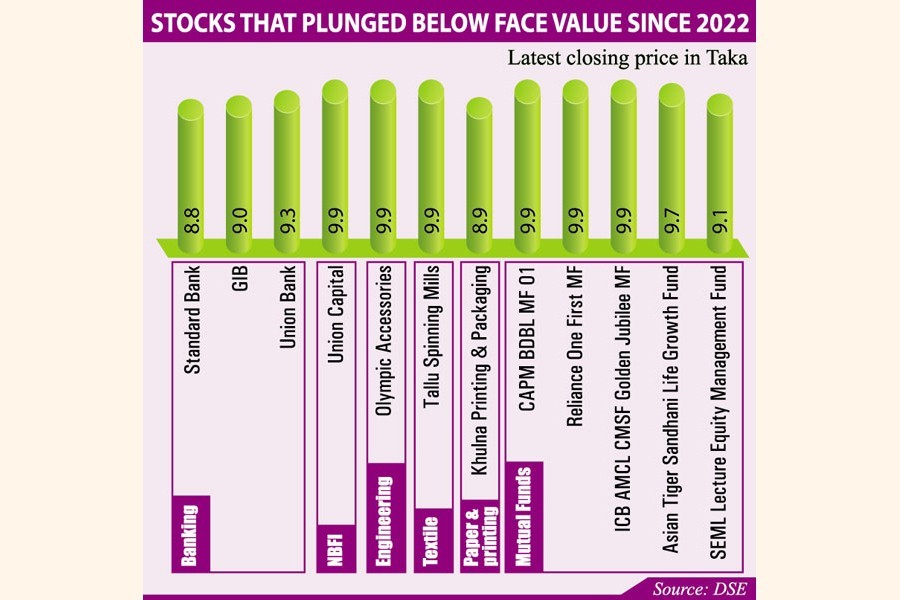

As many as 66 stocks trade below the face value of Tk 10, 12 of them entering the list in the last one year.

They account for as much as 17 per cent of the stock market, a large enough pie to keep the market down.

But it is not the gloomy economic outlook or the depressed market that has caused price erosion. Rather, the poor performance of the companies explains why investors have shunned those.

Many of the lot even had their operations suspended for long, making them unable to give dividends to shareholders.

Some stocks traded below Tk 7 per share even after the imposition of the floor price in July last year, forbidding them to go below a certain level.

Without the restriction, the stocks could have plunged further.

If the securities are grouped under sectors, mutual funds constitute the worst segment.

At present, 354 companies and 37 closed-end mutual funds are listed on the Dhaka Stock Exchange's main trading board.

The Bangladesh Securities and Exchange Commission (BSEC) set the face value of equity shares and mutual fund units at Tk 10 after the 2010 stock market debacle.

About 90 per cent or 33 closed-end mutual funds have been trading below their face value, according to the data of the DSE.

Are MFs managed by professionals?

Investors lacking knowledge about financial instruments usually put their money in mutual funds, a popular global practice but not applicable to the market in Bangladesh.

A mutual fund is pooled money from a number of investors to be invested on stocks, bonds and other assets and managed by professionals. Small savers keep their money with the asset management companies which make investment decisions based on their research to ensure good returns.

The MFs are considered safe investment destinations.

"Unfortunately, that has not happened in Bangladesh over the years for fund mismanagement," said Prof Abu Ahmed, former chairman of the economics department at the University of Dhaka.

Universal Financial Solutions (UFS) Equity Partners recently joined its peers who have had misappropriated funds intensifying the wounds suffered by the sector.

It faces allegations of embezzling Tk 2.08 billion from the investors' funds, according to media reports.

Its top executive Syed Hamza Alamgir fled the country siphoning off Tk 1.58 billion from four financial instruments. The Financial Express ran a report on Sunday, revealing that another Tk 500m could not be tracked down after the investor, National Bank Limited handed the money for two special purpose funds.

The negative image dangling over the sector spoiled investors' appetite for MFs.

Before the 2010 debacle, a bullish trend saw a surge of closed-end mutual funds.

After the debacle, the instruments were squeezed significantly due to the persistent erosion in the secondary market.

The extension of the tenure of closed-end MFs by the previous commission dented investors' confidence further. The extension was done on the pretext that liquidation of the MFs would create a selling pressure in the market.

A legacy of distrust created by banks

At present, seven banks are trading below their face value, including two newly-listed banks -- Global Islami Bank and Union Bank.

Union Bank was listed in the market in January 2022 through the largest IPO in the banking sector. It raised Tk 4.28 billion for purchasing government securities, investing in stocks and financing the SME sector.

Later on, the bank made headlines for granting large loans in violation of banking regulations and for not maintaining capital reserve ratio.

In less than a year after the IPO, the Bangladesh Bank had to give special loans of Tk 14.65 billion to the Union Bank, according to media reports.

The stock fell below the face value of Tk 10 in five months after the debut trading on January 26.

Global Islami Bank's fate was even worse as it fell below the face value in the debut trading. It floated the second largest IPO in the banking sector to get listed, raising Tk 4.25 billion from the market.

As it faced a liquidity crunch too for regulatory breaches, the BB salvaged it by giving Tk 7 billion in loan.

The entire banking sector itself is embroiled in loan disbursement irregularities and liquidity crisis, eliciting negative reactions from investors.

Biggest scam that ruined the image of NBFIs

Eight non- bank financial institutions, including, scam-hit BIFC, FAS Finance, First Finance and Peoples Leasing have been trading below their face value for long.

The NBFIs have been failing to give dividends for years due to financial irregularities and low interest rates.

Among the 23 listed NBFIs, trading of the Peoples Leasing & Financial Services remained suspended since July 2019.

PK Halder, former managing director and CEO of NRB Global Bank, is charged with misappropriations of more than Tk 35 billion drawn from four NBFIs.

The scam is probably the biggest event that tarnished the image of the sector.

Others

Two companies from the pharmaceuticals & Chemicals sector - Beximco Synthetics and Keya Cosmetics have been trading below the face value as well. Beximco Synthetics is in the process of exiting the market.

In the group, there are two stocks from the engineering sector - Appollo Ispat and Olympic Accessories -- and one from travel & leisure sector - Bangladesh Services. Also, 11 textile companies are trading below the face value.

The stock market regulator has taken a series of initiatives last year, including the restructuring of the boards of some "Z" category companies to bring positive changes in their operations.

The promises were big but results so small that the impact is hardly visible.

babulfexpress@gmail.com