The prime index of the Dhaka Stock Exchange (DSE) soared 4.35 per cent last week, the biggest single-week gain since its inception in January 2013.

Market operators said the enthusiastic investors showed their buying appetite on large-cap stocks, especially financial issues, encouraged by the government's steps to mitigate the ongoing liquidity crunch.

DSEX, the benchmark index of the prime bourse, which replaced the DSE General Index (DGEN) more than five years back in January 2013, settled at 5,841 soaring 244 points or 4.35 per cent over the week before.

"The prime index posted the highest weekly return of 4.35 per cent since its inception in January 2013 as the optimistic investors showed their buying appetite amid favorable measures taken by the government," commented International Leasing Securities, in its weekly market analysis.

For easing the ongoing liquidity crisis, the government allowed its agencies to deposit 50 per cent of their funds with private banks, which was previously 25 per cent and slashed the cash reserve requirement (CRR) by 1.0 per cent point to 5.5 per cent, which enhanced the investors' optimism.

The stockbroker noted that the non-bank financial institutions and banking sectors witnessed buying spree as those regulatory changes have direct impact in these sectors.

Accordingly, the financial stocks posted the highest gain of 10.30 per cent and the banking sector soared 5.20 per cent.

"The buying spree was spurred mainly by government's steps to ease the ongoing liquidity crisis coupled with lucrative pricing level in fundamentally sound issues," said an analyst at a leading brokerage firm.

The week featured five trading sessions as usual. Four, out of five sessions closed higher.

Two other indices also saw significant gain with the DS30 index, comprising blue chips, soared 88 points to finish at 2,194 and the DSES (Shariah) index jumped 42 points to settle at 1,356.

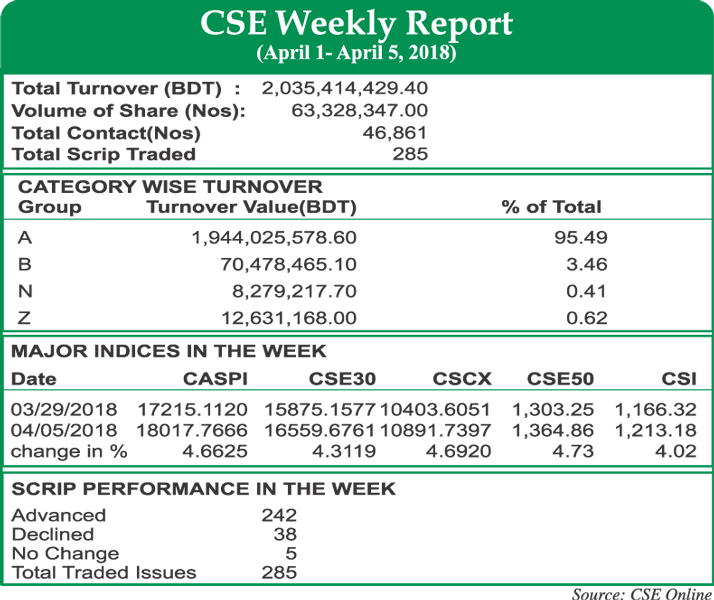

Port city bourse the Chittagong Stock Exchange (CSE) also ended higher with the CSE All Share Price Index - CASPI - soaring 802 points to settle at 18,017 and Selective Categories Index - CSCX -gaining 488 points to close at 10,891 points.

Turnover, another important indicator of the market, stood at Tk 27.15 billion last week against Tk 12.83 billion in the week before. The last week saw five trading sessions instead of previous week's four.

The daily turnover averaged Tk 5.43 billion, which was 69 per cent higher than the previous week's average of Tk 3.21 billion.

The fuel & power sector dominated the turnover chart, capturing 18 per cent of the week's total turnover, followed by banking with 16 per cent and pharmaceuticals 15 per cent.

"The daily average turnover jumped by 69 per cent which indicates that investors took fresh position in stocks," said the International Leasing.