The central bank has allowed all scheduled banks to invest in a private Green Sukuk bond from their special funds meant for investment in the capital market.

Officials say allowing bank investment in the newly devised financial tool aims at facilitating the use of renewable energy in the country.

Under the new provisions, the banks are now eligible to invest money from their special funds in 100-per cent asset-backed listed or supposed-to-be-listed-within-a- year tools from the subscription-closing data Green Sukuk, issued by a private entrepreneur, to run the project with a minimum 70-per cent renewable energy, according to a notification, issued by the Bangladesh Bank (BB) on Monday.

"We've focused the use of renewable energy aiming to achieve sustainable development through protection of environment in Bangladesh," a BB senior official told the FE while explaining the main objective of the notification.

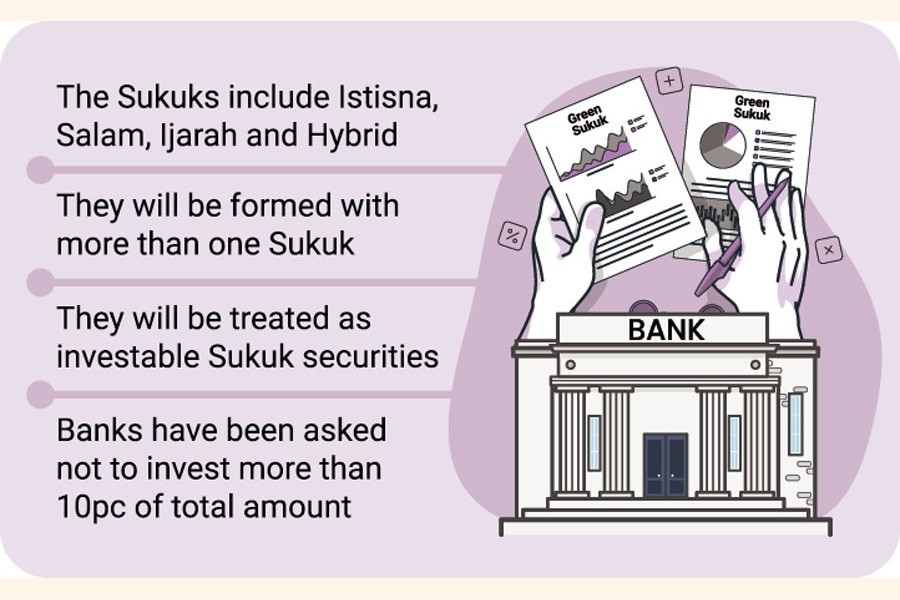

However, no bank will invest more than 10 per cent of the total amount of Sukuk issued through private placement or secondary market, it added.

The Sukuks include Istisna, Salam, Ijarah and Hybrid, which will be formed with more than one Sukuk and will be treated as investable Sukuk securities.

Sukuk is an Islamic financial certificate, similar to a treasury bond and structured to generate returns in compliance with Islamic finance principles.

Former BB governor Salehuddin Ahmed suggests that the central bank should seek report on such Sukuk from the banks for ensuring due diligence of the Islamic securities.

"The reporting format will be finalized through consultation of the BB and the Bangladesh Securities and Exchange Commission (BSEC)," Dr Ahmed said while replying to a query.

He thinks investment in diversified products will help mitigate risks.

However, senior bankers are not interested in predicting the implication of BB's latest moves, saying that it would depend on decision of the board of directors of banks concerned.

Talking to the FE, Syed Mahbubur Rahman, former chairman of the Association of Bankers, Bangladesh, said: "It's a welcome move of the central bank. But we have to look at the risk profile of the issuers."

The central bank has set some conditions on the use of Sukuk funds. As part of the conditions, the letter of credit (LC) will be opened by paying 100-percent margin.

Besides, a bank account named Special Purpose Vehicle (SPV) will be maintained for Sukuk Fund. That should not be allowed to invest or spend excepting specific expenditures from the bank account.

The SPV will have to pay back the money to the investor bankers within a week in case of cancellation of issuing Sukuk or incomplete subscription under private placement within the deadline, set by the BSEC in any cases.

A tripartite agreement will be signed among the trustee of Sukuk, SPV and investor banks in this connection, according to the notification.

In case of the Green Sukuk, the banks will be allowed to invest from their special funds for the capital market until December 31, 2028 instead of 10 February 2025 earlier.

Earlier on February 10 last calendar year, the banks were allowed to create special fund worth Tk 2.0 billion, each of five-year tenure, only for investment in the capital market.

Under the arrangement, the banks may form the special fund with their own resources or with fund received from the BB through repo or re-financing mechanism.

Such investment will not be included in the banks' capital-market exposures, both on solo and consolidated basis, until February 2025.

A total of 35 banks out of 61 have already formed the special fund in line with the BB advice to facilitate investment in the capital market.

Currently, the size of the fund stands at Tk 41 billion. Of the amount, around Tk 17.0 billion has already been invested in the capital market, according to the officials.