The insurance regulator has now prepared "bond insurance product" as a financial tool for attracting bonds onto the capital market to enhance supply of chips for trading, officials say.

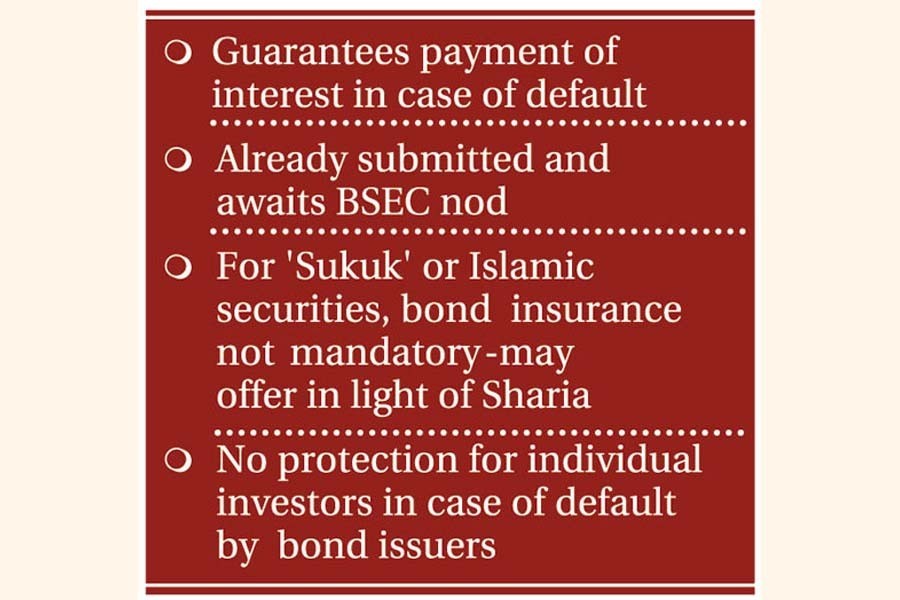

Bond insurance is a type of insurance policy that a bond issuer purchases and that guarantees the repayment of the principal and all associated interest payments to the bondholders in the event of default.

The Insurance Development and Regulatory Authority (IDRA), the regulator, has already sent the product to the securities regulator or BSEC for endorsement.

The insurance regulator has been working to introduce insurance products for bond issuers over the past few months that will guarantee repayment of the principal and all associated benefits to the bondholders in the event of issuer default.

IDRA, the regulator for 81 life and non-life firms in insurance sector, made the move for insurance coverage of the fixed-income instruments on the capital market.

The draft rules say the investors would get 100-per cent yields or profits if the bond issuer failed to pay the interest to the investors. The principal amount, however, will be outside the risk coverage.

People who are familiar with the developments earlier had told the FE that they would consider risk associated with both principal and yields.

But now the product designed by the regulator will cover only interest or yields.

"Actually, the principal is a big amount and getting re-insurance for such amount is challenging", one person having direct knowledge on the matter told the FE Wednesday.

A member of a committee formed for devising the product told the FE that the ball is now in securities regulator's court.

"They may make it mandatory or optional," he said.

However, the regulator who had prepared a guideline on the matter told the FE this is absolutely non-life product as per the Insurance Act 2010.

Earlier, the drafted guideline said insurance coverage should be taken prior to placing application for bond issuance before the securities regulator. "This is a precondition for bond-issuance approval."

However, the securities regulator-Bangladesh Securities and Exchange Commission-in a note on the proposed guidance said that bond insurance cannot be made mandatory. If any issuer offers credit enhancement in the form of insurance, then it will be applicable.

"Bond issuer may decide to seek bond-insurance facility based on its own financial strength or creditworthiness," BSEC said about tricks of the trade.

The guideline also noted that cost of insurance premium must be less than bank guarantee, otherwise product cannot be lucrative.

It says for 'Sukuk' or Islamic securities, bond insurance should not be mandatory or may offer the facility in the light of Sharia.

However, Bangladesh so far has had no major reforms on conduct of the bond market in terms of defaults of the issuers.

If a bank invests in any bond, it can report to the CIB [credit information bureau] of the central bank. But in case of individual investors, there is no such protection measure.

Many of the committee members, however, said that such type of insurance coverage may help develop the secondary bond on the bourses which now is equity-based. Currently, only two bonds are being traded on Dhaka Stock Exchange.

A 10-member high-powered committee headed by general manager of the state-owned non-life insurer Sadharan Bima Corporation (SBC) Bibekananda Saha has been working on the matter.