As many as 25 banks have so far invested Tk 10.33 billion in the capital market in a bid to prop it up in response to the Bangladesh Bank's circular issued last year when the market remained volatile.

The BB issued the circular calling for the formation of a special fund of Tk 2.0 billion by each scheduled bank for the purpose of investing in the capital market.

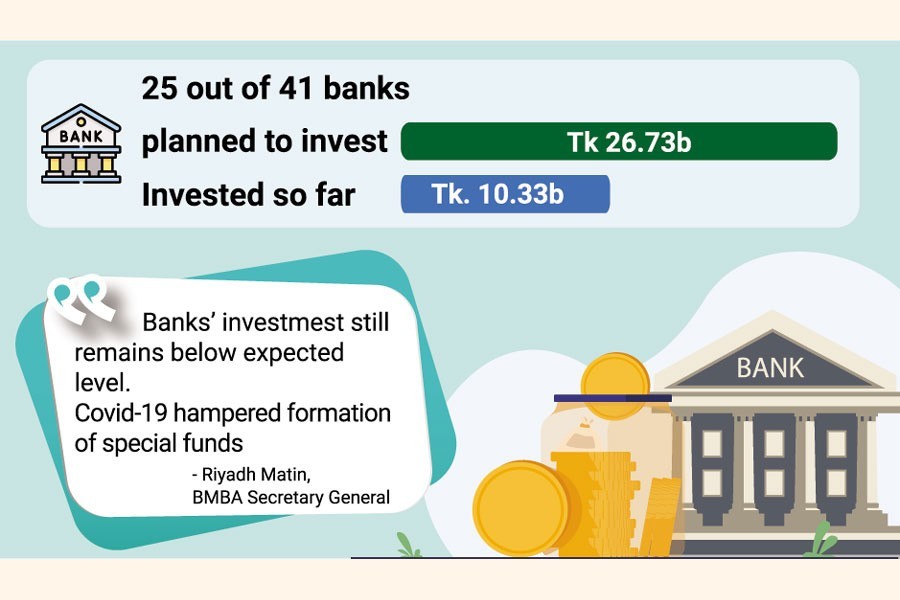

An official of the central bank said some 25 banks, out of 41, had earlier submitted information regarding their plans to invest Tk 26.73 billion through the formation of the special funds.

"As of Wednesday, we have received information about their investment of Tk 10.33 billion in the capital market," the BB official said.

The BB's circular came in February 2020 in the wake of merchant bankers' request for a Tk 100 billion fund from the government to support the ailing capital market.

After the issuance of the circular, the capital market witnessed the banks' investments reach Tk 2.54 billion in August 2020.

Contacted, an official of the Bangladesh Securities and Exchange Commission (BSEC) expressed dissatisfaction over the bank's poor response with regard to the formation of special funds and their investment.

"The total amount of the special funds is supposed to exceed Tk 80 billion as the number of scheduled banks is 41. But the banks' response still remains poor," he said.

He also said the banks have not submitted any information regarding the formation of the fund and their investment after September 2020.

The securities regulator earlier issued a directive seeking information from all the scheduled banks regarding the creation of special funds and investment.

Asked for comment, the BB official said they cannot put pressure on the banks to invest in the capital market.

"The banks will invest their own funds. And it will depend on the decision of their management. The BB issued the circular so that the banks can support the market availing of some facilities," he added.

According to the BB circular, a bank can create a five-year special fund with its own resources or with financing received from the BB through the repo or re-financing schemes.

The funds can be used to invest in equity shares, mutual funds, bonds or debentures, and special purpose funds, maintaining the prescribed criteria.

And the banks will not need to make any provision for a decrease in the market value of their investments.

After issuance of the circular, many banks were not interested to create the special fund due to various reasons, including the fate of investments due to volatility in the capital market.

The outbreak of Covid-19 also played a role behind the bank's poor response to the formation of special fund.

Secretary general of Bangladesh Merchant Bankers Association (BMBA) Riyadh Matin said banks' investment in the stock market still remained far below the expected level.

"It's also true that the formation of special fund was hampered due to Covid-19. We hope that banks will come forward with their plans of investment into the capital market," Mr Matin said.