Startups are never about ultimate perfection, rather are an interactive process of continual development. The founders do not know it all from the beginning but learn in the process as they grow.

Startups are never about ultimate perfection, rather are an interactive process of continual development. The founders do not know it all from the beginning but learn in the process as they grow.

While innovation is the soul of startups, scalability is important to function, sustain and grow. Startups seek to scale by raising investments and generating high returns on investments. They raise investments in multiple rounds - bootstrapping, seed funding, etc - to actualise their rapid expansion benchmarks.

Understanding the investors helps startup founders pitch better to garner greater investment amounts and scale their startups exponentially. Startups with a robust minimum viable product (MVP) - the earliest phase of a product which is open for consumption and feedback, to refurbish - are more likely to attract good investments. It is important for investment seekers to have an outline for budget allocation with action plans before pitching for funds.

Startup culture in Bangladesh: The startup culture is being embraced by the youths of Bangladesh with noteworthy examples of success. There are currently more than 1700 startups operating in Bangladesh. Some successful Bangladeshi startups in the fintech industry include bKash, PayWell, ShopUp and SureCash; the logistics and mobility industry includes Shohoz, Paperfly, Truck Lagbe and Pathao; the service sector has Sheba.xyz, Appoint Me and sManager; the health sector has Praava Health, Maya and Medi Trail; the education sector has 10 Minute School, Shikho and Thrive EdTech among many other startups.

Some startups have successfully leveraged technology to bring radical changes in certain industries, for instance, bKash has taken mobile banking to the farthest corners of the country. Although it began with basic features like 'send money' and 'cash-out,' the startup has been continuously evolving by incorporating greater dimensions of financial management by facilitating bill payments, donations, savings and many more.

On the other hand, DataBird is in an endeavour of creating an interrelated network or internet ecosystem for Bangladesh. Chaldal has turned mobile phones into a virtual gateway to grocery shopping. ShopUp has been connecting shop owners, manufacturers and retailers on its platform. Paperflyis developing a closely integrated countrywide network of logistic ecosystems. These are only a handful of startups among many that have been creating an impact in the country by not only addressing people's underlying needs but also contributing to the economy by attracting large amounts of funds from investors worldwide.

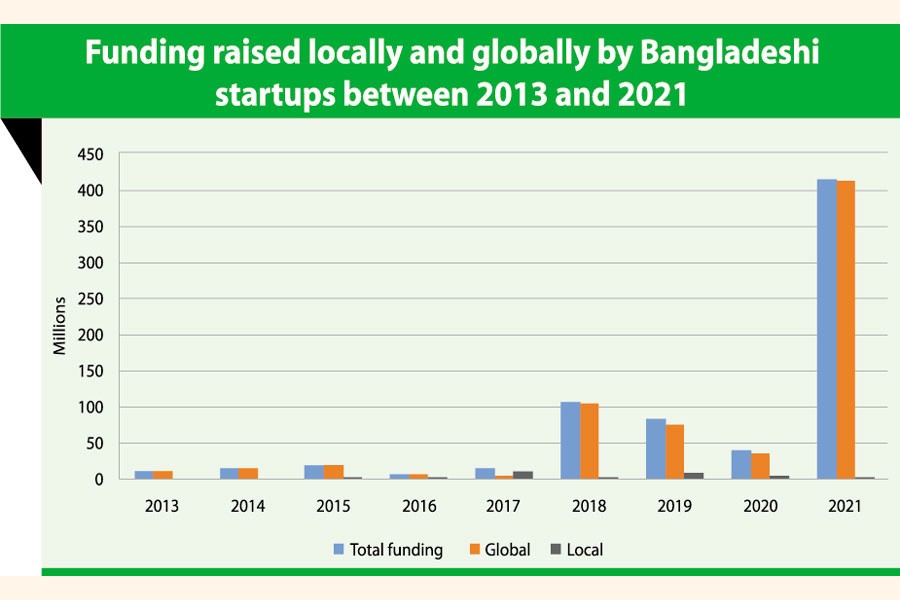

Investment scenario: The total investment raised by Bangladeshi startups rose in the last four years. Based on data availed by Lightcastle Partners about the number of investments raised by the Bangladeshi startups across the years, the chart below represents the local, global and total funds raised by startups in Bangladesh in million dollars from 2013 until 2021.

Although the investments lowered in the years 2019 and 2020, a sharp rise in investments can be noted in 2021 accounting for a total of 415 million dollars. However, the funding from local sources has significantly remained low till date.

The amount of funds raised by the startups in Bangladesh in 2021 has been presented in the chart based on data from Lightcastle Partners and 'Bangladesh Startup Funding Report 2021' by Future Startup.

The year 2021 has encountered the highest amount of total investments raised by the startups of Bangladesh to date. The deal between bKash and Japan's SoftBank brought 250 million dollars of investment followed by 75 million dollars by ShopUp.Other big rising startups too raised noteworthy amounts.

As of May 2022, the disclosed amount of raised funds by Bangladeshi startups already sums to 22 million dollars. This includes the raise of USD 11.8M by Paperfly, USD 2M by 10 Minutes School, USD 1.3M by Arogga, USD 2.5M by Shajgoj and USD 4M by Shikho from global investors and USD 100,000 by EduTechs and USD 780,000 by Zantrik from local angel investors.

Startup ecosystem getting healthier: The growing network of angel investors, impactful investing, and a host of local and international accelerators and incubators catalysed the growth of startups in Bangladesh. The ICT Ministry of Bangladesh implements policies and projects such as IDEA Project and Startup Bangladesh Limited to establish a favourable ecosystem including Hi-Tech parks, data centres and technology infrastructure for startups to thrive in the country.

Bangladesh is considered the untapped digital goldmine of Asia. The market is still unsaturated with plenty of startup opportunities to explore for the modern-day entrepreneurial enthusiasts of the country. The rising international investments evince the strength and potential of Bangladeshi startups.

"Bangladeshi startups are now better positioned in the international investors' mind with their potential on top of the growth story of our economy," Muallem A Choudhury, the principal advisor at Brummer and Partners Asset Management, was quoted as saying by a national daily.

Technology-based services caught the attention of investors during the pandemic period and its growth potential strengthened the credentials to attract more investments than in previous years. The concerned authorities of the Bangladesh government are working to make foreign direct investments more feasible; the reducing bureaucratic barriers further adds to foreign investors' willingness to invest in the potential that the growing Bangladeshi startups possess.

Bangladeshi startups are bringing the future faster through better products and services using modern technologies and innovative ideas and thus getting into the limelight of investments. However, the majority of the startup investments came from foreign investors compared to that of local investors.

Perhaps Bangladeshi investors still are not that risk-takers or do not get the real meaning of how startups grow and innovate. Or, the startups are yet to convince the local investors while considering the local context and cultural viewpoints. Addressing these issues will certainly bring robust change in the local investment scenario as well.

Dr Farzana Nahid is assistant professor of Marketing and International Business, North South University, she can be reached at

[email protected].

Nahin Sultana is a research assistant