Financial literacy refers to the knowledge and skill of effectively managing money. A financially literate person exhibits prudence while taking financial decisions by weighing the benefits, costs, and risks associated with the decision. Being equipped with the ability to manage money practically is important for all income groups. However, persons with lower income face more hurdles while managing their finances so it is crucial for this demographic to attain financial literacy.

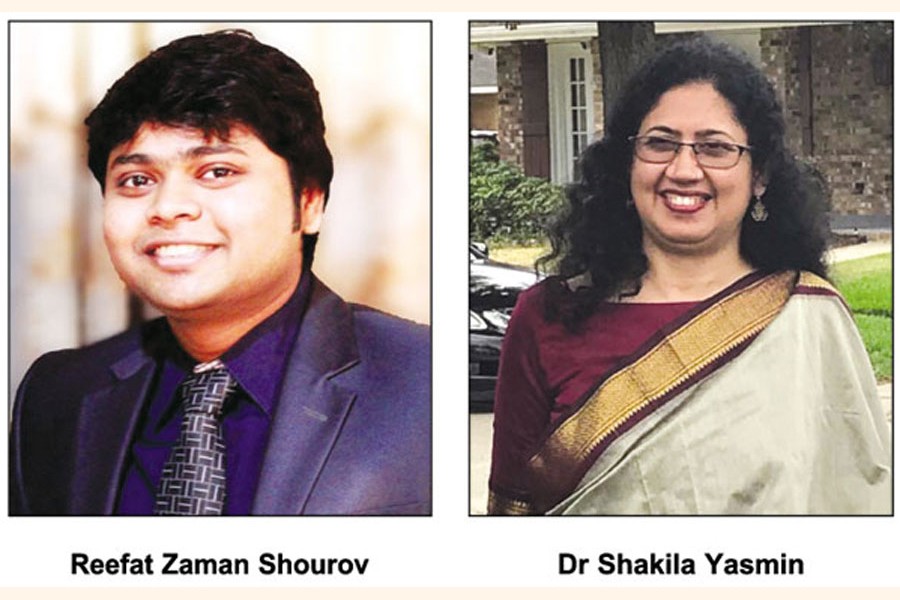

Those who earn less find it difficult to save and budget in their daily lives. The key reason for this is that they only have a scanty amount of surplus money remaining after their expenditure on daily essentials. Reefat Zaman Shourov, lecturer in Finance at the Institute of Business Administration, University of Dhaka delineates two means of budgeting for the short term that would particularly benefit lower-income groups.

"Firstly, it is important to create a benchmark for periodic savings and adhere to it. It often becomes difficult for many to put away a considerable proportion of money at the end of a month as savings. To ease this problem and ensure consistency, they can designate a small proportion of their daily income to save every day," he says. "Secondly, there are several Depository Pension Schemes (DPS) offered by various banks. It is highly suitable for saving a small portion of money periodically and obtaining the principal plus interest earned upon maturity." Many banks offer DPS with competitive interest rates, let consumers save monthly on an EMI basis, and offer a handsome amount at maturity.

Planning for the long term is as important as saving and budgeting for the short term. To be financially prudent in the longer term, it is important to sketch out the amount of money required for children's education, post-retirement period, or similar individual needs and allot a fixed amount accordingly. "Purchasing Shanchaypatra and making fixed deposits in banks that offer high returns are two efficient ways of investing for the long term for people belonging to lower-income groups. Mass people can obtain a considerably high return from Shanchaypatra considering that it is regarded as a risk-free asset backed by the government. Fixed deposits, on the other hand, give guaranteed returns at an interest rate higher than normal savings account after the agreed-upon period irrespective of the market situation. Most banks also allow depositors to take loans against fixed deposits if needed. To prevent keeping money idle and maximise returns, the returns obtained from Shanchaypatra can be invested as fixed deposits," says Reefat Zaman.

Despite the availability of suitable investment schemes, people from lower-income groups often encounter several barriers while accessing them. One such barrier is inadequate literacy. "A large proportion of this group rely on others for gaining useful information about financial instruments and investing in them owing to their limited reading and writing abilities," says Dr Shakila Yasmin, associate professor at the Institute of Business Administration, University of Dhaka. "Documentation issues such as the requirement of NIDs and TINs (Taxpayer's Identification Number) as prerequisites of investment create additional hurdles since many of them are not aware of ways of procuring them," she adds. A feasible way of ameliorating the current situation would be remodelling the overall education system.

"If students are taught about aspects of money management as part of their school curriculum, they would be able to make prudent financial decisions at the later stages of their lives. Learning about the ways of accessing relevant documentation at school would make it easier for everyone irrespective of background to pursue sound investments," Dr Shakila Yasmin further adds. Knowledge about government and private institutes that offer assistance in terms of giving specialised loans and helping marginalised groups can also be useful when one is making decisions associated with personal finance.

There are certain pitfalls that people should be careful to avoid when it comes to managing money. Lack of awareness about fraud accompanied by a lack of foresight may make people susceptible to risks. Falling into debt traps and putting money in unreliable avenues such as Ponzi schemes are pitfalls one should avoid. "People often take loans to meet expenses but do not have feasible plans to generate cash flows to pay off the loan. As such, they are put in precarious positions when they have to take another loan from a different source to pay off the initial loan, thereby descending into a debt trap," says Dr Shakila Yasmin.

Now the question arises: How can knowledge pertaining to effective money management be imparted to financially underprivileged groups?

Several approaches can be taken by multiple stakeholders to do so. Firstly, NGOs aiming to promote inclusion can design financial literacy programmes that the target groups can benefit from and practically apply in their lives. "NGOs can scale up their financial inclusion programme by partnering with Mobile Financial Institutions (MFI) and using their distributors to reach target groups based in rural places. Their modality of imparting knowledge about financial planning can range from conducting in-person Uthan Boithoks (courtyard meetings) to the distribution of posters within a community," says Reefat Zaman. Secondly, corporations can take initiatives to teach lower-income employees such as caretakers, gardeners, and cleaners about money management. The chances of the former group falling into poverty at any stage of their lives would be minimised greatly if such initiatives are executed properly. If such initiatives are implemented at large, a spillover effect would be created which would ultimately increase financial literacy, and in turn, contribute to greater financial inclusion.

The writer is a fourth-year BBA student at IBA (DU).

[email protected]