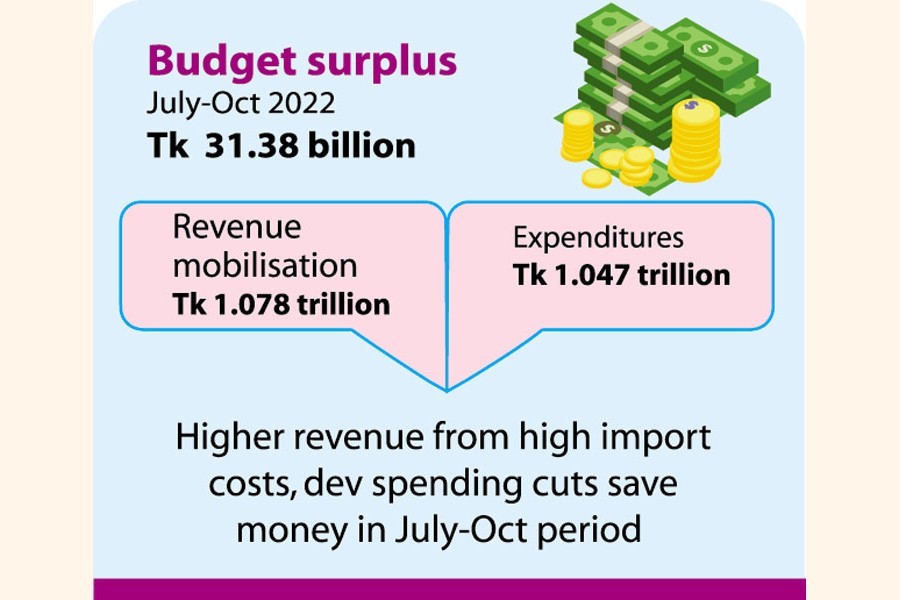

Two unusual financial developments helped the government put aside a budget surplus of Tk 31.38 billion in the first four months of the current fiscal year, which economists, however, believe is transitory.

According to data released from the Ministry of Finance (MoF), revenue mobilisation was Tk 1.078 trillion, compared to expenditures amounting to Tk 1.047 trillion, during the July-October period of the fiscal year 2022-2023.

During the period, the total revenue collection increased by 5.6 per cent compared to the corresponding period of the previous fiscal year (FY22) and achievement as to the annual target was 24.8 per cent.

The tax revenue, consisting of both NBR and non-NBR revenues, stood at Tk 958.04 billion, up by Tk 58.92 billion from the same period a year before. Non-tax revenue or NTR was recorded at Tk 117.95 billion during the period under review.

The major share of government revenue comes from NBR (National Board of Revenue) sources (86.8 per cent up to October 2022), the data showed.

In FY 2022, during the corresponding four months, the budget balance was negative at Tk 13.82 billion.

Economists say the four-month budget balance remained surplus for two major reasons. One is the revenue board bagged additional money from costly imports. Import prices were exorbitant during the first few months of the fiscal year on the back of price hike of commodities on the international market. So the NBR received much resource.

The second one is the government recategorised its development projects and postponed some projects.

In the FY 2022, during the first four months, the development expenditure was recorded at Tk 201.25 billion. And in FY 2023, it declined to Tk 185.18 billion, down by Tk 16.07 billion during the same period.

However, they noted that at the end of the fiscal year, the surplus would not last as now imports have shrunk following the tightening of import under government austerity recipe to navigate the ongoing global crises.

Dr Ahsan H. Mansur, executive director at the Policy Research Institute of Bangladesh, sees this as a temporary phenomenon.

"This surplus will not last till the end of the fiscal year," he told the FE, explaining usual trends.

On a critical note, he says the government cannot spend the funds at right time for the people and for the economy.

"The key divisions, including the health services division, cannot spend to the targets, leading to fall in the outlays."

Dr Masrur Reaz, chairman of the Policy Exchange of Bangladesh, told the FE that imports have now been reduced and so the revenue mobilisation from the external sources would drop in the coming months.

He also points out that the government earns revenues from development projects as VAT and other taxes. Whereas many projects' funding now remained suspended so it will affect the resource mobilisation.

"I think the surplus will not last at the end of the fiscal year," says Dr Masrur.

Finance Minister AHM Mustafa Kamal placed a budget worth Tk 6.78 trillion for the current fiscal year. The budget estimated development expenditures at Tk 2.50 trillion and non-development expenditures at Tk 4.11 trillion.

jasimharoon@yahoo.com