The government's tax revenue collection efforts, economists have feared, might face a setback in the final quarter (April-June) of the current fiscal year (FY) because of the latest lockdown.

The government has only recently downsized the tax receipt target for the FY'21. The National Board of Revenue (NBR) could collect tax revenues equivalent to 50 per cent of the original target, set for the July-February period of the FY.

However, the amount collected was 4.55 higher than that of the corresponding period of the previous year. Taxmen are optimistic about better revenue collection in the last quarter of the current FY.

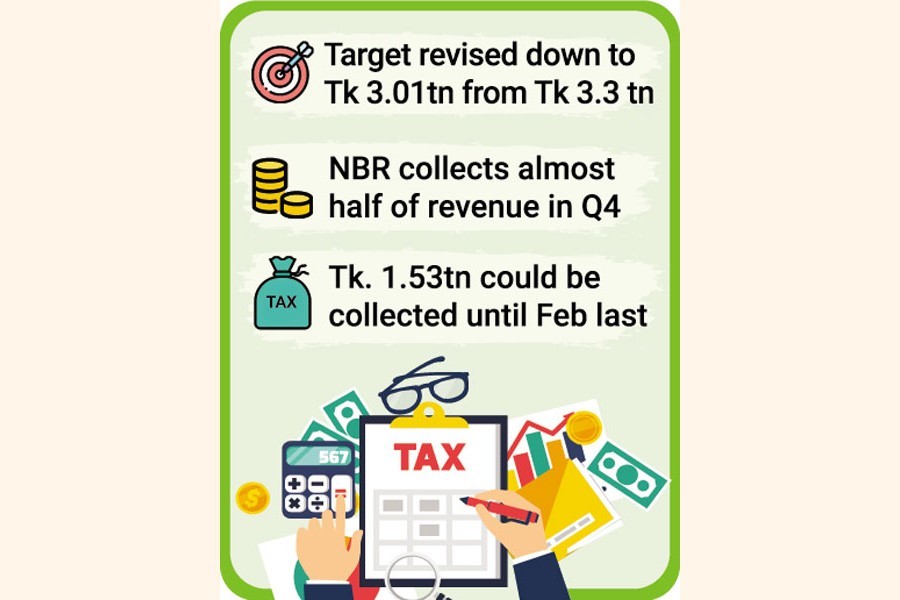

The Q4 is the most productive period for the National Board of Revenue (NBR). During the period, it collects almost half of its total annual earnings.

If the current phase of the lockdown goes beyond one week, tax officials said, the VAT collection at the local level might suffer.

Achieving the revised revenue might become difficult. During the first eight months of the current FY, the tax collection had been picking up, taxmen said.

Due to a significant shortfall, the finance division had revised down the FY's collection target to Tk 3.01 trillion from the original target of Tk 3.30 trillion.

Following the setback, the NBR could collect Tk1.53 trillion in revenue until February last, registering a 4.55 per cent growth over the corresponding period of last FY, according to provisional data of NBR.

The revised target for July-February period was Tk 2.0 trillion.

However, the tax collection grew by 10 per cent in the month of February alone as compared to the same month last year.

Talking to the FE, Director General of the NBR's research and statistics wing Md Anwar Hossain said that the NBR might lose revenue from the hotels and restaurants due to the lockdown.

"We are observing the Covid-19 situation which is very much unpredictable," he said.

Mr Hossain, however, expressed the optimism about maintaining a steady growth in tax collection as the factories and production of goods remained out of the purview of this lockdown.

On closure of the shopping malls, he said, an insignificant amount of revenue comes from the sector and it might not leave any major impact on the revenue collection.

However, the economists were sceptical about the claim and they feared a major setback in the tax collection due to the resurgence of Covid-19.

Dr Ahsan H Mansur, Executive Director of the Policy Research Institute (PRI), said the tax collection will certainly face a blow due to an economic slowdown amid the lockdown.

"The NBR may hardly collect Tk 2.40 trillion in tax revenue in the current fiscal year," he said.

It is also a matter of concern that the government has adopted a conservative approach relating to its spending, he said, adding that it spent only 29 per cent of the development expenditure so far.

He was also sceptical about achieving the GDP growth target of 7.2 per cent in this FY. The data does not match with the eroding purchasing power of common people and sluggish investment scenario, he said.

"The government will have to inject money into the economy like other developed countries to make the economy vibrant," he added.

Until February last, the VAT collection at local stage grew by 3.27 per cent while income tax 5.05 per cent and customs duty 7.86 per cent.

However, the NBR fell short of its revised collection target by Tk 430.43 billion until February last.

The VAT wing faced the highest shortfall of Tk173.37 billion, followed by customs Tk 161.56 billion and income tax Tk 95.49 billion against their respective targets.