The country's tax revenue collection grew by 2.10 per cent in the first half (H1) of the current fiscal year (FY), 2020-21, although the Covid-19 pandemic hit economic activities hard.

The National Board of Revenue (NBR) collected Tk 1.08 trillion as income tax, travel tax, VAT and import duties in the July-December period, according to provisional data of the board.

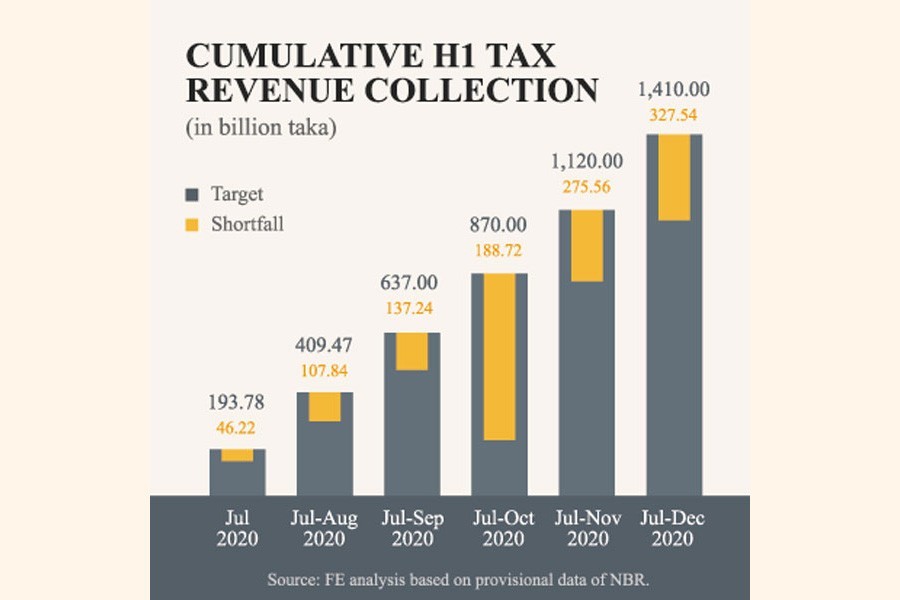

However, the revenue collection lagged behind the target of Tk 1.41 trillion, set for the first six months of the FY, by Tk 327.54 billion.

Officials said a major slide in VAT collection from domestic sources aggravated the shortfall in revenue collection.

The NBR's VAT Wing faced a negative 16.58 per cent growth in December, as per provisional data.

However, the VAT collection amount will increase further after the deadline for VAT return submission will end on January 15, 2021.

A senior official said the provisional data of VAT collection does not reflect the actual scenario, as collection usually goes up by 25th of a month.

Economists and VAT practitioners said the collection of consumption taxes depends on the purchasing capacity of people that has already been reduced in the pandemic.

In December 2020, the NBR collected Tk 213.77 billion revenue against its target of Tk 282.65 billion.

However, tax collection declined by 2.11 per cent in the month compared to that of the same month in the previous year.

According to the NBR data, income tax collection grew by 6.33 per cent and import duties by 8.61 per cent in December.

An analysis of the FE, based on the NBR's previous data, found that tax collection growth was negative in three months of H1.

In July, tax collection growth declined by 6.77 per cent, while it was negative 7.10 per cent and 2.11 per cent in November and December respectively.

However, it never exceeded 10 per cent growth until December, while the target for the current FY has been set expecting around 46 per cent growth compared to that of the actual collection in the previous year.

Until December, both income tax and import stage tax grew by 4.73 per cent and 6.66 per cent respectively.

However, VAT collection declined by 3.36 per cent in the first six months of this FY compared to the corresponding period last year.

A senior tax official said taxmen's relentless efforts and the NBR's timely steps helped to make a positive growth in revenue collection despite the Covid-induced economic situation.

He noted that the NBR will try to boost revenue collection in the next six months, tapping the potential sectors, especially in the area of consumption tax.

The official, however, said it will not be possible to achieve the target of Tk 3.30 trillion for the current FY, as it seems ambitious like the previous year's target.

The NBR's Customs Wing achieved higher growth in December 2020, as import orders grew by 8.0 per cent to US$ 13 billion in November, he added.

Actual import, in terms of value, also increased by more than 9.0 per cent to $3.64 billion in November from $3.34 billion in the previous month.

Talking to the FE, Senior Research Fellow of the Center for Policy Dialogue (CPD) Towfiqul Islam Khan said the economy is showing a turnaround, but it is yet to return to the pre-Covid state.

Such poor growth in tax revenue constraints the government's fiscal space.

"For this reason, we are yet to see expansionary and counter-cyclical measures of the government to address the downturn of the economy."

Proper use of resources is important along with checking tax evasion and cutting tax exemption, Mr Khan opined.

In case of downsising the Annual Development Programme (ADP), the government should prioritise projects in a comprehensive manner, he added.