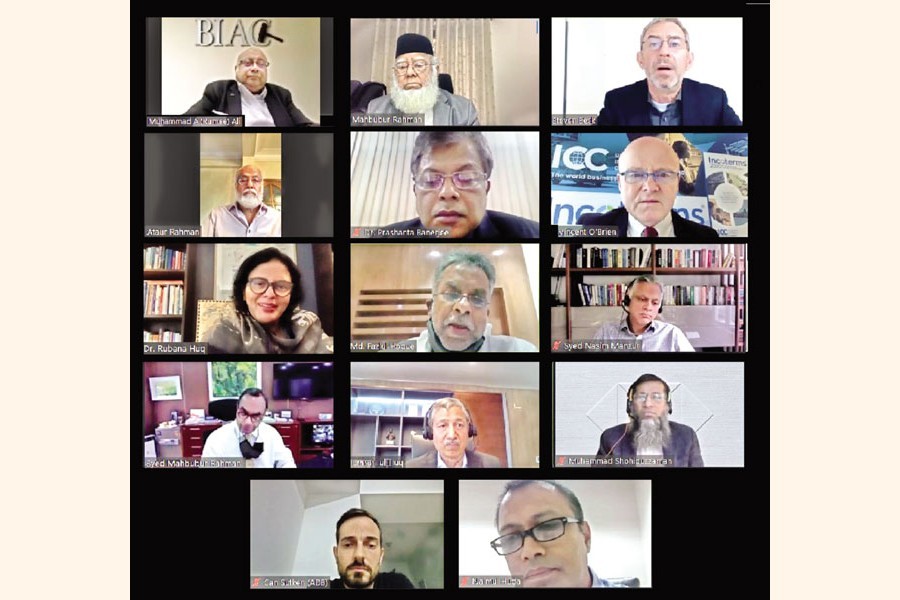

President of International Chamber of Commerce Bangladesh (ICCB) Mahbubur Rahman (top, middle) and other distinguished persons at the webinar on "Global Awareness on Open Account Export Transactions and Recent Policy Changes in Bangladesh" held on a digital platform on Thursday

Speakers at a webinar on Thursday stressed the need for finding a mechanism to develop a bridge between the Export Development Fund (EDF) and foreign financial institutions (FFIs) for taking credit guarantee risks in cases of open account exports.

Taking part in the discussion, business leaders, bankers and academics expressed the concern that the country was losing competitiveness in the international market due to not having an affordable mechanism for the open account exports.

Bangladesh requires its own factoring for functioning open account exports well so that it could offer international standard services at competitive rates, they added.

The distinguished speakers said the central bank should formulate policies in this regard.

They also called for making ways of protecting the country's exporters in open account trading as there is no way back to letter of credit for international trading.

They said there should be buyers' credit rating as well to protect the country's exporters.

International Chamber of Commerce-Bangladesh (ICC-B), ICC UAE and Asian Development Bank (ADB) jointly organised the webinar titled "Global Awareness on Open Account Export Transactions and Recent Policy Changes in Bangladesh".

Member of the Executive Board of ICC Banking Commission, Paris and Director of ICC United Arab Emirates Vincent O'Brien moderated the webinar.

Speaking at the programme, President of International Chamber of Commerce Bangladesh Mahbubur Rahman said, "It is (now) open account system and we should have to continually see (that) adequate protection is there for exporters from a given country."

He said around 85 per cent trading are now being handled by this system around the world. "We should have to go for it and we should also see that our interests are protected."

"From that point of view, factoring and insurance are there and ICC is looking for the ways to protect traders," he said, adding that importers have to have their credit rating so that the exporters from Bangladesh can rely on them.

He said the Covid-19 shocked the international trade and, as a result, the serious challenges of international trade transactions are being translated into disruptions and shrinkage of trade finance; the main driver of economic development.

Currently, around 70 per cent of Bangladesh's export is conducted under preferences given by some developed and developing nations under the LDC criteria.

According to experts, export market diversification will be a major challenge for Bangladesh in the post-LDC era, he said.

Under these circumstances, he added, Bangladesh Bank's circular issued on June 30, 2020 on 'conditional open account transactions' was a good initiative.

The ICC-B president said only the introduction cannot ensure benefits. "All the stakeholders need to work to optimise benefits."

He said the policy will help the exporters to access the appropriate finance up to the value addition portion, back to back payment would be settled on receipt of final payment on maturity.

He said the facility offered under the changed policy has been in operation for the last seven months.

"I understand that the exporters still prefer export through Letters of Credit instead of open account and the banks are yet to have arrangements with international factoring companies/foreign banks/foreign financial institutions/trade financiers/insurance entities for international export factoring," he said.

Former president of Metropolitan Chamber of Commerce and Industry (MCCI), Dhaka and Managing Director of Apex Footwear Limited Syed Nasim Manzur said simplicity, lower costs are among many advantages of open account trading but there are risks if things do not go right.

He said these risks are mitigated by private credit insurance, but their costs are simply too high.

The government of Bangladesh has export credit guarantee scheme, but "it doesn't work and it's too expensive as well", he added.

"I think it needs to be worked out on how the export credit guarantee cost can be reduced," he said, adding that there are three key risks - nonpayment after delivery, goods not accepted and short payment. "We need to identify each of these in the policies."

Mr. Manzur said the EDF is one of the greatest innovations the country has had for affordable exports.

Head of Trade and Supply Chain Finance of the Asian Development Bank (ADB) Steven Beck said the ADB continued to work with the central bank and ICC-B in the transition period from LC to open account.

Relationship Manager of the ADB Can Sukten said the ADB cannot facilitate direct bank guarantee to solve guarantee or coverage issue. "But we can identify the big international banks which helps this appetite and ADB can come in and fund which may in turn cut the cost of trading," he said.

Chairman of ICC-B Banking Commission and CEO of Bangladesh International Arbitration Centre (BIAC) Muhammad A. (Rumee) Ali said: "We must not lose sight of potential risks and we have seen what can happen. During the pandemic, we had some issues with RMG industries which makes it important for us to look at the other side of the issue."

He said that 'what-would-happen-after' should be considered first and there should be coverage for the potential risks.

Mr. Ali said the parties should think about the issues properly and make sure that the contracts have clauses to mitigate risks, including dispute resolution.

Professor and Director of Bangladesh Institute of Bank Management (BIBM) Dr. Prashanta Banerjee presented a keynote paper on Bangladesh Bank Policy on Open Account Export Transactions and its impact on exporters during July 2020 -February 2021.

Speaking as panelist, president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA) Dr. Rubana Huq said there is a need for underwriting the risks of Bangladeshi manufacturers right now considering the Covid-19 pandemic.

"So, we are facing two aspects here, one we are welcoming open accounts for selling credit and, on the other hand, we are exposing ourselves to further vulnerabilities," she said.

She added that they would propose buyers' credit rating in order to balance the two sides.

"Most of the buyers are known to us, but there must be credit rating," she said, adding that there should be both external and internal credit rating to solve the problems.

She said the open account has been introduced to many unproven and unknown retailers who do not have credit rating too.

"Bangladesh has US$ 8.0 billion receivables at this point," she informed the webinar, adding that it is a huge risk selling to unknown retailers.

Former president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Md. Fazlul Hoque said the markets are demanding more factoring, but the factoring service is not organised at all in Bangladesh.

"Few foreign companies are offering factoring services, but there is no unified rate and the cost is too high," he said.

He said it would be good if Bangladeshi companies come up with factoring services of international standard and competitive rate.

Mr. Hoque said the central bank can formulate a factoring policy.

He said that these open account system, factoring and other related issues were not organised in Bangladesh. "This whole model only exists in paper."

Former chairman of Association of Bankers Bangladesh (ABB) and managing director of Mutual Trust Bank Syed Mahbubur Rahman said global awareness is required so that everyone knows about it on both sides. He said the exporters are always running a risk.

He said the EDF is playing a big role which is very cheaper now in comparison with open account. He hoped that open account will be popular once the Covid-19 is over.

Dhaka Bank Limited managing director Emranul Huq said the payment guarantee in open account system increases the cost while open account was introduced to reduce the cost.

He said that the credit rating for the companies might be a solution for this problem.

Country Head of Global Trade, and Receivables Finance of HSBC Muhammad Shohiduzzaman said the foreign financial institutions are reluctant to give credit coverage to the Bangladeshi business outlets.

"Negative business outlook due to, mainly, Covid is the main reason that they are not interested," he said.

He said the international insurance companies are not also interested to provide credit coverage. He thought that tagging the EDF fund with foreign FIs might make the system workable.

Incepta Pharmaceuticals Ltd. chief finance officer Md. Naimul Huda said most of the country's pharmaceutical products export destinations do not accept open account currently due to less regulated market.

He said open account currently will not be used widely in the sector due to this limitation. But open account will be popular if pharma products get access hugely to the developed markets like US, he said.

Secretary General of ICC-B Ataur Rahman offered vote of thanks.