Tax Holiday (TH) is a temporary relief of tax on some industries to support them to sustain immediate competition in the market. Countries announce their tax holiday policies depending on their own needs. In Bangladesh TH was introduced for newly established industries in 1973 under the Income Tax Act, 1973 (14A, the Finance Act 1974). Presently, the TH is allowed for five, seven and ten years for industries set up in the developed, less developed, least developed areas respectively. Export Processing Zones Authority (EPZA), Economic Zones (EZ), public-private partnership (PPP) projects have also these types of schemes and are applicable based on their own rules. The period of tax holiday is calculated from the month of the beginning of commercial production of an industry. Eligibility of tax holiday is determined by the revenue authority and the commencement of production by the respective sponsoring government bodies.

Tax holiday is one of the popular schemes for extending better facilities to industries so that industrialisation spreads to remote areas and regional industrial dispersion can take place. But industrial dispersion has not happened up to the desired level. Industries are still concentrated in city areas - Dhaka contributes most, and Chittagong comes next.

Experience shows that extension of tax holiday alone is not sufficient to encourage investment. For this, it is necessary to create a total investment-friendly environment -- adequate infrastructure, utility services such as electricity, gas, water etc, and supportive bureaucracy. Availability of raw material is another criterion.

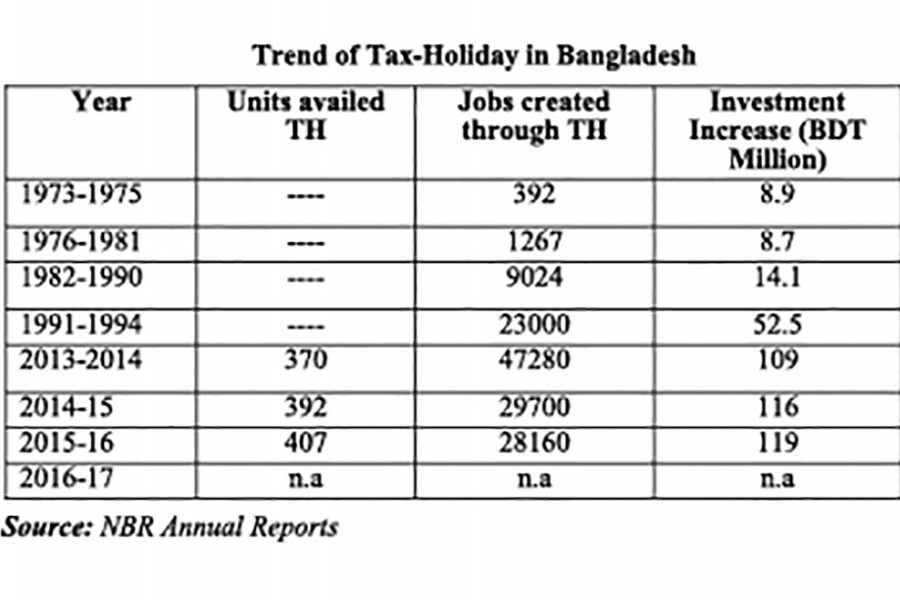

National Board of Revenue (NBR) data show that 370 industries enjoyed TH from 1973 up to 2013-14. These industries created employment for 47,000 people and invested Tk 109 million. Investment may not be big enough but employment creation is considerable.

CONDITIONS FOR TAX HOLIDAY FACILITIES: Tax holiday is provided to industries upon their fulfilment of certain conditions. These are: the undertaking is set up in Bangladesh between July 01, 2008 and June 30, 2019; a company defined under Companies Act 1913 or 1994 having subscribed and paid-up capital of not less than two million (section 26B); the undertaking is engaged in a business as per the allowable list of the government (as per section 46(B) of Income Tax Ordinance or ITO).

In addition to the above, 30 per cent of the tax-exempted income is to be invested in the same undertaking or for a new industry; an additional 10 per cent profit has to be invested each year for purchasing shares of listed companies in Bangladesh within 3 (three) months of closing the income year.

Besides, there should be an undertaking that the industry has not been formed by splitting up or by reconstruction or reconstitution of an existing business or by transfer to a new business of any machinery or plant used in Bangladesh at any time before commencement of the new business.

If an entity can meet these conditions it can apply to the NBR for its approval within six months from the end of the month of commencement of its commercial production.

Sectors are selected based on the priority of the government. For example, information technology (IT)-enabled service sector will enjoy tax holiday benefits until 2024.

However, some sectors like leather and leather goods, engineering and electronics, and plastic and plastic goods which have potential to grow and create employment, are yet to get tax holiday facilities. There could also be some differential benefits for export-oriented industries which are enjoying duty draw backs, cash incentives, bonded ware house, tax at source, lower corporate tax and many other benefits. Some effective financial schemes are also extended to the export sectors.

ATTRACTING FOREIGN INVESTMENT: But tax holiday benefits are primarily important for facilitating domestic industries. Some countries use these benefits for attracting foreign investment in the remote areas. In Bangladesh, priorities are given on the sectors like power generation companies.

The industrial undertakings in EPZs are exempted from the tax policies (Income Tax, Land Development Tax and Municipal Tax) as per the Bangladesh Export Processing Zones Authority (BEPZA) Act 1980, Section 11-A. Currently, 460-plus industrial enterprises, established in the EPZs are enjoying tax holiday benefits. These industrial units produced goods worth $38.33 billion during the period of 2009-2016, the amount of tax compromise was about $ 2.02 billion (considering 26.66 per cent value addition) over the period. In the recent years, export from EPZs has increased to about $ 7.0 billion and for the present fiscal, the target is about $8.0 billion.

Special Economic Zone (SEZ) has announced slab-wise exemption, and no SEZ industrial unit is yet fully ready to enjoy these benefits. However, 45 projects (investment amounting $ 14.86 billion) on infrastructure (Transport, Health, Economic Zone, Tourism, Education, Social, Energy and Civil Accommodation) are in the pipeline. The industrial undertakings would be beyond the purview of some laws (Income Tax, VAT Act, Customs Act, Stamp Act and Municipal Tax Act etc.). The infrastructure projects will get tax holiday for a 10-year period. The capital gains would also be exempted from income tax.

CRITERION FOR TAX HOLIDAY: For making an application for tax holiday certificate, criterion has been prepared by the National Board of Revenue (Tax Holiday Booklet). It requires 12 documents and 10 consecutive steps where three tiers (Applicant, Concerned Circle of NBR and NBR) of parties are involved. It takes 3 (three) months to get approval for getting a TH certificate.

TH operation is done by the circle officers who have other responsibilities to be accomplished. They are de-motivated because of potential revenue loss to the government. Frequent transfer of concerned officials makes the situation worse. The refund and concession of tax is complicated.

Discrepancies in announced policies and implementation gaps, proper guidelines for selecting firms or inclusion of new sectors, continuation of support to the existing enterprises create uncertainties among entrepreneurs. No set criterion is followed for selecting any sector for TH entitlement (ITO 1984, Section 46).

SUGGESTIONS: Absence of proper and authenticated documentation (ledger, voucher and books of accounts) from the applicant's side is another issue. Most of the businesses think tax as a burden or share of profit which is taken away from them forcibly. Information on declaration of capital machinery used and imported is another concern.

The Balancing, Modernising, Replacing and Expansion (BMRE) process for renewing TH has been stopped from the year of 2018. Certificate renewal process is cumbersome. The NBR, as the key regulator, can rethink for e-introduction of ITO Part-3 where clear guidelines for each and every process of Income tax system need to be elaborated clearly.

The policy of the government for providing tax holiday benefit should be target-oriented: whether to support import-substituting industries or export-oriented sector or encouraging foreign investment or the industries producing primary or intermediate raw materials.

Process simplification is another aspect. Certificate renewal application should be made online (fully automated). Regional offices for tax holiday needs should be established with adequate manpower and logistics. The auditing agencies should be accountable for the financial audit report of TH-enjoying enterprises. The Board of Directors would need to submit required and relevant information so that tax officials can get a clear picture on these issues. The value addition of an industry needs to be considered as a criterion for selecting an industry for tax holiday benefits.

Ferdaus Ara Begum is CEO of Business Initiative Leading Development (BUILD), a joint

collaboration of DCCI, MCCI and CCCI. [email protected]