Changes in the socioeconomic landscape of Bangladesh were evident during the last decade with its rise as an emerging economy that consistently maintains above 6.0 per cent growth on an average.

In the wake of global recession, Bangladesh economy proved to be resilient as the major economic indicators remained healthy during the period. In 2015, Bangladesh crossed the threshold of lower middle-income country status fulfilling the criteria set by the World Bank (WB).

It is evident that challenges that concern countries worldwide irrespective of how developed they are, such as climate-change, migration, conflict, cannot be dealt only with isolated efforts by individual countries. This aspiring agenda is a reminder of the challenges the world faces to this date, as many countries were not able to make sufficient progress on every single goal under the Millennium Development Goals (MDGs).

At this stage, it is crucial for Bangladesh to have a reasonable estimate of costing and mode of financing before jumping into the implementing of Sustainable Development Goals (SDGs). With the aim to assess the cost of implementation of SDGs, the General Economics Division (GED) of Bangladesh Planning Commission has done an estimate of overall costs. It, in fact, determines the financing needs for SDGs implementation with a view to mobilising internal and external resources.

The "SDG Need Assessment and Financing Strategy: Bangladesh Perspective" provides an estimate of the annual resource gap and an opportunity to revise the government interventions and financing strategies accordingly.

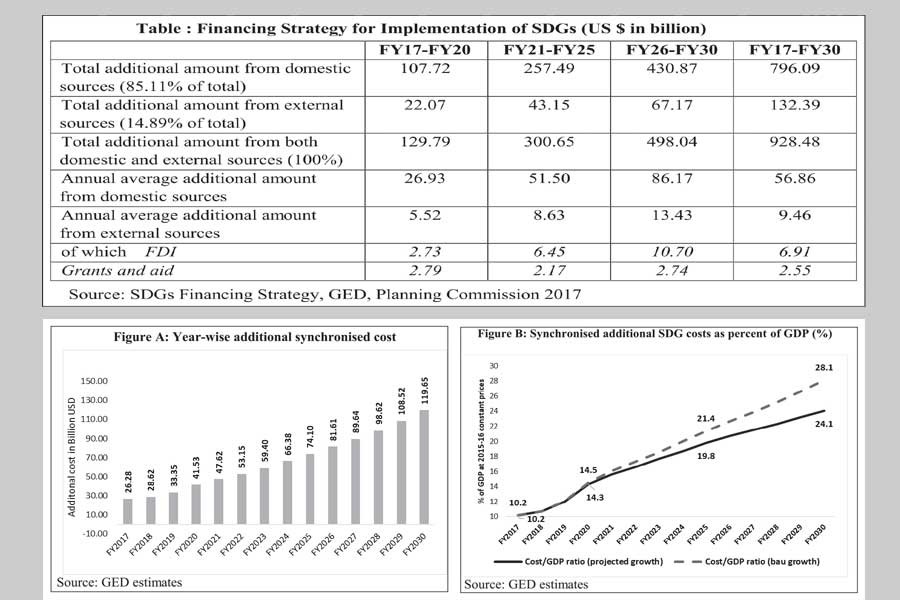

The report estimates that an additional amount, over the current provision of investment related to SDGs by public sectors and external sources, would be US$ 928.48 billion at 2015-16 constant prices. This amount would be required for SDGs implementation over the period of FY 2017-FY 2030, which is 19.75 per cent of the accumulated gross domestic product (GDP) under the 7th Five-Year Plan (FYP) extended growth scenario. The annual average cost of SDGs would be US$ 66.32 billion (at constant prices) for this period.

Two possible scenarios have been considered to come up with the SDG financial Need Assessment. First, the business-as-usual (BAU) scenario, where average annual growth rate of real GDP has been considered to be 7.0 per cent from FY2017 to FY2030. Second, the 7th five year plan (7FYP) extended growth scenario for achieving SDGs in Bangladesh, where it is projected that the GDP growth rate would be 9.0 per cent by FY2030 due to boost of SDGs implementations. This suggests a SDG plus scenario where the growth rate of real GDP is more than the requirement under SDG8.

According to the 7FYP extended growth scenario, the aggregate GDP at constant 2015-16 prices for the period FY2017-FY2030 would be Tk 498,900.3 billion (US$ 5,004.99 billion). On an average, the annual GDP at constant prices during this period would be Tk 35,635.73 billon (US$ 357.50 billion). In contrast, the total GDP at constant prices based on the BAU growth scenario during FY2017-FY2030 would be Tk 460,814.95 billion (US$ 4,646.33 billion), and the annual average GDP would be Tk 32,915.35 billion (US$ 331.88 billion).

Around 80 per cent of the 169 targets of SDGs have been covered in the costing exercise. Diversified method has been applied in the cost estimation. In some cases, multiple methodologies are used for different targets under the same goal. For most of the goals, Multiplicative Factor Analysis (MFA) procedure is applied to calculate the total cost per annum.

This costing procedure takes into account the cost required to achieve certain targets, while considering several factors including quantity, quality, efficiency, sustainability and capacity building. The other methods applied for this study include poverty gap analysis, Incremental Capital-Output Ratio (ICOR) analysis, investment requirement for certain sectors and block allocation for some targets. For a few goals and targets, current programmes under national budget have been used as the base for the cost estimation and these programmes are considered to scale up for better coverage.

The total additional unsynchronised cost (estimation of costs of implementation for each target not considering interactive effects with other targets) for the SDGs has been estimated to be Tk 118,274.59 billion (US$ 1162.76 billion) at constant 2015-16 prices during the period FY2017-FY2030. After removing overlaps through the process of synchronisation for each year, the total additional synchronised cost for the implementation of SDGs has been estimated to be Tk 94,711.65 billion (US$ 928.48 billion) at constant prices, which is 19.75 per cent of the accumulated GDP under 7FYP extended scenario during the period FY2017-FY2030.

The additional synchronised cost taking interaction effects of goals to each one is smaller for the initial period of implementation and the cost increases gradually for the later periods. The additional synchronised cost of implementing SDGs would be Tk 11,100.27 billion (US$ 129.79 billion) during the period FY2017-FY2020, which would increase to Tk 54,466.91 billion (US$ 498.04 billion) for the period FY2026-FY2030. Similarly, the annual average additional synchronised cost of SDGs will be Tk 6,765.12 billion (US$ 66.32 billion) for the period FY2017-FY2030.

The additional synchronised cost for all 17 goals would be 10.16 per cent of the projected GDP (at 2015-16 constant prices) under 7FYP extended growth scenario in FY2017 which would increase to 24.06 per cent in FY2030. Under BAU growth scenario, the estimated total additional cost of SDGs would be 10.18 per cent of the projected GDP (at 2015-16 constant prices) in FY2017, which would increase to 28.14 per cent in FY2030.

Since the major synchronisation is done among the SDG7, SDG8 and SDG9, an aggregated synchronizsed additional amount of Tk 55,135.27 billion (US$ 535.64 billion) for SGD7, SDG8 and SDG9 would be required during the period FY2017-FY2030, which would be about 59.12 per cent of total additional cost of SDGs. In contrast, the least cost would be incurred for the implementation of SDG17, which would be Tk 16.96 billion (US$ 0.18 billion).

SOURCE OF FINANCING: Five potential sources of gap financing have been suggested in the report. These are: Private Sector Financing, Public Sector Financing, Public-Private Partnership (PPP), External Financing (foreign direct investment or FDI, foreign aid and grants), and Non-Governmental Organization (NGO).

The external source has an average share of around 15 per cent. On average, public sector would account for around 34 per cent of the financing requirement, whereas private sector has the share of around 42 per cent during 2017-30 period. The Goals and associated targets of SDGs have large public goods aspect for which much public funding would be required in comparison to private sector's contribution.

The average share of PPP is 6.0 per cent. The external sources have an average share of around 15 per cent where the share of FDI is 10 per cent and that of foreign aid is 5.0 per cent. Finally, the NGOs would contribute around 4.0 per cent for the same period.

The article is adapted from a paper Prof. Shamsul Alam, Member (Senior Secretary), General Economics Division, Bangladesh Planning Commission, presented at the Bangladesh Development Forum, 2018.