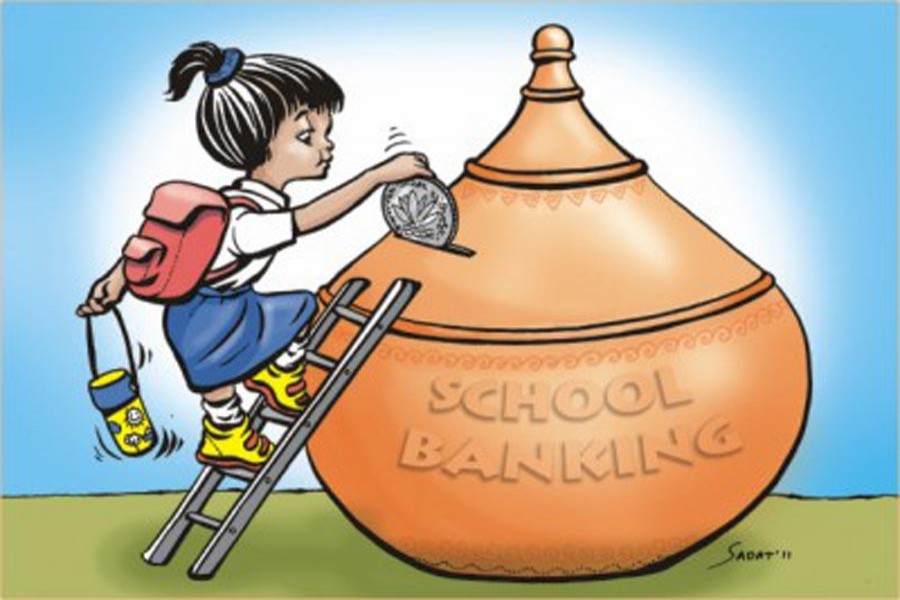

Monetary matters are the part and parcel of everyman's life. There is no way to ignore it. Without financial empowerment no plan can work. So, if the habit of dealing with monetary matters prudently is cultivated in the early life, that sets the stage for doing anything in a planned way in the later years. When it comes to school age children, it is important for them to have the orientation to how to save a little each week and see how the amount grows. At one stage that small savings become the all-important matter in one's life. With that end in view the school banking has been launched. It has already drawn good response. School-going kids are now crowding the banking outlets. They are becoming smarter financial decision makers depositing whatever they can save. Thus the horizon of financial inclusion is broadening. Sowing the seed of a financial concept in the mind of a student in early age may help them one day either own a large conglomerate or be policymaker in the country or elsewhere. The banks are very enthusiastic about bringing the tender-aged students under the banking network as their cash flow in the area of school banking is growing and they can invest the money in different potential sectors.

The students aged below 18 in the country have now started dreaming thanks to their small savings growing in their bank accounts and many are dreaming of going abroad for pursuing higher education. Moreover, the tender-aged students once will become the valued customers of the banks. That is why the banks are in a race to woo the tender-aged kids.

According to a survey of the World Bank, the countries with the highest financial literacy rates are Australia, Canada, Denmark, Finland, Germany, Israel, the Netherlands, Norway, Sweden and the United Kingdom. In those countries nearly 65 per cent or more are financially literate. On the other hand, South Asia hosts countries with some of the lowest financial literacy scores where only a quarter of adults-or fewer-are financially literate. Singapore has the highest percentage of financially literate adults (59 per cent) in Asia. Japan is also well-positioned in increasing financial literacy through schooling.

In Bangladesh, though late, the campaign has kicked off and the volume of deposits under school banking rose to Tk 10 billion (1,000 crore) as of December 2016. The deposits in the bank accounts of school students stood at Tk 7.14 billion (Tk 714.49 crore) as of December 31 in 2014 and Tk 8.44 billion as of December 31 in 2015. A total of Tk 11.28 billion was mobilised in 1,334,343 school banking accounts as of June 30, 2017.

The Bangladesh Bank in November 2010 asked all scheduled banks to introduce school banking in a bid to broaden the financial inclusion as well as boost the financial literacy across the country and help the future generation grow up with a savings habit cultivated in the early age. Following the instruction, the banks have started launching kids-friendly school banking products. The banks are trying to foster the school banking habit. They give the kids different gift items including reading materials displaying logos of the banks concerned.

The criteria for school banking are as follows:

- Students aged six years to below eighteen will be able to open accounts under the School Banking Operation but early in 2016 the Bangladesh Bank relaxed the age limit. The accounts have to be operated through father or mother or any legal guardian of a student.

-The existing uniform Account Opening Form and KYC (know your client) Form are used to open any School Banking accounts. For such accounts, both the Guardian and the student have to fill up the Personal Information part of the Account Opening Form and both forms must be signed by the legal guardian.

-Such a type of accounts will be opened as Savings Account. However, if necessary, any saving schemes can be opened by transferring the balance from these accounts. The minimum initial deposit for such an account will be Tk. 100/- (one hundred) and both the account holder and the Guardian/Legal Guardian will be citizens of Bangladesh.

-The KYC forms of both the account holder and the account operator must be filled up properly. In this context, the attested photocopies of the birth registration certificate and institutional identity card/Certificate issued by the educational institute/the latest receipt of school fees of students have to be collected. All these documents must be preserved by the bank concerned, the BB guideline says.

-The legal source of fund deposited in the account must be verified and related transactions must be rational in this respect.

-ATM card (only debit card) can be issued against this type of account. Maximum limit for monthly withdrawal through ATM Card and Point of Sales (POS) will be Tk. 2000.

This limit may be increased up to Tk. 5000 on request of the Guardian. There will be a system of SMS Transaction Alert to the mobile number of an account holder's guardian.

-No service charge/fee will be imposed on this type of account except government fees. If ATM Card is issued against School Banking accounts, the ATM Card issuance fee and renewal fees will be considered from the same point of view.

-Banks can collect monthly fees of students on behalf of educational institutions with prior understanding with educational institutions through such accounts. Banks will inspire the educational institutions to make sure the students of every school come under the banking services.

-Concerned bank branches may establish separate school banking Counter/Desk to facilitate banking activities among students. Banks will provide deposit/withdrawal services along with other banking services through this counter. Moreover, bank branches may provide this service by opening a booth on the premises of an educational institution.

-All kinds of scholarship/stipend of students can be deposited through School Banking Account. In this regard, the scholarship/stipend provider Government/Semi-Government/Autonomous/ Private institutions have to sign a Memorandum of Understanding with the concerned banks.

-Concerned banks can provide the education insurance facility to these accounts, if any student faces any financial crisis to continue his/her education.

-Besides this, banks will disclose the updated information on school banking activities in their annual reports and on websites.

-In case of conversion to savings accounts, the full KYC must be accomplished and other declaration letters with the transaction profile (TP) must be obtained.

The largest ATM service provider Dutch Bangla Bank Ltd opened a total of 123,172 school banking accounts as of December 2016.

Right now a total of 2,929 junior schools and 16,478 secondary schools are in the country, according to the ministry of education. Around 19,552,979 students are in 108,537 primary schools in the country, according to the Directorate of Primary Education.

Since nearly 23.5 per cent of people are still under the poverty line in the country, the parents of such school-going children intend not to open an account with Tk 100. So, this limit should be revised downward right now mainly for the sake of the people who live from hand to mouth. The central bank may reissue a letter providing for an initial deposit of Tk 10 instead of Tk 100 for opening a bank account by a student.

According to the Bangladesh Bank, as of December 2016 a total of 783,574 accounts were opened from urban schools and 473,796 from rural schools. So the urban schools are going ahead.

Since scheduled commercial banks are allowed to open one branch in a rural area and then another in an urban area as per directives of the central bank, the banks should do same regarding the financial literacy campaign with the help of local administration. Most school-going children from needy families should get special waiver while opening accounts.

In 1961, the Reserve Bank of India (India's central bank) performed its first banking nationalisation phase and directed every bank to open four rural branches before opening an urban bank branch with a view to bringing the unbanked under the financial system. This is widely known that private commercial banks keep themselves aloof from non-business areas in opening branches while state-run banks are obliged to provide government services to the common and destitute people incurring losses year after year. Though the school banking campaign kicked off long ago the country has not yet seen significant growth in opening of accounts with 56 commercial banks compared to the total number of students. State-owned banks have more opportunities to gear up the financial literacy campaign. The banks may open the accounts of teenagers by using their agent banking outlets in hard-to-reach areas. The Bangladesh Bank should ask the banks to use this channel. Smart phones are there in every hand featuring a good number of services. These may be another mode of school banking operation.

Customer Due Diligence (CDD) must be ensured while opening an account by a legal guardian and, if necessary, Enhanced Due Diligence (EDD) should be maintained apart from the KYC form and Transaction Profile (TP). That would help battle terror financing and the central bank also can make on or off-site supervision.

To improve the country's financial literacy rate the state has a role to play. The state can introduce a financial course/subject on the banking concept from the primary to high school levels. Full-fledged financial inclusion is still a big challenge for Bangladesh, since haor, char and riverine areas lacking any proper road network have little access to traditional banking except mobile banking.

The writer is Executive Officer at Managing Director's Secretariat, Social Islami Bank Ltd.