The livelihood issues of workers are neglected in the globally recognised ready-made garment (RMG) sector of Bangladesh. Addressing the changes in workers' livelihood need due attention not only in the context of present-generation workforce of the sector but also for the future generation of the workforce. Based on a sample survey of 115 workers in four major RMG clusters, the present study examines the livelihood issues of RMG workers in order to better understand the challenges for ensuring their decent living.

COST OF LIVING OF WORKERS' FAMILIES

Rise in non-food costs changed overall lving expenses: It has been observed that workers' livelihood expenses have been changing - the overall share of non-food expenditure outweigh that of food expenditure. Traditionally, food expenses were considered to be most important expenditure for workers and their families. With the rise in income due to the revision of wages in 2010 and 2013, the consumption pattern has been changing with a rise in non-food expenses. The average monthly expenditure of sample RMG workers has been found to be Tk. 22435, where food costs are Tk. 8,125 and non-food costs Tk. 11,142 (Table 1). The ratio of food and non-food expenses is 36:64 now, which was 50:50 in 2013 (Moazzem et al, 2013). Thus, workers' living expenses have been changing with more non-food costs, unlike the past where food-related costs dominated living expenses.

Among different food-related items, the highest costs are related to cereal (24.8 per cent of total food cost) followed by meat and egg (14.7 per cent), vegetables (14.0 per cent) and fish (9.3 per cent). Interestingly, the highest non-food cost is repayment of monthly dues (22.3 per cent). Other major non-food costs include house rent (18.9 per cent), followed by costs for education (15.1 per cent) and medicare expenses (9.7 per cent). It is important to note that workers have significant expenditure for education and medicare - a large part of that is related to their children. Overall, workers' cost of living has increased by 17.2 per cent per year between 2013 and 2018, with food-related expenses increasing by 11.4 per cent and the non-food-related expenses increasing by 17.2 per cent. Such a rise in expenditure is not fully explained by the rise in inflation - as the national consumer price index increased by 26.04 per cent only between December 2013 and June 2018.

Lack of Necessary Facilities Make Workers Bear Additional Costs in Gazipur: There is a modest variation in workers' living costs in different locations. Both food and non-food costs are the highest in Gazipur. This is perhaps associated with a high concentration of factories and limited development of required facilities for workers, including housing, medical and schooling facilities etc. In order to reduce the gap between demand and supply, both public and private investment is necessary for community facilities in major RMG clusters including Gazipur.

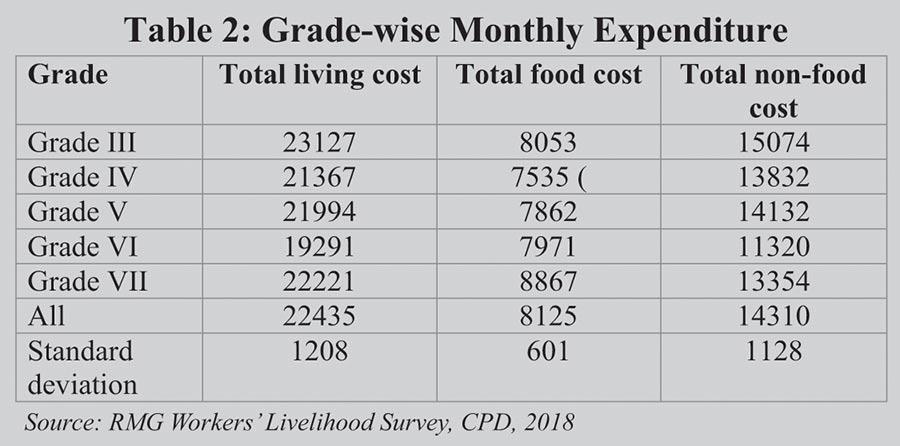

Workers still struggling to meet essential needs: It is usually expected that workers working in upper grades consume more because of their relatively high income. The living cost is high for grade-III workers (Tk. 17652), but it is not necessarily the lowest for grade-VII workers (Table 2). Relatively low standard deviation of food cost (Tk. 601) and partly non-food cost (Tk. 1128) indicates that consumption patterns of workers in different grades are almost same. Perhaps, this is because of the low level of income and lower income-gap between different grades, which does not allow consumption beyond subsistence level.

Rise in number of family members putting pressure to accommodate additional costs: The living expenses of workers rise with the changes in the size of the family (Table 3). The living expense is relatively low for a two-member family (Tk. 19,938). The high living cost is found in the case of workers having five members in the family (Tk. 23,039). Hence, workers are usually forced to accommodate additional costs for additional members in their families.

LIVELIHOOD ISSUES OF RMG WORKERS' FAMILIES

Accommodation of workers: Majority of workers stay in poor housing conditions without adequate facilities. Among the surveyed, only 47.8 per cent of workers stay in one room either alone or with family members. In other words, about 52.2 per cent of workers stay in a room shared with non-family members. However, the situation appears to be improving compared to the past because of rising income and modest improvement in accommodation facilities. It is important to note that workers' expenditure on housing has increased by 38 per cent when they stay in the same location and 22 per cent when they stay in different locations. Because of that, over 68 per cent workers did not stay in the same location probably to minimise the cost of housing among other reasons. Majority of workers still use toilet on a shared basis (86 per cent); similarly, 85 per cent workers use shared kitchen facilities. Overall, majority of workers are unable to rent a room with independent kitchen and toilet in order to avoid high costs as well as their inability to meet the additional expenses.

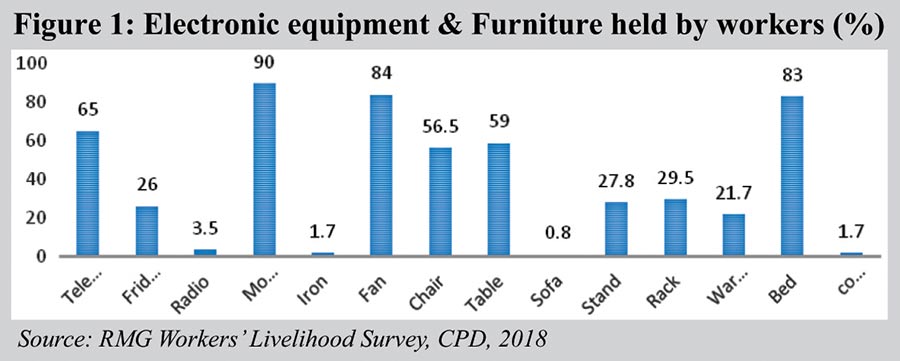

Assets of the workers: Workers' household assets are still scant - nearly 40 per cent of workers have inadequate furniture, 44 per cent do not have any chair (Figure 3). It is really unfortunate that 17 per cent do not have any bed and have to sleep on the floor. Furthermore, 16 per cent of workers are living without a ceiling fan. In other words, their current incomes do not allow a considerable number of workers to meet their essential household requirements. Around 90 per cent of workers have mobile phones, 65 per cent have television, but only 24 per cent have refrigerators. These assets have been generated through accumulated savings from the earnings of the family members of RMG workers. At the same time, few workers possess a computer at their home and the proportion is very low (1.7 per cent). It seems that the workers' livelihood condition is improving because of rising income, but the situation is still pitiable as a large proportion of workers are yet to ensure comfortable living both for them as well as their family members.

Workers' liabilities and savings: A high percentage of workers (32.2 per cent) took personal loan which was repaid every month. In other words, majority of workers do not have sufficient emergency savings in order to accommodate emergency needs of their families. Besides, 41.7 per cent workers have long-term debts. In most cases, personal borrowings and debts are related to meeting family expenses, particularly for settling medical expenses, construction and/or repair of houses, and/or purchasing of land. Often workers depend on informal financial markets for borrowing money at a very high rate of interest. The cost of borrowing could be significantly reduced with effective and extended financial services by formal financial institutions. According to the survey, about 56.5 per cent of workers who are in the upper grades and their families are found to make more savings compared to those working in the lower grades. However, these amounts of money are mostly 'forced' savings made by sacrificing basic amenities and requirements as discussed above.

Availability of Public Facilities/Amenities: Workers are deprived of basic facilities in their communities and localities. Most of the workers usually prefer to stay near their workplace; at the same time, they expect other facilities such as schools for children in nearby areas. The average distance from workplace is about 1.0 km, while average distance for a government school, private primary school and madrasa is 1.0 km, 0.78 km and 0.72 km respectively (Figure 4). Among the educational institutions, government schools are located the farthest, while madrasas are the nearest. Similarly, among the higher educational institutes, government colleges and clinics are located further apart compared to private colleges and clinics. On the other hand, recreational facilities are located farthest from their dwelling places - average distance for a park is about 3.2 km and a cinema hall 3.1 km. Since workers' families spend a modest amount for recreational facilities - these need to be developed in their localities.

CHALLENGES FOR WORKERS CONCERNING THEIR LIVELIHOOD

Major changes in the composition of expenses: Workers are increasingly in need of meeting expenses for their children. Education, medicare and repayment of monthly dues are the three important non-food expenses that are not so much discussed. Because of the lack of low-cost public facilities for education and medicare, workers often depend on high-cost private sources. Similarly, absence of formal banking services push workers to accept informal financial services at high cost. Therefore, the government should invest heavily in developing community-based education, health, financial and recreational facilities for workers in the garment clusters.

Workers' personal income is not adequate to cover family expenses: Workers in the lower grades have their own families and tend to be increasingly responsible for their extended families as well. On average, 67 per cent of garment workers are married with a family size of 4.1. The income of the workers made significant contribution to meeting the needs of the families. With the revisions in wages, workers are able to better accommodate family expenses. Still, their wages cover only 47 per cent of the family expenses. These workers could manage the family expenses with the incomes of other family members.

Community-based facilities need to be developed in RMG clusters: In case of housing, the government and private commercial banks should extend loan facilities to the private landowners to vertically expand the existing housing facilities as well as set up new multi-storied housing facilities. Both public and private house-building lending organisations can extend credit facilities for the development of housing in the RMG localities. Moreover, entrepreneurs in specific locations can form 'Community Trust' along with the local landowners, under which housing facilities can be built under private arrangements. Besides, the government should set up more low-cost clinics for the workers, which could be set up under public-private partnership (PPP) arrangement as well as through specialised NGOs. More public schools and colleges need to be made available for the children of the garment workers. More recreational facilities like parks, amusement parks and movie theatres need to be set up for workers and their family members.

Financial transactions should be via bank accounts: The ministry of labour and employment (MoLE) should make it mandatory for factories to undertake bank-based financial services for workers. Given the limited banking facilities in workers' localities, it is important for trade bodies such as the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) to discuss with banks for setting up branches/booths and agent banking in order to offer necessary facilities for the workers.

Rise in workers' wages likely to contribute to future human resources development: With the rise in wages, workers' ability to spend has increased over time. A major dynamics of changing cost structure is that majority of workers are investing in their children as much as possible. Such investment not only helps the families in ensuring their future wellbeing, it also indirectly helps in developing future human resources who would be better educated and more healthy and knowledgeable. Hence, enterprises should facilitate such investments by the workers by sufficiently raising their wages.

It is therefore important to take into account the recent changes in livelihood and living of workers while addressing the issue of minimum wage for RMG workers.

Khondaker Golam Moazzem is Research Director, Centre for Policy Dialogue (CPD), moazzem@cpd.org.bd; Md Arfanuzzaman is Programme Manager of Centre for Policy Dialogue (CPD).

moazzem@cpd.org.bd