Bilateral trade between Bangladesh and the United States (US) increased significantly in the last two years when global trade has gone through a tense period. It is the surge in the US export to Bangladesh or Bangladesh's import from the US that enhanced the bilateral trade as well as reduced the trade gap of the US with Bangladesh.

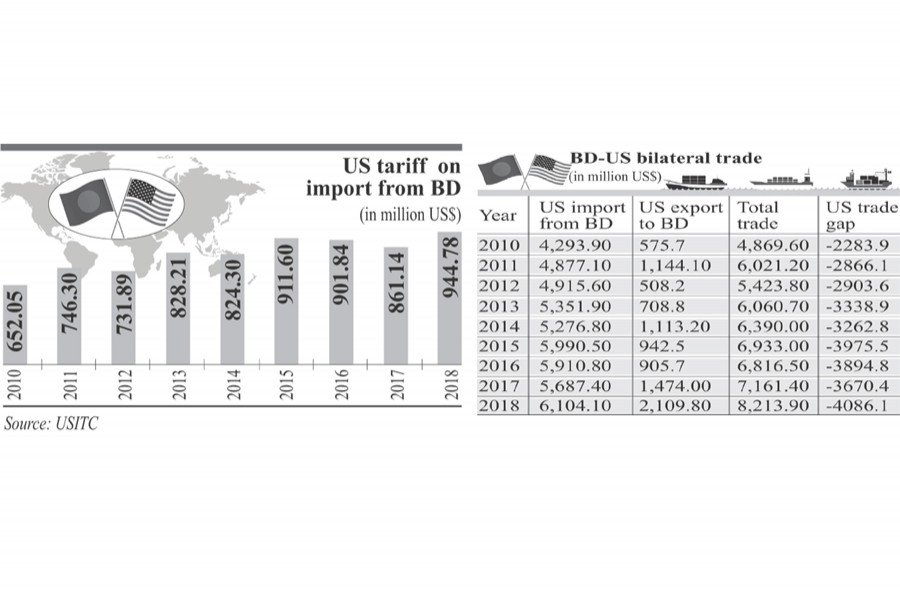

Statistics available with the US Department of Commerce showed that bilateral trade in goods between Bangladesh and US jumped by 14.70 per cent in 2018 to US$ 8.21 billion which was $7.16 billion in 2017. This was the highest ever growth in bilateral trade since 2011. Jump in export from US to Bangladesh by 43 per cent contributed to increase the trade volume in the past year (Table-1). It is for the first time US export to Bangladesh crossed $2.0 billion mark. Import from Bangladesh (or Bangladeshi export to the US) also crossed $6.0 billion level for the first time by registering 7 per cent growth.

US export to Bangladesh crossed $1.0 billion level in 2011 for the first time but it couldn't be sustained in later years. In 2014, it again crossed $1.0 billion mark and came down below $1.0 billion level in 2015 and 2016. In 2017, it posted around 63 per cent growth and stood at $1.48 billion which further increased to $2.10 billion in 2018.

Higher demand of cotton, iron, steel and oil seeds in Bangladesh market pushed US exports to the country. As US export means Bangladesh import, it also indicates that consumers in this country are gradually looking for higher quality of goods manufactured in the US.

Big jump in US export compared with the moderate rise in US import from Bangladesh reduces US trade gap with Bangladesh. It came down to $3.99 billion in 2018 from $5.0 billion in 2016 and $4.22 billion in 2017. The current trade policy of the US considers 'negative trade balance' a 'bad thing' for America. So when it reduces, no matter what the volume, it may be considered as a positive development for them.

TARIFF COLLECTION: Mr Donald Trump, the President of the US has initiated tariff wars with China and some other big countries. As Bangladesh is already facing higher tariff rate in the US market, the tariff war doesn't put any immediate challenge for the country.

In 2018, the US customs authority collected $944.78 million tariff on Bangladeshi shipments which was $861.13 million in 2017, according to United States International Trade Commission (USITC). The average rate of tariff on Bangladeshi products thus stood at 15.47 per cent in the past year (Graph-1).

In an analysis last year, Washington-based Pew Research Centre also unveiled the similar picture. It said: "Nearly all Bangladeshi imports were subject to US duty, and the tariffs on them were equivalent to 15.2 per cent of the total value of that country's shipments to the US - the highest such average rate among the 232 countries, territories and other jurisdictions in the ITC database."

It is to be noted that average tariff rate on US imports from a country generally depends on two things: the share of total imports that are subject to duty, and the average rate the US places on that share.

Major export item of Bangladeshi is clothing. Average US duty on clothing product is 17 per cent, highest among the importable products. It means the US levies higher tariff on essential consumer items than other products. For instance, average import tariff on electrical machinery and equipment was below 3 per cent in the last year.

To put it in another way, the US customs collected around 2.0 per cent of its total annual import tariff through the custom duties levied on Bangladeshi products in the past year. The total tariff collected by the US was around $48 billion in 2018. The annual import tariff increased by 45 per cent in the past year over the previous year. It may encourage the US trade policy makers to continue the tariff hike spree.

Nevertheless, an analysis by a group of American economists unveiled that Donald Trump's trade war cost the US economy worth $7.8 billion of gross domestic product (GDP) in 2018. Analysing the short-run impact of Trump's actions, the researchers found that imports from targeted countries declined 31.5 per cent while targeted US exports fell by 11 per cent in the past year. After accounting for higher tariff revenue and gains to domestic producers from higher prices, the aggregate welfare loss was estimated at $7.8 billion which was 0.04 per cent of the US GDP. It is thus interesting to note that big jump in tariff revenue not always brings real benefit.

GSP AND MARKET ACCESS: The US administration under President Obama scrapped the generalised system of preferences (GSP) facility of Bangladesh in 2013. Though Bangladesh has taken a number of initiatives to revive the trade benefit, the US did not show any positive response in this regard. GSP scheme, however, covered around only one per cent of Bangladesh's total export.

Against the backdrop, the former commerce minister of Bangladesh last year categorically declared that the country would not make any effort to revive the GSP. On the other hand, the incumbent commerce minister urged last week to the US to reinstate Bangladesh's GSP. It is probably a wrong request to Trump regime. The US president has already threatened to revoke GSP facilities enjoyed by India and Turkey. Like Bangladesh, only a fraction of India's exports to the US enjoy GSP preferences and India's savings on customs duties added up to just $190 million annually.

Again, the US has been denying tariff-free market access to Bangladesh so far on the plea that Doha round multilateral trade talk under the World Trade Organisation (WTO) is yet to be finished. Now, Trump administration makes it clear that WTO or multilateralism is no more a preferred option for the US. Instead, it now prefers bilateral deal and so, some argued that Bangladesh needs to work on signing bilateral free trade agreement (BFTA) with the US.

But it is a highly ambitious proposition as Bangladesh is yet to sign BFTA with any country. Moreover, the structure of the US FTA is beyond trade in goods and services. It extensively covers investment, intellectual property right and standards of labour and environment. In fact, the country believes in 'deep integration' and so full liberalisation of goods and services is an inherent component of any BFTA with the US.

Thus, expecting any trade preference in the US market at the moment is an impractical proposition for Bangladesh especially when US trade-restrictive policy is likely to continue. Though bilateral trade has increased significantly in Trump regime, it has little to do with his trade policy. Rather it reflects that trade grows in its own way and all Bangladesh should do is to maintain the current trade growth.