Populist economics has rarely had it so good. The US economy is roaring, the stock market is soaring, and the Trump administration's protectionism has apparently had a negligible impact on growth. Trump's dictum that "trade wars are good" even seems to be catching on politically, confounding some of his critics. They still insist that tariffs are undesirable in general, but they now concede that such measures could be appropriate and useful to stymie China's rise.

A similar picture has emerged in Europe, where Hungarian Prime Minister Viktor Orbán and Poland's de facto leader, Jaroslaw Kaczynski, are riding high on the back of full employment and labor shortages. Under these conditions, one of the populists' strongest arguments is simply to point out that all the warnings by the globalist elite, Davos cosmopolitans, neoliberals, and one-percenters about the dangers of populist economics were baloney. The British Remainers behind "Project Fear" overstated the costs of Brexit; the UK economy has not collapsed after all.

But, of course, it is only a question of when, not if, the economic reckoning will come. Populism is not only about promises to give more to more people; but, without those promises, all of the cultural elements of populism would look merely outdated and reactionary. And even reactionaries do not like reactionary politics if it hurts them in their wallets.

In the United States, the midterm congressional elections in November will be decided by whether enthusiasm about the state of the economy is strong enough to compensate for the widespread disapproval of Trump's personal style and divisive, sexist, and racist rhetoric. Yet it is precisely on this issue that the conventional wisdom breaks down.

Classical economic liberalism assumes that bad policies will be punished immediately by bad outcomes. Over the past 25 years, bond-market vigilantes have argued that all-seeing, forward-looking financial markets will always anticipate the future consequences of populist policies and impose risk premia. According to this logic, as borrowing costs rise, populist governments will not be able to deliver on their rash promises, and sanity and orthodoxy will eventually return.

Economists who study populism generally draw lessons from Latin America, where past episodes of nationalist over-promising have quickly led to massive fiscal deficits that could not be financed. In these cases, populist economics always produced cycles of inflation, currency depreciation, and instability, because global financial markets and other outsiders were skeptical from the start.

The problem is that the Latin American experience is not universal. Bond markets are not as predictable as many seem to believe; nor can they be relied on as an ultimate source of discipline. Like markets generally, bond markets can be captured by a popular narrative (or what might euphemistically be called the management of expectations) that overstates the prospects of a certain outcome.

Like today, the interwar period had liberals who predicted that the unconventional response to the Great Depression would end tragically, only to be exposed as purveyors of falsehood when their prophecies did not immediately come to pass.

The most extreme response to the Depression came from Hitler's Germany. The Nazis did not miss an opportunity to boast about how quickly their programs had wiped out unemployment and built new infrastructure. With the German government keeping inflation in check through extensive price and wage controls, there was much talk about an economic miracle.

The Nazis' apparent success in defying economic orthodoxy looked to many conventionally minded analysts like an illusion. Critics outside Germany saw only a deeply immoral polity pursuing a project that was doomed to fail. They were right about the immorality, of course; but they were wrong about the imminence of the project's economic collapse.

In 1939, the Cambridge University economist Claude Guillebaud published The Economic Recovery of Germany, which argued that the German economy was quite robust and would not collapse from overstrain or overheating in the event of a military conflict. Guillebaud was widely vilified. The Economist, that bastion of classical liberalism, pilloried him in an unprecedented two-page review, concluding that not even the chief Nazi propagandist Joseph Goebbels could have improved on his interpretation. His work, the editors lamented, was emblematic of a "dangerous tendency among democratic economists to play the Nazis' game."

Guillebaud was also excoriated by other academics who were far more famous than him, such as the British economist Dennis Robertson. And yet Guillebaud was fundamentally right: Nazi Germany was not an economy on the brink of collapse, and the Western powers would have done well to start mobilizing a proper defense.

The contemporary debate is similar. The record of populist economics in Europe is neither particularly bad nor particularly outstanding. More to the point, today's populists have benefited from a general recovery that began before they arrived on the scene. When the next downturn comes, they will quickly find that their own reckless policies have severely constrained their ability to respond. At that point, Orbán, Kaczynski, and other Central European populists may decide to pursue more aggressive options.

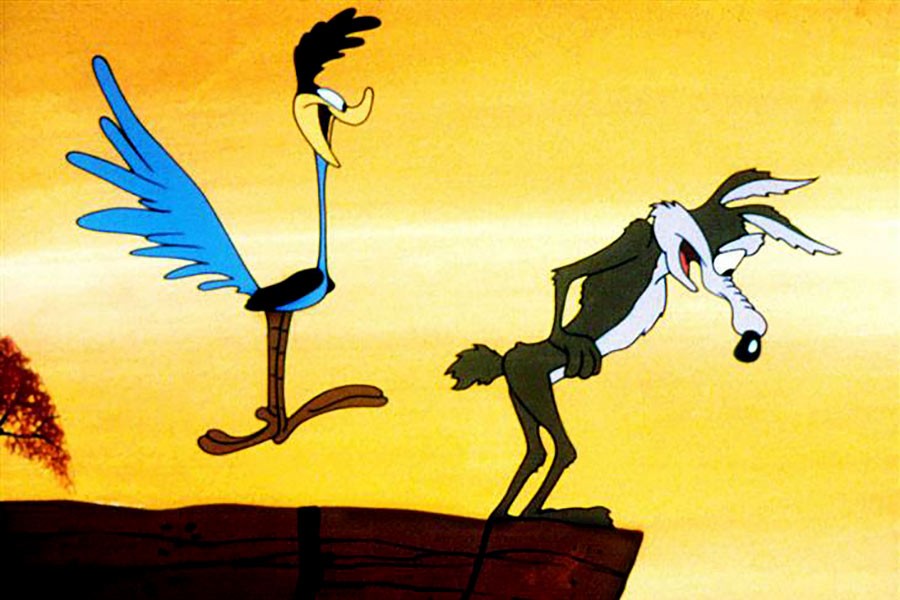

If populism had an avatar, it would be the immortal cartoon character Wile E. Coyote, who, in his futile pursuit of the Road Runner, routinely sprints over cliff edges and continues to move forward, suspended by the logic of his own belief. Eventually, he realizes that there is no ground beneath his feet, and he falls. But that never happens immediately.

In the 1990s, when Russia was feeling the pinch of economic reforms, the Russian political provocateur Vladimir Zhirinovsky asked, "Why should we inflict suffering on ourselves? Let's make others suffer." The ultimate danger of nationalist populism always reveals itself during a setback. When things start to go wrong, the only way forward is at the expense of others.

As in the past, when the illusion of today's painless economic expansion ends, politics will return to the fore, and trade wars may lead to troop deployments.

Harold James is Professor of History and International Affairs at Princeton University and a senior fellow at the Center for International Governance Innovation.

Copyright: Project Syndicate, 2018.

www.project-syndicate.org