Over the past few months a renewed debate has arisen on the merits of an interest rate cap on bank loans. The intention is to encourage economic growth by helping lower the cost of funds and increase access to credit for businesses and individuals. While well-intentioned, the results of the rate cap may turn out to be the direct opposite. Credit, particularly to individuals and small and medium-sized enterprises (SMEs), will likely dry up, increasing the vulnerability of the banking sector and jeopardising economic growth and stability. Global investors have seen this "movie" play out elsewhere -- history shows that a rate cap has generally a negative result.

In Africa, the Kenyan parliament passed a bill in September 2016 capping interest rates on loans at 4.0 per cent above the policy rate. The rate cap was removed in November 2019 because it failed to achieve its goals, and those three years caused significant harm to the economy and well-being of the people. A memorandum by the president to parliament calling for repeal stated, "it is apparent that the capping of interest rates has caused unintended effects that are significant and damaging to our economy and in particular, the Micro, Small and Medium Enterprises (MSMEs) which are the hardest hit."

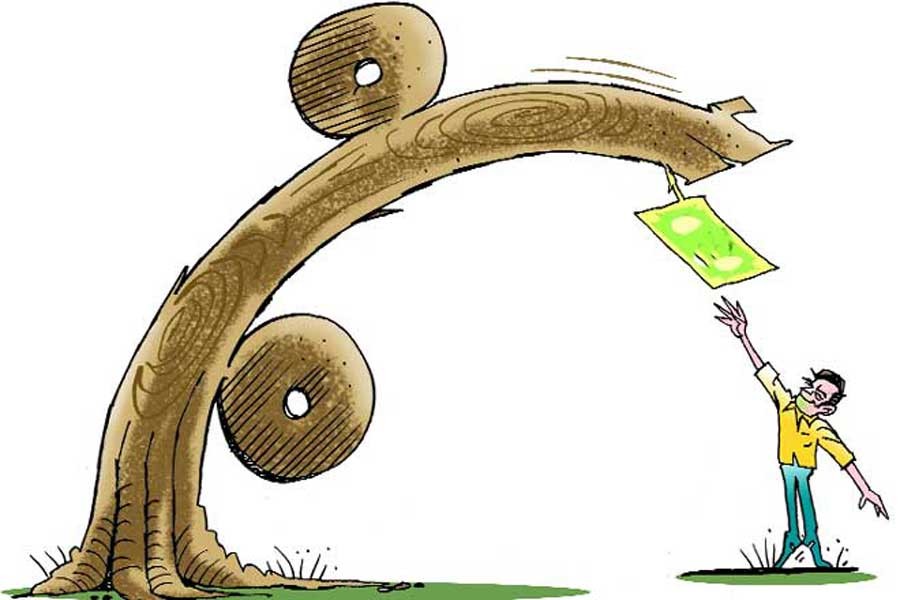

As Figure 1 below illustrates, as lending became unprofitable for banks, real credit growth rate turned from double digit to negative almost immediately after the rate cap was implemented. In particular, smaller banks that lent to individuals and micro and SMEs were hit hard. As the memorandum pointed out, "Studies indicate that the lending activity … (declined) by about 5 per cent in the 12 months ending September 2017. Small banks have been disproportionately hit by capping due to their different business model of relying more on higher-risk/higher-return borrowers..." The memorandum also noted the "mushrooming", or growth of loan sharks and unregulated lenders that took advantage of the lack of financing available to small businesses and individuals. The result -- Kenya's private sector credit-to-GDP (gross domestic product) ratio shrank from a pre-rate cap high of 34 per cent to 28 per cent by 2018.

The economy suffered, with growth 0.4 per cent lower in 2017 and 0.2 per cent lower in 2016 as credit dried up. Government tax revenue growth decelerated from 12 per cent to 5.0 per cent.

In addition, non-performing loans (NPLs) in the Kenyan banking system shot up from 6.8 per cent in 2015 to 12.3 per cent in 2017. NPLs surged because borrowers' working capital and capital expenditure needs were interrupted. Instead of promoting growth, as the interest rate cap intended, it instead caused defaults and hardships for businesses and individuals.

Kenya is not an isolated example. The World Bank published a study on rate caps around the world and concluded that "interest rate caps often have substantial unintended side-effects. These side-effects include reduced price transparency, lower credit supply and loan approval rates for small and risky borrowers, lower number of institutions and reduced branch density, as well as adverse impacts on bank profitability."

Capping deposit rates does not ameliorate the issue and will likely cause a liquidity crunch for the system. The proposed 3.0 per cent interest spread with a 6.0 per cent deposit rate and 9.0 per cent loan rate barely covers the credit and operational costs of most banks, let alone SME and retail-focused banks that have an intrinsically higher cost base because they must serve many customers as best as they can. Moreover, by offering a deposit rate that is lower than what the market demands, depositors will look for alternative investment venues, causing a slowdown in deposit growth. The resulting liquidity crunch would exacerbate the funding challenges already faced by banks today.

What is concerning is that in Bangladesh NPLs are already high, and profitability levels are much lower than Kenya pre-rate cap. Return on assets was 3.1 per cent in Kenya pre-rate cap, as compared to 0.3 per cent currently in Bangladesh. NPLs were 5.6 per cent in Kenya versus 12 per cent in Bangladesh, currently. System shocks can lead to capital shortfalls, and the ability of Bangladeshi banks to absorb such a shock will be tested. The capitalisation of the Bangladeshi banking system is already low at 11.7 per cent, as compared to 19 per cent in Kenya before the rate cap introduction.

There are more effective means to promote access to credit. The Bangladesh government is already on the right path by reducing the attraction of the National Savings Certificates, which compete with bank deposits. A reduction of the budget deficit and government borrowing from banks should also alleviate the crowding out effect and allow for more deposits being directed towards commercial loans rather than government securities. Likewise, on the demand side, the government is doing a good job of supporting key industrial sectors, such as textiles. Other positive steps include reducing loan scams and large borrower defaults so that liquidity can flow to productive users. Promoting technologies that reduce credit distribution costs will also help in the long run.

Bangladesh has one of the most impressive records of economic growth in the world over the past decade. It is laudable that the business community is not complacent and is thinking of ways to stimulate further progress. Unfortunately, rather than being a device to help the private businesses that have been Bangladesh's growth engine, the rate cap could be a hindrance. It could have adverse consequences for the country's economic stability, which has been exemplary among developing nations over the past decade.

Beidi Gu is Portfolio Manager and Managing Director,TRG Management LP, New York. USA.