When Imran Khan was in power, the economy of Pakistan faced the biggest shock. The rampaging Covid-19 pandemic across the world sent its economic growth into the negative territory. As soon as the pandemic subsided, the economy started to recover. The growth rate recovered from -0.47 per cent in 2020 to 3.94 per cent in 2021. In 2022 the growth rate was set to exceed the 6.0 per cent mark. Then came the Russia-Ukraine war, another shock for the global economy. The global oil market started to boil. Once at the freezing point, the oil price rose as high as US$ 80 per barrel. But Prime Minister Imran Khan chose to move ahead without rocking the growth boat. He made no price adjustment in the domestic market, kept the subsidies unaffected. He was battling a far higher growth in import payments and an inflation rate of nearly 13 per cent.

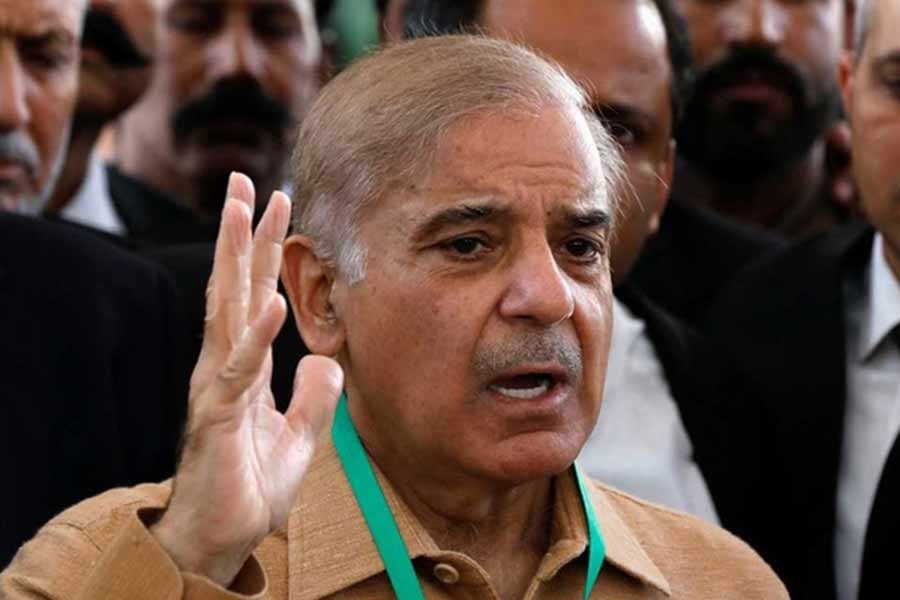

The opposition political camp brought an allegation of economic mismanagement against him. Without elaborating how they will correct the course, they brought the no-confidence motion against Imran Khan in the National Assembly. Imran Khan warned that it would be the economy that would be the worst sufferer. The opposition did not heed what he said. Finally, Imran Khan lost the vote and the government led by Shehbaz Sharif took over.

As soon as they came to power, they started rocking the boat instead of steadying it. The axe fell on subsidies. In June last they raised the fuel oil prices to secure IMF funding as the forex reserve was depleting fast. That hit power generation and some factories reportedly closed. The inflation rate soared to around 23 per cent. To cut the current account deficit, they started tightening their grip on imports. Resultantly, the economic growth in the full fiscal year of 2021-22 slowed to 5.97 per cent.

In July last they raised electricity prices despite rampant inflation to cut the gap with power generation costs. In the month the import costs were reduced by nearly US$ 2.0 billion. If the US$ 2.0 billion accounts for luxury goods, there remains no problem with the import cut. But if imports of raw materials or capital machinery are cut, that remains a cause of concern. Already the budget for the fiscal year 2022-23 targets a slower growth rate of 5.0 per cent. Now all eyes are riveted on how the incumbent government steers the boat in the turbulent water in the days ahead.