The government has, indeed, taken a good decision by creating a central database of the investors of the savings tools under the Directorate of National Savings (DNS). This has been done in order to bring some reforms in the system which is expected to modernise the management of the savings instruments and convert those to a sustainable source of deficit financing.

As per the decision, a self-sufficient central database of investors in savings tools will be created linking with their national identity cards under the DNS. Besides, the DNS will formulate a guideline to include all information about investors in the database. A separate component is likely to be incorporated into the framework of Strengthening Public Expenditure Management operated by the Finance Division.

The pious objective of the National Savings Schemes is to motivate people to save money, through their small savings and meet national budget deficit. The tools are also the source of incomes for country's particular sections of people like women, senior citizens, Bangladeshis working abroad and the physically handicapped. It is undeniably playing an important role in reducing dependence on foreign aid and checking inflation etc.

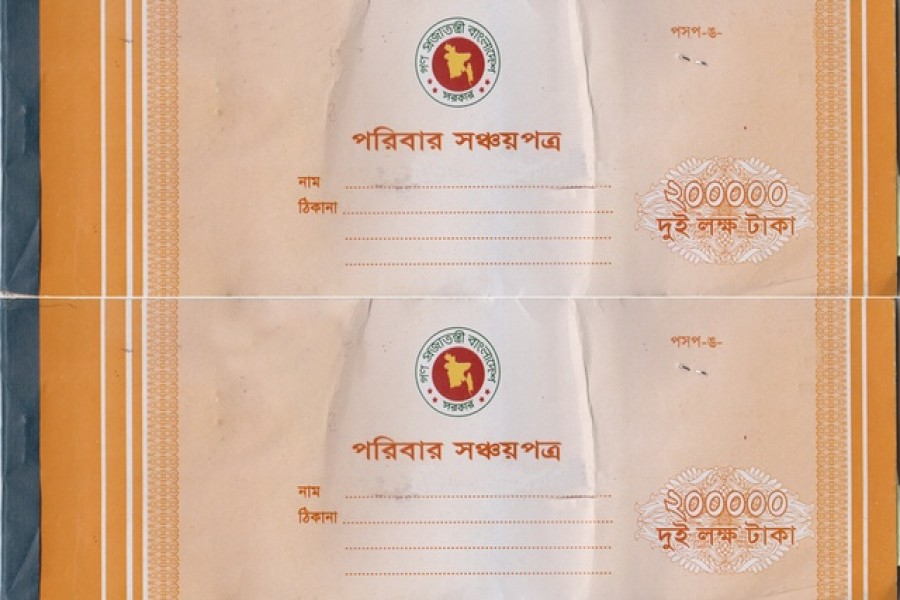

There was, in fact, no specific data on the country's savings tools investors from the DNS. Some tools appear to be popular. These are: 5-year Sanchayapatra, three-monthly Sanchayapatra, Pensioner Sanchay-apatra, Poribar Sanchayapatra etc.

The Finance Division has proposed some short-term reforms under the DNS in the first phase. According to the proposal, a self-sufficient central database of clients/investors will be created linking with the National Identity Card under the DNS. Updated information about investment will be uploaded after preparing the database and collecting information about investments in the high-yielding savings certificates.

Besides, a guideline will be formulated to include the overall information of investors in the proposed database. Currently, the DNS is under the Internal Resources Division (IRD) in terms of allocation of business. On the other hand, the Finance Division handles the administrative activities on loan affairs. For this, the DNS takes care of short-term reform activities to implement the modernisation of the national savings tools.

There is no denying that overall management of DNS needs to be brought under automation. A separate component is likely to be incorporated into the framework of Strengthening Public Expenditure Management operated by the Finance Division.

The trend suggests that the people sometimes cross investment ceiling by buying saving tools from different outlets. Such practice can be controlled by preparing database and linking it with their national identity numbers. Currently, savings certificates are sold through the central bank, commercial banks, post offices and the Department of National Savings (DNS).

Analysts, however, see policy and administrative challenges involving the government borrowing tools. Policy challenges are more fundamental but administrative challenges are important. The database of savings tools is good for management and also depositors if it is implemented.

When the country's savings tools have received widespread popularity among the common people, the International Monetary Fund (IMF) advised the government to reduce its borrowing costs by cutting reliance on such instruments. It called for phasing out the savings instruments and increasing the issuance of treasury bonds and bills as an alternative to the tools. The lending agency, in a report on the country's latest economic situation presented various drawbacks of the savings instruments. The interest paid on the tools amounts to about 1.0 per cent of the country's gross domestic product. It said the certificates' interest rates are significantly higher than those of any other savings schemes in the market.

The government, on the other hand, defended the system by saying that the certificates are playing an important social role by providing support to vulnerable segments of the population in the absence of unemployment insurance and wide pension coverage.

What the government should do is to improve monitoring mechanism in order to properly identify the beneficiaries, and weigh options for aligning the certificates' rates with market interest rates.