Available information on Bangladesh's present situation of financial inclusion show that only one-fifth of population has access to banks, only 40 per cent adults have access to mobile services, only 5.0 per cent of rural adults have access to bank accounts against 40 per cent in urban areas. Obviously, the fragile financial inclusion disfavours the rural population.

In a regime of unequal ownership of land and the inequitable social structure, so runs the argument in the literature on rural markets, institutional credit is likely to reach first to the larger farmers to the denial of the poorer ones despite the latter's dire needs for the adoption of input-intensive modern agricultural technologies. In consequence, differentiation of peasantry and polarisation of peasant households are likely to occur over time with increased supply of credit. Beside this, greater social and political power - springing from concentration of land and control over the tenancy market - provides well-off rural households with greater access to formal financial institutions. The formal financial institutions turn their back to poor farmers since they cannot afford to provide collateral security and the transaction costs for providing small loans are much higher than the government stipulated interest rates for serving them.

Due to restricted access of poor rural households to formal financial institutions, the rural credit market is characterised by dualism in many developing countries. There is a formal market where institutions provide intermediation between depositors and lenders by charging relatively low rate of interest, often subsidised by the government. On the other hand, for centuries an informal market exists side by side with the formal market, where groups and segments within the villages supply credit from their own savings, known as professional money lenders, traders, landowners, friends and relatives. Compared to the formal market, the interest rate from the informal market is often many times higher, often 10 per cent per month.

In Bangladesh the inception of the formal financial system for providing rural credit started with the establishment of the Agricultural Development Bank in the 1960s. Later the government also encouraged commercial banks to set up branches in rural areas for financial inclusion. In 1977 a special agricultural credit programme called, "MatirDak" was launched. The rural branches were engaged both in collection of savings and provision of credit.

However, on a close scrutiny, it was observed that the access to finance was provided mostly to large and medium landowning households and big traders and fishermen. There has long been huge allegation against agricultural credit serving the rural richer segment with better collateral. The landless and marginal farmers remained excluded from the market. A survey conducted in 1982 jointly by the International Food Policy Research Institute (IFPRI) and the Bangladesh Institute of Development Studies (BIDS) revealed that 62 per cent of rural households from smaller landowning groups obtained loans from informal sources. Only 14 per cent of rural households could access financial institutions that contributed to 25 per cent of total loans received by rural households. According to the critics, the history of government's involvement in extending agricultural credit to rural households is a history of frustrations and wasteful endeavours.

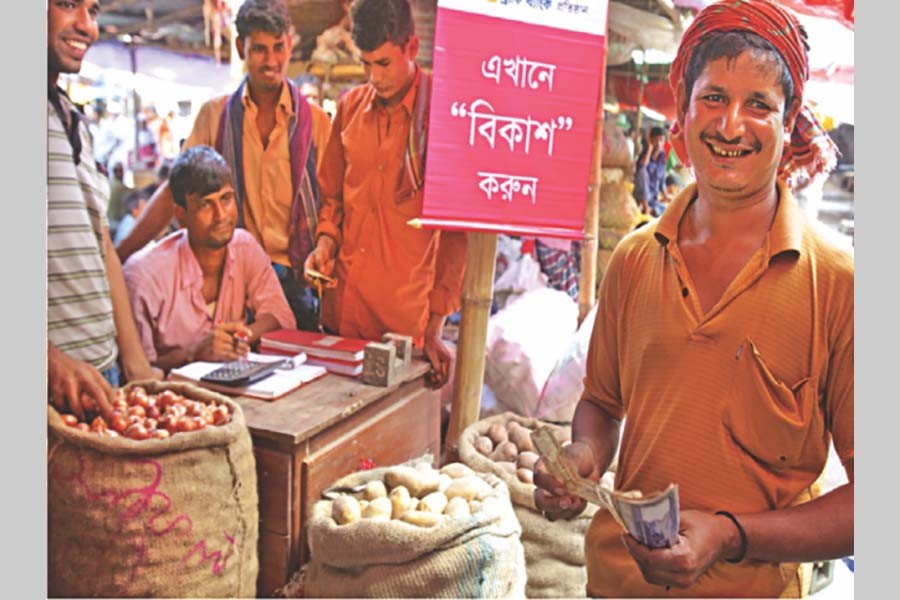

Recently some qualitative changes have been brought in the credit delivery system that contributed to improvement in credit business targeted for farmers and small enterprises. The monitoring cell of the Bangladesh Bank (BB) has been strengthened for ensuring transparency in the credit business and reducing the transaction cost for obtaining credit by borrowers. Priority is given to credit support for women in agriculture to increase women's participation in economic activities. Emphasis has been laid on development of marketing facilities for agricultural products to ensure fair price. Priority has been given to reach credit to relatively impoverished and neglected region such a char (island), haor and coastal areas. The central bank made it mandatory for the state-owned commercial banks as well as the private and foreign banks to allocate at least two per cent of their loan portfolio for agriculture. Recently, the BB has issued a directive to commercial banks to disburse agricultural loan openly in presence of local representatives from union, concerned agricultural officers, teachers and other respected persons to ensure transparency. Another innovative step towards financial inclusion is the opening of bank account by all farmers at a minimal charge of Tk 10 (12 cent), so that credit, subsidies and other government transfer could be directly deposited to farmer's account. This has helped reduce leaks in the implementation of the government's agricultural subsidy and the 'safety nets" programme. The BB has brought 13.2 million people under banking service that includes farmers, hardcore poor, and the unemployed youth.

A recent survey of households in rural areas shows that households taking loans have increased from 37 to 55 per cent over about three decades since late 1980s, when the NGO MFIs began supplying credit in rural areas. The financial inclusion has increased faster for land-poor households (primary target for NGO MFIs), compared to the land owing households. For example, in 2013, 60 per cent of land-poor households had accessed credit compared to 48 per cent for households who own land in sizes over 0.5 acres whereas the financial inclusion was almost the same for both groups in 1988.

As noted before, the most recent data reveal that 55 per cent rural households accessed credit in 2013, and 44 per cent of them got credit from commercial banks and NGOs. Thus, the financial exclusion still remains high despite rapid expansion of the NGO MFIs. The most noteworthy information is that in 2013 only two per cent of rural households received credit from the commercial banks, although the average size of loan is almost five times higher than the amount provided by the NGOs. It indicates that the commercial banks increasingly serve the better-off sections requiring large amounts. Policies should be framed in such a way that government agencies deliver credit to targeted groups of the poor segments.

Abdul Bayes is a former Professor of Economics at Jahangirnagar University.