The struggle of the poor and low-income group that began with the outbreak of Covid-19 in early 2020 is now worsened by the unabated rise in the prices of essentials. These people are still grappling with their limited budgets as the pressure of price hikes continues to mount. This is affecting the economic recovery process as a large section of people is still struggling to stay afloat. Though the current price hike is mainly due to high import cost, domestic factors, such as market distortion by a few dominant players, are also responsible.

The 12-month average food and non-food inflation rates have fluctuated in a cyclical pattern over the past ten years. Increases in food inflation were generally accompanied by decreases in non-food inflation, so the overall general inflation rate has remained largely stable in the short-term. In the long-term, the overall general inflation rate has experienced a slight decline.

Engel's law states that as income increases, people spend a smaller proportion of their total income on food. In Bangladesh, nominal household income increased by 7.86 per cent per year on average and real household income increased by 0.16 per cent per year on average between 2010 and 2016. Food expenditure as a share of income decreased from 53 per cent in 2010 to 46 per cent in 2016. Again, food expenditure as a share of total consumption expenditure decreased from 55 per cent in 2010 to 48 per cent in 2016. However, the weights used for food in the calculation of Consumer Price Index (CPI) are significantly higher than share of food expenditure in either income or consumption expenditure. Thus, the consumption basket used for calculating overall general inflation which was created in 2005 does not reflect the current consumption pattern of consumers or the actual prices in the market in 2022.

Inflation during the Covid-19 pandemic exceeded the monetary policy targets set in FY20, FY21 and FY22. Due to problematic calculations of the CPI, actual inflation did not exceed inflation targets of the monetary policy by a large margin. Prior to the pandemic years, inflation targets were met in FY15, FY16, FY17 and FY19, although in reality the cost of living kept rising.

The Centre for Policy Dialogue (CPD)'s analysis shows that at least 29 imported essential food items currently face a high incidence of tax. High inflation has revealed the inherent weakness in the government's domestic resource mobilisation approach which is largely dependent on revenue collection from indirect taxes. The government has recently been obliged to withdraw VAT on soyabean oil in a bid to prevent the price of soyabean oil from increasing further. It is likely that if inflation continues at the present rate, the government may be compelled to withdraw other indirect taxes on essential items as well. Thus, fiscal policy which is highly dependent on indirect taxes propagates economic inequality in society and forces the government to trade-off revenue generation in the face of high inflation.

The Bangladesh Telecommunication Regulatory Commission (BTRC) declared its "One Country, One Rate" policy with the stated objectives of providing affordable broadband internet and reducing the digital divide. Unfortunately, it appears that most internet service providers (ISPs) are currently not abiding by the BTRC mandated prices, especially for the internet packages of higher speeds. Additionally, there are wide variations in the prices of broadband internet across the country which is completely contradictory with the "One Country, One Rate" policy of the BTRC.

The Bangladesh Competition Commission, should file lawsuits under Bangladesh Competition Law 2012, clause 15(2)(a), against all ISPs which are violating BTRC's mandate by colluding within themselves and charging abnormally high prices.

LIVING COST: Assuming that each person consumes the average amount of food, as indicated by the Bangladesh Urban Socioeconomic Assessment Survey 2019 conducted by the Bangladesh Bureau of Statistics (BBS), the average monthly cost of a basket of 20 common food items ("regular diet") for a household of 4 persons in Dhaka city was Tk 21,358, as of May 30, 2022. Assuming that a household lives on a "compromised diet", and never consumes fish, mutton, beef, or chicken, the average monthly cost of food for a household of 4 persons in Dhaka city was Tk 8,016, as of May 30, 2022.

Apart from the high price of basic food items, the high price of non-food items was putting a huge burden on households. Crowd-sourced data shows that maintaining even a modest standard of living was becoming prohibitively expensive for households in Dhaka. In the absence of support from the government, out-of-pocket expenditure on health for a household of 4 persons was equivalent to Tk 2,625 per month in 2019, at purchasing power parity. It is apprehended that many households are at risk of falling below the poverty line due to out-of-pocket expenditure on health.

The average cost of living on a "regular" diet for one household of four persons living in an apartment with one bedroom outside of city centre in Dhaka in May, 2022, would be approximately Tk 42,548. The average cost of living on a "compromised" diet for one household of 4 persons living in an apartment with one bedroom outside of city centre in Dhaka in the last month would be approximately Tk 29,206.

Assuming a 5.0 per cent annual increment of the basic salary since latest year of wage review, the minimum wage in 2022 for workers in all industries would not be sufficient for affording a "regular diet" for a household of four persons. Again, assuming a 5 per cent annual increment of the basic salary since latest year of wage review, the minimum wage in 2022 for workers in the shrimp industry, fish and trawler industry, hotels and restaurants industry, soap and cosmetics industry, tailoring factories, cotton textile industries, bakery, biscuit and confectionery industry, automobile workshop industry, and leather and footwear industry would not be sufficient for affording a "compromised diet" for a household of four persons.

Thus, high inflation is directly threatening the food security of workers earning a minimum wage. Hence, it is urgent to revisit and revise the minimum wages of workers in all industries immediately.

Assuming a 5 per cent annual increment of the gross salary since 2017, the average wage in 2022 for workers and employees in all industries would not be sufficient for affording average monthly cost of living for one household of four persons living in an apartment with one bedroom outside city centre and consuming a "regular diet" in Dhaka. If there is a 5 per cent annual increment of the gross salary since 2017, the average wage in 2022 for workers and employees involved in most forms of economic activities would not be sufficient for affording average monthly cost of living for a single household of four persons living in an apartment with a single bedroom outside city centre and consuming a "compromised diet" in Dhaka.

So, it is clear that a 5 per cent increment hardly makes any difference to workers and employees, given that most prices are increasing in double digit growth rates.

While workers on minimum wages are unable to afford food, and workers on average wages are unable to afford high cost of living, the number of superrich individuals and corporations is on the rise in Bangladesh.

The number of bank accounts worth greater than Tk 500 million, and the amount of money held in such accounts, has increased substantially, indicating that capitalists and their corporations have been largely unaffected by rising prices.

A new consumption basket should be formulated for calculating CPI inflation, based on rigorous research as regards consumer behaviour and expenditure patterns. All targets, projections, and plans in the monetary policy and the 8th Five Year Plan (8FYP) should be revised in accordance with this new consumption basket for CPI and new base year for inflation.

The National Board of Revenue (NBR) should immediately consider removing the advance income tax (AIT), advance tax (AT) and regulatory duty (RD) on all imported essential food items. The role of the Bangladesh Competition Commission needs to be strengthened, particularly in the case of the essential consumer goods market. The Commission should develop a database, regularly monitor the dominant market players' operations, examine the market control and manipulation (if any), and take proper measures.

The Bangladesh Competition Commission should also adopt a strong stance against cartels and a zero tolerance policy towards collusive practices. The Competition Act 2012 should be revised to directly address monopolies and include specific anti-trust clauses, along with concrete penalties for violators. Efficient market management through close monitoring and supervision will be critical to keep the commodity prices under control.

The Minimum Wage Board needs to consider increasing the minimum wages in all industries so that workers earning minimum wages may at least afford basic food. Private sector corporations should consider a higher salary increment in 2022, given that a 5 per cent increment of salary in the face of double digit price hikes is compelling workers to seriously compromise their standard of living.

SUPPORT MEASURES: Various support measure by the government are also necessary to help people suffering in the time of high inflation.

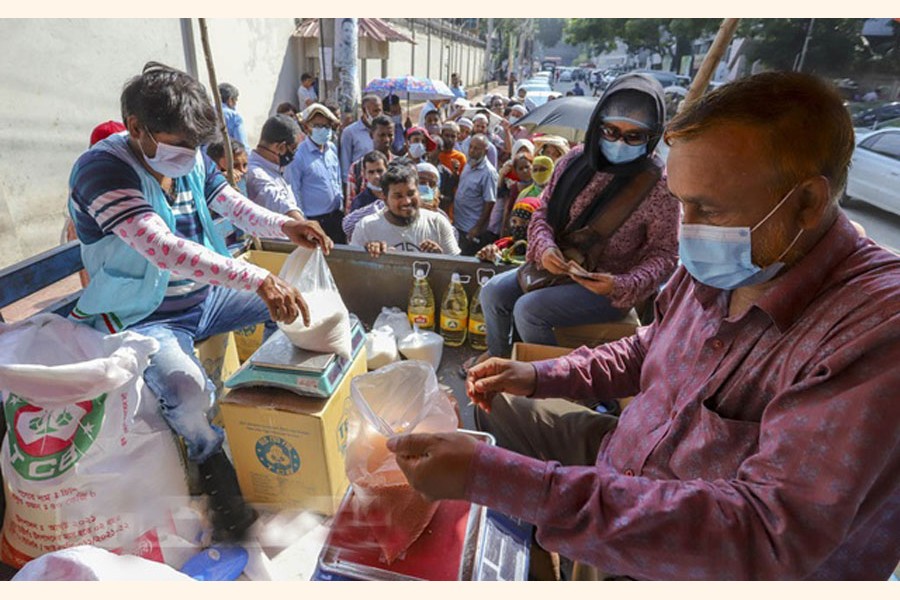

The volume of sale of essential commodities through the open market system (OMS) should be increased and distribution of these commodities must be managed effectively and without any corruption, so that eligible people have access to these items at low prices. The government should also provide direct cash support to the poor, enhance social protection for low-income families, and extend stimulus to the small businesses for their survival during difficult times. The government need to prepare for maintaining adequate food stock not only through better agricultural production, but also through importing food.

There is a need for actual demand estimation of rice and other food items in the country. During a crisis, food-exporting countries would not export food without meeting their domestic demands first. If they decided to export, the prices would be exorbitant. Therefore, planning the production and import of food should be done early on.

Inflationary pressure will hamper a sustainable and inclusive pandemic recovery, since the real purchasing power of many people will decline, causing further inequality.

Dr Fahmida Khatun is Executive Director, Centre for Policy Dialogue (CPD); Professor Mustafizur Rahman is Distinguished Fellow, CPD; Dr Khondaker Golam Moazzem is Research Director, CPD; and Towfiqul Islam Khan is Senior Research Fellow, CPD. [email protected]; [email protected]

[[The article is slightly edited version of power-point

presentation made by the authors at the CPD Media Briefing on State of the Bangladesh Economy in FY21-22

(Third Reading) on Sunday]