In the past 25 years, the global trend has been moving towards flexible exchange rate regimes. Yet, roughly half the economies of the world still maintain fixed or managed floating regimes. Bangladesh floated its exchange rate in 2003 but continued to adhere to a 'managed float' through intermittent intervention in the foreign exchange market.

There is a strong link between exchange rate, export performance and GDP growth. To the lay person, the connection might seem remote. But it is not. A proper management of the exchange rate should be a critical part of trade policy geared to a superior export performance and high economic growth. Historical and cross-country evidence shows that dynamic and rapidly growing economies have also proactively and effectively managed their exchange rates to ensure that they do not become overvalued. Rather, these countries made sure that their exchange rates were sufficiently undervalued to make their exports more competitive in the world market. The most recent example is China which practiced a deliberate policy of undervaluing its exchange rate for over 30 years. The other example is South Korea which did the same during its rapid growth phase starting in the 1960s.

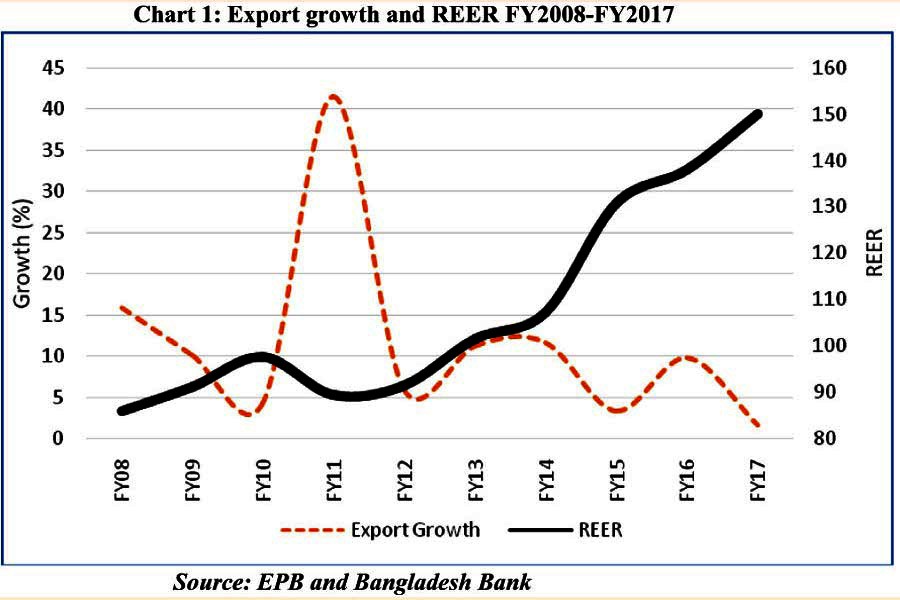

Starting with the intensive phase of trade liberalisation in early 1990s, Bangladesh experienced double digit export growth for nearly 20 years. During this entire period, though not overly proactive, exchange rate management was prudent with the real exchange rate hovering around a relatively narrow band with the help of mini devaluations until the Taka was floated in 2003. The real effective exchange rate (REER which is the nominal exchange rate adjusted for inflation differences between Bangladesh and its major trading partners) remained fairly stable and moderately depreciated to keep exports competitive. Trade economists consider the REER to be the more relevant indicator as it reflects overall exchange rate competitiveness by taking into account the movements in the nominal exchange rates and inflation in relation to the country's major trading partners. Trade economists have been strong in their advice that countries should avoid overvaluation of their REER as it has deleterious effects on exports. In the past few years, the Bangladesh real exchange rate has taken a turn for the worse, thus hurting exports. Between FY2012 and FY2017, the REER appreciated by nearly 45 per cent serving as a significant damper on exports (Chart1). As expected, exports remained sluggish throughout this period. In FY2018, the situation improved somewhat not so much due to the modest nominal depreciation of the Taka but rather for the appreciation of the US dollar and other external developments.

There is plenty of research evidence (Johnson, Ostry, and Subramanian, 2007; Easterly, 2005) to show that foreign exchange shortages, unsustainably large current account deficits, and balance of payments crises are associated with overvalued exchange rates, with deleterious impact on economic growth. Other research confirms that greater degree of undervaluation engenders economic growth, but it is mostly pertinent for developing economies (Gala, 2007). For example, the high growth in China for three decades was accompanied by considerable undervaluation (from 100 per cent overvaluation to 50 per cent undervaluation).A cheaper Yuan made Chinese exports less expensive, boosting the overseas sales that have been among the main drivers of growth during the nation's remarkable economic progress over the last three decades. To compensate for institutional weaknesses or market imperfections, Bangladesh could undertake a depreciated real exchange rate approach to keep exports buoyant. Undervaluation could then even be a substitute for industrial policy.

A depreciated exchange rate paves the way for a surge in growth as domestic goods become cheaper in foreign countries, which in turn, increases the demand for these goods. It also makes foreign goods more expensive for local consumers, which drives them towards purchasing more domestically produced goods. Many prominent economists believe that undervaluation promotes growth because it motivates firms to invest in high productivity tradable industries, which increases overall productivity rates (Rodrik, 2008). Others believe that undervaluation of exchange rates lowers labour costs, which boosts investment and thereby causes growth (Levy- Yeyati, Sturzenegger, and Gluzmann, 2013). Undervaluing a currency also enables countries to enjoy positive trade balances which often alleviate risks of capital flight and financial crises (Reinhart and Rogoff, 2009). Moreover, it also makes entries into new markets profitable for both domestic and foreign investors. An undervalued currency potentially boosts foreign direct investment as domestic assets become cheaper for the foreign investors. Increases in foreign investment brings forth surges in growth as more employment opportunities open up, better technology is adopted and labour productivity improves. Unemployment also goes down during undervaluation because the persistence of lower wages relative to foreign imports encourages firms to hire more workers. In addition to stimulating exports and employment intensively under a regime of 'good currency management', there's more exploration of new products and markets, more diversification opportunities emerge, and more restructuring of trade away from traditional export sectors to modern services occurs (Freund and Pierola, 2008).

Other narratives focus not on the level of the real exchange rate alone but on its volatility too. More often than not, exchange rate volatility discourages trade and investment, which are crucial for fostering growth dynamism. The Korean case reminds us that it is not just the level of the exchange rate but also the maintenance of that level which is important to jump start growth. Korean specialists would say that it is the stability of the rate that matters for growth because excessive fluctuations in exchange rate cause uncertainties in product markets which is not welcome news for businesses. In short, exchange rate overvaluation and excessive volatility both have detrimental effects on the external sector. Keeping it at appropriate levels and avoiding excessive volatility enable a country to exploit its capacity for growth and development, to acquire a disciplined labour force, a high savings rate, and makes it a lucrative destination for foreign investment.

The exchange rate is not immune to our policy of protection either. High protection by restricting import demand also has the effect of curtailing demand for foreign exchange. In a floating exchange rate system (managed float in the case of Bangladesh) this would enable the country to maintain a lower exchange rate (i.e. a lower Taka price of foreign exchange) than otherwise would be the case. This would mean that export proceeds, expressed in Taka, would be lower than what the exporter would receive had the protection levels provided by tariffs and para-tariffs been lower. Thus, an overvalued exchange rate creates pressure for the persistence of protection (by cheapening competitive imports), making return to more liberal trade policies even more difficult without exchange rate adjustment. Undervaluation would then relieve that pressure and make protection reforms easier.

THE POLICY DILEMMA: Export margins are typically thin (typical profit margins for our exports are five to seven per cent or less). Global competition continually squeezes profits by driving down prices for our export products, including readymade garments. Trade theory tells us that as a small open economy we are price takers (i.e. with little power of price determination). With all the negotiating skills that our exporters can muster, they can only make marginal gains. Recent investment in remediation work in the RMG factories have imposed additional burden on our primary export sector. Exporters would therefore love to see the nominal exchange rate depreciate significantly (i.e. yielding more Taka per dollar of exports) to compensate for difficulties on the price front. While selected non-traditional exports have been identified for cash subsidies ranging from 5 per cent to 20 per cent, this is still not the answer for all the 1300+ non-RMG export items which cannot all be covered with subsidies. Moreover, when compared with the subsidy given to import substitutes through tariff protection (e.g. plastic and ceramic tableware receive nominal protection of 125 per cent+) the incentives are biased against exports. But Bangladesh Bank has avoided letting the exchange rate slide for the fear of fuelling inflation. The interbank Taka-dollar exchange rate has depreciated only modestly over the past five-six years within a narrow band of three to four per cent. Clearly this is not enough when the REER has appreciated 45 per cent between FY2012 and FY2017. Is there a way out?

The preceding analysis reveals accumulating research evidence that if exchange rates become excessively overvalued, a nominal depreciation has to be made accompanied with either fiscal or monetary adjustments as needed. In the Bangladesh context we find that (i) external inflation rates are beyond our control, (ii) domestic inflation is unlikely to be brought down to 2 per cent-3 per cent anytime soon, and (iii) the real exchange rate could be depreciated only by adjustment of the nominal Taka rate.

We find there are two interconnected resistance scenarios: resistance to any depreciation and resistance to reduction of protective tariff rates (on import substituting consumer goods). Can the two birds be killed with one stone? Here is a proposition out of the trade policy menu.

A WAY OUT-COMPENSATED DEPRECIATION: A policy of 'compensated depreciation' could be an option for policymakers to consider. This involves an exchange rate depreciation that is counterbalanced by downward tariff adjustments. Such a measure could: (i) be an incentive to exporters, (ii) maintain protection level for import substitute producers, (iii) have neutral effect on the price level, and (iv) be revenue neutral.

Here is how it works. In principle, a 10 per cent depreciation of the exchange rate (say, from Tk.80 per dollar to Tk.88) is equivalent to a 10 per cent subsidy on exports, a 10 per cent increase in effective protection on import substitutes (because it raises tariffs on output and inputs equally). It also raises the value of imports by 10 per cent to yield 10 per cent extra revenue. But this would also affect prices of imports and import substitute products upward by 10 per cent, which leads to the fear of fuelling inflation via currency depreciation. That is where the compensation principle kicks in. If tariffs are then reduced by 10 per cent across-the-board, the price effect of the currency depreciation would be neutralised. The net result is a 10 per cent uniform (i.e. non-discriminatory) incentive to all exports but without increasing the prices of imports. Effective protection and revenues will remain unchanged. To be fair, any depreciation does raise the Taka cost of servicing foreign debt. But Bangladesh's debt servicing capacity (at 3.5 per cent of foreign exchange earnings) leaves room for bearing the extra cost which will raise public expenditures marginally with only a ripple effect on the fiscal deficit.

A better export performance is an absolute imperative if the targets of the 7th Five-Year Plan on industrial and GDP growth are to be achieved. Whereas cash subsidies on exports can create budgetary pressure and risks violating WTO rules in the near future, depreciation would be a WTO-compliant trade measure that could stimulate exports for an economy that is a price-taker in the world market and, theoretically speaking, faces limitless markets for its exports, if it can produce competitively. That is what explains the fact that the world market for readymade garments is still open and Bangladesh's share could be much higher than the 06 per cent that it currently commands.

IMPLEMENTATION ISSUES: In a 'managed float' environment, depreciation is not the same as devaluation under the old fixed exchange rate regime when the central bank could simply fix the exchange rate. Under the present system depreciation could come from some liberalisation of imports or other current account transactions (e.g. relaxation of current account transactions, raising the foreign exchange limit for foreign travel for business, health or education). Regarding compensated reduction in tariff, in principle, it is possible to uniformly shave off 10 per cent from all tariffs that will, for example, result in a 2.6 per cent reduction in our average nominal tariff (including protective supplementary duties) of about 26 per cent, in FY2018. Expert advice is locally available on how to rationalise the tariff structure to counterbalance any rate of depreciation without undermining the existing rate of effective tariff protection. Gradually reducing effective protection levels by pre-announcing a policy of phased reduction is the way to go. We have to start by reducing the top protective tariff rates, rather than tariffs on inputs (which has been the case in the past). A systemic tariff cut to compensate for the exchange rate depreciation could be formulated during the preparation of the next budget. The 'compensated depreciation' principle should take the wind out of the sails of any protectionist opposition.

For a rapidly developing economy like Bangladesh, it is reasonable to expect strong import growth along with exports. Imports keep the wheels of the productive economy moving. Strong import growth also put pressure on the exchange rate to depreciate and Bangladesh Bank would be hard pressed to keep it from depreciating by selling US dollars out of its reserves. It simply does not have an unlimited supply of reserves to shore up the Taka rate. It would be strategic to intervene as needed to avoid overvaluation of the REER. Instead, its undervaluation should be the approach of choice for Bangladesh as it is embarked on a trajectory of high growth.

It is worth remembering Keynes' famous dictum (quoted in Eichengreen, 2008), "…policies that affect the real exchange rate even in the intermediate run may be enough to have a significant imprint on growth".

Dr Zaidi Sattar is the Chairman of Policy Research Institute of Bangladesh (PRI)

Sabrina Shareef is a Senior Research Associate at Policy Research Institute

[The article is excerpted from April, 2019 issue of Policy Insights, the quarterly publication of PRI]