Nothing appears to be working as far as buoying up the country's stock market, a vital economic indicator, is concerned.

Since its collapse in December 2010, if not others, the Investment Corporation of Bangladesh (ICB), either by its own initiatives or under outside influence, has tried to infuse dynamism into the market. But the initiatives produced some temporary results, as the market after showing a few signs of recovery went back to its previous moribund state.

The situation now prevailing in the stock market is certainly better than that of the post-collapse days. But the market position is well below the level desired by most investors and other stakeholders. The contribution of the market to the economy has also remained below its potential.

The world over, stock market remains a strong and stable source of long-term funds for both companies and infrastructure development. But, in the case of Bangladesh, because of underdevelopment, people seeking long-term financing for their enterprises, have been crowding banking institutions. Such an extensive dependence has created distortions in the financial market because of the mismatch between lending and deposit tenures. Banks take short-term deposits and lend the same on a long-term basis.

Thus, the gap has given rise to problems for the banks. They do have a huge burden of non-performing loans (NPLs). Most loans belong to the long-term category.

The economy does need to reduce businesses' dependence on banks for long-term funds. Only a strong and vibrant stock market can ensure it. It seems that the people concerned have burnt enough of midnight oil to restore health and vibrancy in the stock market. But, things, unfortunately, have not moved in the right direction as the 1996 and 2010 scams have severely eroded the investors' confidence.

One particular investment institution, the ICB, has tried to buoy up the market. Recently, the Corporation floated Tk 20 billion worth of bond and it could mobilise about Tk 14 billion. Out of that, it has invested Tk 12.36 billion in the stock market. The fund infusion had some positive impact on the market indices for a limited period. On November O6, 2018, the main DSEX index was 5,204 points. But following the availability of ICB fund, it had risen to 5,950 points in the later part of January this year.

The ICB fund actually was a drop in the ocean. That is why it has failed to leave any lasting impact. However, the ICB has floated a proposal to create yet another investment fund worth Tk 50 billion.

The investment of ICB in the bourses, according to a report published in this paper last week, was about Tk 106 billion until June last year. The amount went further up in the final months of 2018.

In fact, ICB remains the lone large institutional long-term investor. The possibility of market becoming stable and vibrant is considered to be remote without large long-term investments by other institutional investors.

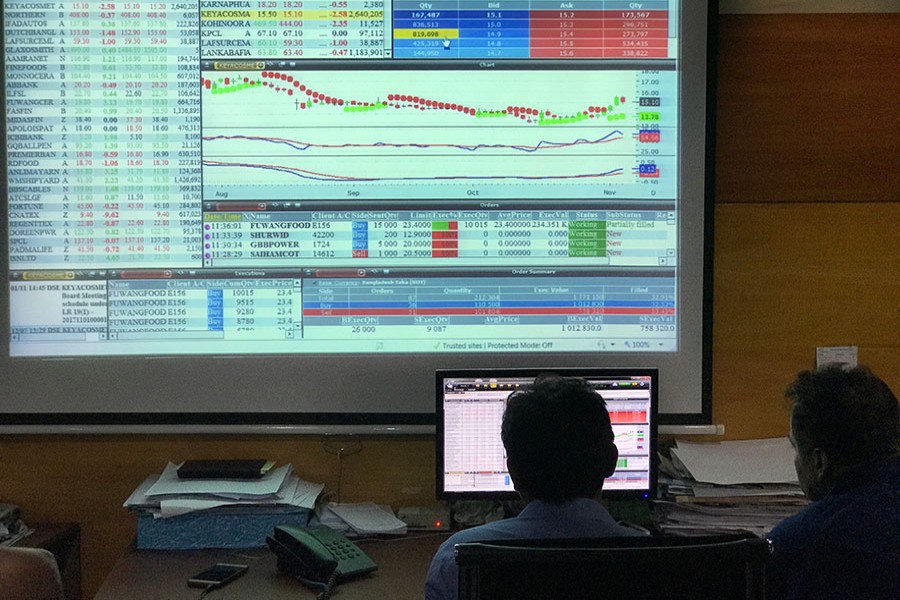

With a daily turnover of Tk 3.0 to 4.0 billion, it will be foolhardy to expect the market to be lively. Turnover will, naturally, go up when investors, particularly the institutional ones, come to the market and invest. Such investments if made on the long-term basis are always beneficial for the market.

The problem with this market has been that the majority of institutional and individual investors barring the ICB are more prone to making short-term investment. At the moment there is a serious dearth of both types of investors.

The nature of two stock market scams, it is believed, was not identical. During the 1996 scam, both market and securities regulator were disorganised and that left room for the manipulators to carry out their mission without any difficulty.

The administration too was not familiar with the stock market bubble and its consequences. They got elated by the rush of ignorant investors in their thousands, considering it to be a great economic achievement on its part.

In 2009-10 periods, there had been behind-the-scene organised move to push the market up gradually. The entry of the institutional investors, particularly banks and other financial institutions, made all the difference. The problem was that these investors entered the market with the mindset of small individual investors; they were after short-term gains. In fact, many banks made huge gains through stock trading at that time.

With inflow of huge funds, courtesy of banks and other financial institutions, market went berserk. So, the central bank asked the banks to behave and bring down their investment within the permissible limit. That was when the market crashed. During the 2010 heydays, many banks had formed their subsidiaries for the security trading. So, they could pass losses involving security trading on to those units and keep their own accounts relatively clean.

These days, banks are not particularly interested in stock trading and that is why the market has been experiencing a serious dearth of funds. The market would have benefitted more had the banks made judicious investment in equities on a long-term basis. It is not possible on the part of ICB alone to create demand in the market.