This year the award goes to three American economists for their researches that 'significantly improved our understanding of the role of banks in the economy, particularly during financial crises'. Another season of awarding Nobel Prize concluded last Monday with the naming of awardees in economics. Announcing the winner in economics usually comes after a two-day break or the weekend of the consecutive announcements on core five Nobel prizes in medicine, physics, chemistry, literature and peace. The award was introduced in 1895 by the will of Alfred Nobel, a wealthy Swedish industrialist and inventor of dynamite. His will did not include economics for the award. It was added to that list 67 years later in 1968, under the sponsorship of Sveriges Riksbank, the Swedish central bank. The bank made a donation during its 300th anniversary to 'facilitate celebrating the brightest minds in economics.'

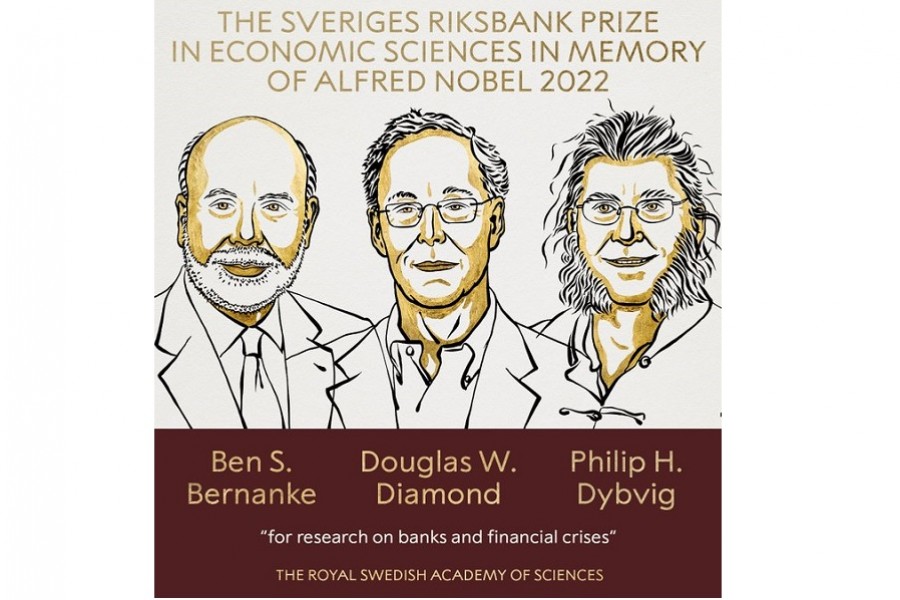

It is officially named Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. With the announcement of this year's awardees, this prize has been awarded 54 times to 92 laureates. So, for the last five decades, the Nobel Prize in Economics is seen as the most prestigious award in this field. Also, the prize is heavily criticised for endorsing economics as a science or mathematical science instead of a social science. Many argued that the term 'economic science' is misleading. The efforts of the neoclassical economists to turn it into mechanical physics ended up in the mid-20th century as a purely mathematical notion of rigour. Thus rigorous mathematical exercise and modelling have become a major thing to do in the study of economics. There is also a big obsession with abstract theories instead of real-world issues.

Many economists and economic thinkers, however, argue that a certain level of mathematics is necessary as a tool to examine and re-examine various theories and propositions. However, others viewed that that converting the tool into a core element of the subject is wrong.

Again, neoclassical economists and their followers, also considered mainstream economists, argue that 'consumers want to maximise their personal satisfaction and thus they make informed decisions based on the evaluation utility of a product.' In other words, they presume that humans are always rational and selfish and so 'make economic decisions rationally.' In reality, these are not true as people always do not decide or act rationally. Human being is also not selfish all the time.

Many economists have already acknowledged the limitation of neoclassical perspective and developed alternative versions to explain economic behaviour. As the realistic effort to analyse economics gaining more space and popularity, it is also reflected in the awarding of Nobel prize in economics. Daniel Kahneman, one of the pioneers of behavioural economics, got the Nobel in 2002. He was mainly a psychologist. Other behavioural economists who got the prize include George A Akerlof (2001), Elinor Ostrom (2009), and Robert J Shiller (2013). By giving the award to Richard H Thaler in 2017, the Royal Swedish Academy of Sciences formally acknowledged 'his contributions to behavioural economics.'

As this year's award goes to three American economists for their researches that 'significantly improved our understanding of the role of banks in the economy, particularly during financial crises,' it may be billed a fresh recognition of behavioural economics or real- world model in broader sense. The three awardees are Ben Bernanke, the former US Federal Reserve Chairman and now a professor at The Brookings Institution in Washington, Douglas W Diamond, now with the University of Chicago, and Philip H Dybvig, now a professor of Washington University in St. Louis. Interestingly, Dybvig did not start out as an economist. In 1976 he graduated from Indiana University with a double major in mathematics and physics.

The Nobel committee found that the foundations of the modern banking research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. The research clarifies 'why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises.'

There are some criticisms about Ben Bernanke for his handling of the 2008 financial crisis, which originated in the United State (US) and spread across Europe and Asia. Critics argue that he failed to foresee the 2008 crisis and also missed the warning signs of the subprime housing crisis. As crisis hit, he deployed vast amount of public money to rescue some Wall Street firms. These firms were, however, responsible for their reckless bets on subprime mortgages that fuelled the crisis. Bernanke also introduced an unconventional monetary policy namely Fed's quantitative easing programme to boost the economy. Though the easy monetary policy was crucial in restoring the US economy, some argued that the move increased inequality, inflated asset prices artificially and steered a period of easy money that 'sowed the seeds of the current inflation crisis.' Despite the criticism, awarding Bernanke along with two others for their works and analyses on banking and financial crisis is highly relevant even today.

For developing countries like Bangladesh, this year's Nobel in economics bears some significance. A series of scams and irregularities hit the country's overall banking sector in the last decade making the sector vulnerable. Now, default or non-performing loans (NPL) are increasing. The ratio of gross NPL stood at 8.96 per cent at the end of last fiscal year (FY22) against 8.18 per cent at the end of FY21.

As a matter of fact, there has been a longstanding vulnerability in the banking sector of Bangladesh. Low asset quality coupled with low levels of capital, and weak governance hamper productive lending and create stability risks.

The World Bank, in its latest country economic memorandum on Bangladesh, titled Change of Fabric, also said: "Most banks are controlled by owners of large business groups and politicians, and are heavily engaged in related-party lending, diverting scarce financial resources from the most productive use. Strong presence of the state in the financial sector, both through the ownership of underperforming state-owned banks and the interventions such as interest-rate caps, further contributes to crowding out of scarce resources from the private sector."

It also found the current regulatory and supervisory framework for banking sector weak and required to be aligned with international good practice so that the existing vulnerabilities could be addressed. Thus, the message of this year's Nobel prize in economics needs to be taken seriously, especially by the policymakers in Bangladesh.