A raging debate centring the issue whether Bangladesh authorities had sought information from the Swiss authorities about the money deposited in the Swiss Banks by Bangladeshis has only subsided recently.

Even the country's higher court had sought clarification from the Anti-corruption Commission (ACC) about it. Most part of the siphoned-off money is deposited in the banks of Switzerland, the number one tax haven of the world. Recently Singapore, Malaysia, the Philippines and Sri Lanka have also emerged as tax havens in Asia.

The Canadian Revenue Agency defines a tax haven as jurisdictions with: (1) no tax, or very low rates of taxation; (2) strict bank secrecy provisions; (3) a lack of transparency in the operation of its tax system, and (4) a lack of effective exchange of information with other countries.

Tax havens also help their users to: (1) bypass financial regulations and regulatory watch dogs; (2) launder money earned illegally through drug trafficking or organized crime; and (3) hide from criminal laws and liabilities.

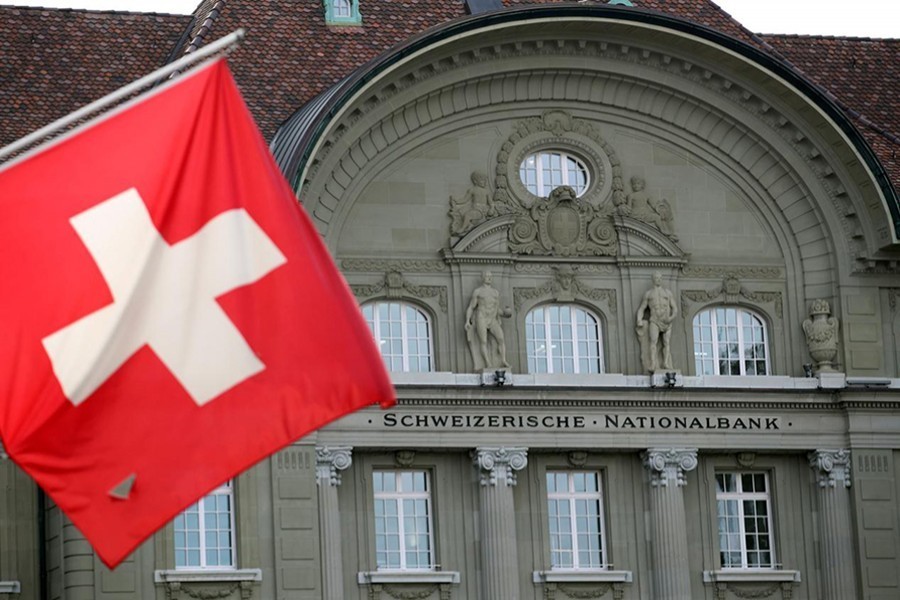

Swiss banks are well-known for their secrecy. They have been observing a code of secrecy regarding balance and accountholders for over 300 years. Swiss Parliament had made regulations in 1713 to keep registers of bank clients but prohibited the banks to share the information with anyone except the clients themselves unless the council approved any disclosure. The secrecy in Swiss banking system was covered by the civil and commercial codes. This meant that any accountholder could seek damages against any bank or bankers that did not maintain his/her confidentiality. In 1934, Switzerland passed the Swiss Federal Banking Act which made the disclosure of a client's identity or information a criminal offence. Thus, Swiss secrecy became legal and stronger. But a section of the population was opposed to the law and alleged that it was against tax justice. In 1984, a referendum was held on the issue and interestingly, 73 per cent of the people voted in favour of bank secrecy.

There have been some positive moves from The Organization for Economic Co-operation and Development (OECD), European Union and G20 group. OECD has established a threshold of bilateral tax-information exchange agreements.

The initiative of EU has motivated major improvements in tax-related transparency. The EU requires members to exchange tax information using automatic systems since the end of 2011.

OECD sponsored a Multilateral Competent Authority Agreement for the Common Reporting Standard (CRS MCAA). Any country can ratify it and notify to the authority concerned. The notifications to be filed by each country include (i) a confirmation that domestic CRS legislation is in place and whether the jurisdiction will exchange on a reciprocal or non-reciprocal basis, (ii) a specification of the transmission and encryption methods, (iii) a specification of the data protection requirements to be met in relation to information exchanged by the jurisdiction, (iv) a confirmation that the jurisdiction has appropriate confidentiality and data safeguards in place and (v) a list of its intended exchange partner jurisdictions under the CRS MCAA. A particular bilateral relationship under the CRS MCAA becomes effective only if both jurisdictions have the Convention in effect, have filed the above notifications and have listed each other. Activated relationships can be consulted here.

Switzerland ratified the OECD sponsored multilateral Convention on Mutual Administrative Assistance in Tax Matters. This ratification re-affirms Switzerland's commitment to greater tax transparency and marks another important step in implementing the Standard for Automatic Exchange of Financial Account Information in Tax Matters.

As a response to concerns and global pressure about the role of Switzerland, the Swiss government has stated that it does not want to see untaxed assets in Switzerland and launched a new 'White Money Strategy' for this purpose.

The Bangladesh government has reportedly had requested the Swiss authority for information about Bangladeshi accountholders in Swiss Banks and naturally there is no response. Swiss authorities are by no way bound to share any information with Bangladesh since such disclosure is prohibited under Swiss law. Bangladesh Bank reportedly trying to ink a memorandum of understanding (MoU) with the Swiss banks if the latter agree to the proposal. But the exercise of writing letters or any MOU will not serve the purpose unless it ratifies the CRS MCAA.

Our neighbors Pakistan and India have ratified the multilateral Convention on Mutual Administrative Assistance in Tax Matters and signed agreement with Switzerland for the Automatic Exchange of Financial Account Information (MCAA). They have already signed co-operation agreement under the convention. Bangladesh not yet ratified the convention.

Bangladesh has a bilateral double taxation avoidance treaty (DTAT) with Switzerland only to avoid double taxation. It should ratify the multilateral Convention on Mutual Administrative Assistance in Tax Matters and sign the Automatic Exchange of Financial Account Information (MCAA) with Switzerland. It should also sign Foreign Account Tax Compliance Act (FATCA) agreement with USA. It should amend the law and rule to support the protocol and agreements.

Information about the deposits of the Bangladesh accountholders in Swiss banks would not be divulged until and unless the government here follows the due process of getting it.

Non-government adviser to the Bangladesh Competition Commission