As the socially responsible investment movement in fixed income began to take off a decade ago, a great deal of ink was spilled on the similarity of green bonds and Sukuk. Both products are explicitly ethical and appeal to investors' social consciences over and above their desire for financial returns. The thesis at the time was that an ever-increasing number of investors would seek out these types of ethical investments, leading to a steep upward trajectory in demand for both green bonds and Sukuk. (Sukuk is a sharia-compliant bond-like instruments used in Islamic finance.)

To a certain extent, that thesis has played out. Between 2010 and 2020, annual issuance of green bonds increased from less than US$5 billion to more than US$270 billion. They have successfully transitioned from being a highly niche product to one that is has a role in the portfolios of major institutional investors across the globe. Green bonds became the product that mainstreamed socially responsible investing on the fixed income side of the capital markets.

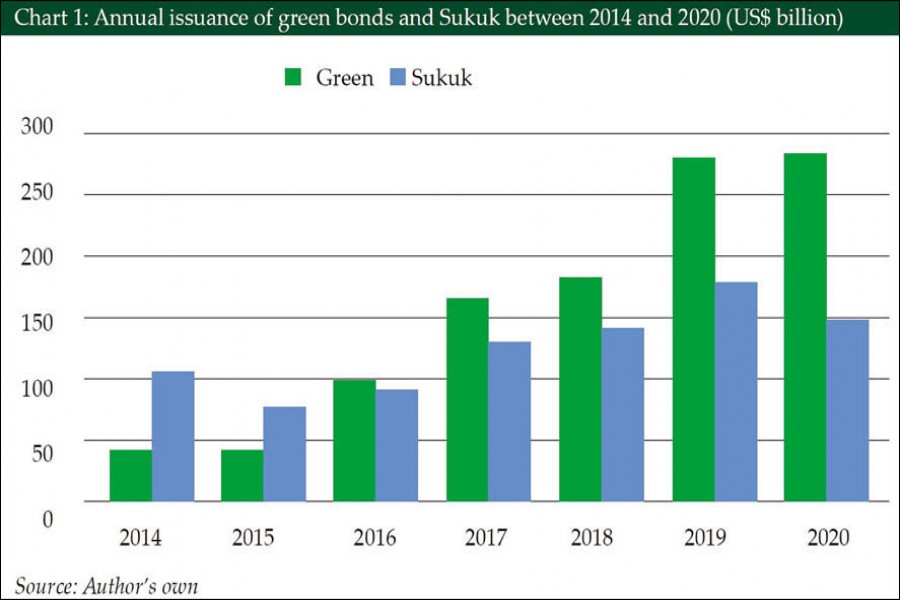

Sukuk have also increased during that time-period, going from $53 billion of annual issuance in 2010 to US$140 billion in 2020. While a 164 per cent increase in annual issuance volume is impressive, it clearly lags the 5,300 per cent growth for green bonds. This divergence in the growth trajectory of the two products can also be observed in the graph that looks at annual issuance volumes between 2014 and 2020.

In absolute terms, it should come as no surprise that Sukuk volumes now trail green bonds, as there is a much larger market globally for conventional instruments than for Shariah-compliant ones. Even the most passionate supporters of Islamic finance accept that the potential market for Islamic products is only fraction of that of their conventional comparators. However, that does not explain why, in percentage growth terms, Sukuk has fallen so far behind green bonds. Why has one product exploded while the other has made only a steady climb?

Many explanations have been offered for why Sukuk has not grown at a faster pace in recent years. These usually focus on global economic hurdles that have impacted the market (e.g., oil price declines, Covid related slowdowns). However, many of these same issues have impacted, to one degree or another, the conventional markets as well. In addition, some economic hurdles could reasonably be expected to increase issuance volumes (e.g., a decrease in oil prices could cause an oil exporting sovereign to have greater need to tap the capital markets). Therefore, these explanations seem insufficient to fully explain how green bonds have grown at such a faster clip than Sukuk.

I believe the reason for the difference may stem in part from the fact that the Sukuk market has simply not responded sufficiently to the socially responsible investing movement. As the remarkable growth of the green bond market proves, predictions a decade ago that socially responsible, fixed income investing was about to take-off were correct. In other words, the socially responsible investing wave did indeed come. The problem for Sukuk is the product has not found the best way to ride that wave.

Sukuk are ethical instruments. They cannot be used to finance impermissible activities like gambling, tobacco, and weapons manufacturing. Also, they are structured to avoid high degrees of leverage and speculation, and therefore promote a sounder financial system. Many investors who are motivated by ethics and feelings of social responsibility should be quite happy to add Sukuk to their portfolios, regardless of whether they are adherents of Islam.

A conventional bond has none of these built-in restrictions. Therefore, to make a conventional bond an "ethical investment," additional steps must be taken, for example adding covenants to limit the potential uses of the financing. This building in of these additional prohibitions is the genesis of green bonds and other labeled sustainable development bonds. In essence, these bonds adopt the types of restrictions on the use of proceeds that already to a certain degree exist for Sukuk.

However, the Sukuk market has not sold the standard Sukuk product as ethical. Rather, it has treated Sukuk as equivalent to a conventional bond (no better or worse from an ethical perspective), and therefore sought to develop green and socially responsible labels for certain types of Sukuk that mimic the labeling that is required to make a conventional bond ethical. I believe such labeling of certain Sukuk can have the unfortunate impact of obscuring the ethical nature of the basic Sukuk product and, at the extreme, possibly throwing the socially responsibility of most Sukuk into doubt. In other words, if certain Sukuk are labeled "socially responsible sukuk," what does that imply about all the Sukuk that do not carry that label?

While I certainly would not advocate against green and other types of labeled Sukuk, I think the Sukuk market needs to spend more time and effort to be clear that such labeled Sukuk are simply special use of proceeds instruments within a broader universe (i.e., all Sukuk) that is already ethical in nature. Such an approach would mirror the one the World Bank takes in the conventional market. The World Bank issues green and other labeled bonds from time to time, but our priority always is to stress the ethical nature of all our issuances.

By focusing on the ethical quality of the Sukuk product itself, I believe Sukuk can best benefit from the ethical investing movement, and take its place, aside green bonds, as an ethical investing success story.

The piece is excerpted from the World Bank Blogs (www.blogs.worldbank.org)