Bangladesh Bank (BB), on July 31, announced a shift from monetary aggregate targeting (M2) to interest rate targeting (IRT) in the conduct of its monetary policy. The new policy will be introduced by second half (H2) of the FY '21. The BB governor Fazle Kabir alluded that the central bank is now proceeding with foundational work for adopting the IRT-guided policy regime with technical assistance from the International Monetary Fund (IMF). This is a paradigm shift - albeit, long overdue. If I may, I would recommend some expert help from the US Federal Reserve - the ultimate reservoir of astute and experienced monetary policy operators and professionals.

The Federal Reserve (Fed) has been conducting the IRT policy since the mid-1980s. I have been promoting the procedure ever since my December 2000 week-long monetary economics workshop at BB's Motijheel head office. I articulated this policy again as recently as March 2017 during my monetary economics presentations at BB's training academy in Mirpur. It may be noted that the IRT approach deemphasises monetary aggregate targeting - while using it as one of the intermediate targets.

The interest rate in play in the Fed's IRT approach is the federal funds rate (RFF) analogous to BB's call money rate (CMR). The federal funds are simply commercial banks' reserves (reserve money - a component of the monetary base) which are available for borrowing overnight by banks in reserve deficiency or for other exigencies. This reserve market is called the federal funds market - analogous to the call money market in BB's vocabulary. They're called federal funds because the Fed facilitates inter-bank borrowing of these reserves and the interest rate on the funds is called federal funds rate. The Fed sets a range of variability of the RFF. The current RFF target range is 2.00-2.25 per cent. On a given day or hour the exact rate within this range depends on the supply and demand for funds by banks. If the RFF tiptoes outside the range, the Fed's open market managers would pursue Repo and Reverse Repo to restore RFF within the range. The IRT approach may require the BB conduct the Repo and Reverse Repo operations daily if the CMR slides off target.

All economies are subject to both internal and external shocks that often stand in the way of realising the desired policy goals. Besides, there's the lag in the effect of monetary policy (LEMP), which is long, variable, and distributed. The LEMP is defined as the time period that elapses between the change in policy and the point at which the effects of the policy are beginning to alter key economic variables. This isn't a point-input-point-output realisation; instead, the process proceeds with a distributed lag.

Years of empirical analysis have established that the effects of a monetary policy action (MPA) are distributed over a period of at least 24 months of which, say, 25 per cent may be realised after three months, 50 per cent after nine months, and the peak effect (maximum effect, say 60 per cent) at around 12-15 months and then declines over time. It is thus simply unrealistic if BB expects to realise its policy objectives in six months. Consequently, BB's forsaking the current practice of assessing and publishing bi-annual performance reports and setting goals in favour of more comprehensive year-end reports is a prudent decision. This by no means implies that BB will not gauge the stance of policy effectiveness and tweak policy actions as warranted as weeks and months progress during the year. MPA is thus a continuous adjustment process as required by changing global and national economic conditions.

Because of LEMP and lack of full information about the economy, the Fed constantly gauges the stance of policy actions -- and as needed -- adjusts the policy parameters as new data (information) emerge. For example, in the US the GDP (gross domestic product) data is published on a quarterly basis whereas unemployment and inflation data are released monthly. That is precisely the reason the Federal Open Market Committee (FOMC -- a 12-member policy architect, consisting of seven Board of Governors and five Presidents of the 12 Federal Reserve district banks) meet eight times during the year. The FOMC's policy actions and the review process have been viewed as a two-stage procedure.

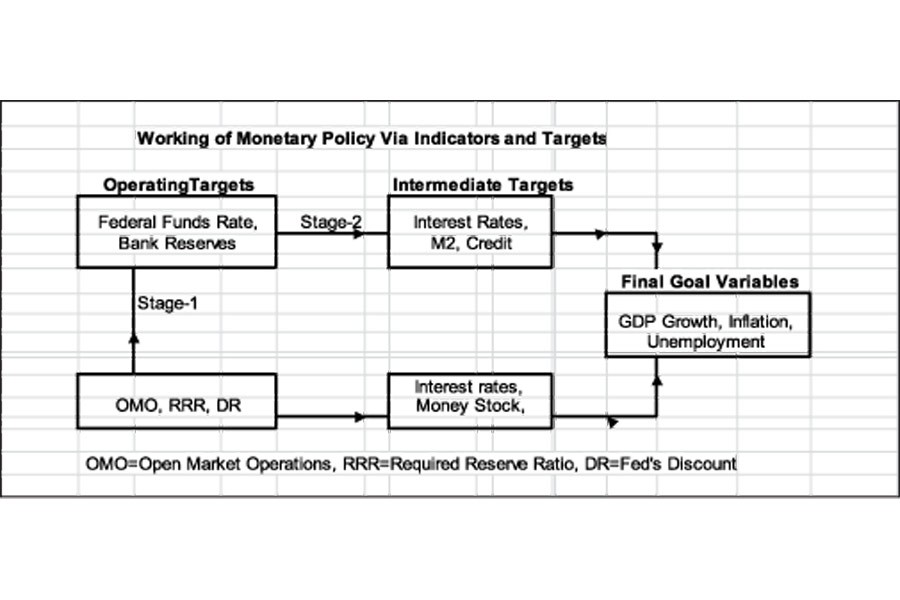

The US Commerce Department publishes the quarterly GDP data and other economic statistics. Under conditions of partial knowledge of economy's structure, unforeseeable events, and the inescapable LEMP, the use of targets and indicators facilitate the Fed to gauge the effectiveness of policy actions at different stages of the transmission process. Policy instrument or PI (PI: Repo and Reverse Repo also called open market operations or OMOs) does not affect the final goal variables or FGVs (FGVs: GDP growth, inflation rate, and unemployment rate) directly. In the two-stage policy approach, PI affects the operating target or OT (OT: RFF or CMR) directly, which in turn brings changes in the intermediate targets or ITs (ITs: market interest rates, M2, credit growth etc.) and, consequently in the FGVs. As the transmission process is working through the economy, the Fed gauges the direction and magnitude of policy actions from indicators of policy. These indicators include market interest rate (e.g. lending rate), weekly money growth, monthly unemployment rate, CPI (consumer price index) inflation rate, and industrial production growth rate data etc.

Setting the values of FGVs and achieving their desired values are a real challenge. Let's see how the Fed fine-tunes the policy instruments in a two-stage procedure.

First, the Fed estimates the current state of the economy and analyses how it's likely to do in the near term, say, over the next two quarters or so. Then it compares these estimates to its desired goals for FGVs. If there's a gap between the estimates and the goals, the Fed decides how forcefully and how swiftly to act to close that gap. Of course, the lags in policy complicate this process. But so do a host of other factors such as the adoption of new technology, unanticipated oil price, and supply shocks, natural disasters and so on which require resetting the policy parameters,

Even the most up-to-date data on key variables aren't current enough -- they reflect the past conditions, not what prevails today. Besides, there're competing theories and models and each may provide estimates that are sometimes at variance with each other. So, in practice, the Fed tries to deal with many uncertainties by using a variety of models and indicators, as well as informal methods, to construct a picture of the economy.

Interest rate targeting policy requires an active bonds market and an active call money market (overnight inter-bank borrowing reserves market). Another inevitable prerequisite is denationalising the state-owned commercial banks (SOCBs). The government must participate in the financial market to raise funds for deficit financing. That way, SOCBs would be free from the clutches of the government - one that is a long-standing demand of all and sundry, including the IMF. Once denationalised, they will have to compete with private commercial banks on an evenly leveled playing field and become efficient - if they were to continue doing the business of banking. Finally, the biggest impediment to IRT policy adoption is BB's operational status as being an acquiescent entity of the ministry of finance, unlike the Federal Reserve, which is a constitutionally independent institution.

Abdullah A Dewan, formerly a physicist and a nuclear engineer at BAEC, is professor of Economics at Eastern Michigan University, USA.