The role of the financial market in the economy of a country is immense. It is better, if all the sectors in this financial market contribute to development of the economy.

Now there arises a question. What is most important for development of the economy? Bank financing or stock market-based financing? There are a lot of arguments on both sides of the divide, which are based on very sound logic. However, there is no alternative to raising funds from the capital market for long-term investments. And it is in the interest of the long-term financial stability of an economy.

Many studies have shown that financing is not that important, whether it is bank-based finance or stock-based finance, in the economic development of a country. In fact, what is important for the economy is the good governance in the country's financial market.

One problem in any area of the financial market leaves its rippling effect on the other areas. So, taking prudent decisions is important for maintaining stability of the financial market.

Let us delve deep into it. In the Table 1 below, we see the performance of banks in Bangladesh. They are categorised as a) State-owned commercial banks (SCBs); b) State-owned development financial institutions (DFIs); c) Private commercial banks (PCBs), and d) Foreign commercial banks (FCBs).

The concern is that the country's banking sector has not been doing well for the last several years. Experts say there is a lack of good governance in this sector. For example, the recent decision to reduce the cash reserve ratio (CRR) is considered as self-immolation in the banking sector. How? The CRR is a small fraction of deposits which a bank is required to hold in cash and the new limit of CRR is 5.5 per cent. Basically, in the event of CRR reduction, the underperforming banks can take the advantage of it in doing aggressive banking. When the amount of non-performing loans is increasing in our banking sector, reducing the CRR is not a good decision anymore.

The Graph 1 shows the trend of non-performing loans in the banking sector in the last seven years:

After the share market debacle in 2010-2011, the banks' overexposure to the capital market was criticised by various quarters. Different sources said that 10 to 12 banks violated the Bank Company Act and invested beyond the limit of 10 per cent in the capital market. At the same time few banks focused more on stock business rather than mainstream banking. Two main factors worked behind the latest share market debacle: a) The banks saw their overexposure to the stock market, and (b) the market was excessively dependent on the banking sector. If the capital market and the banking sector maintained a safe distance, the debacle could be averted.

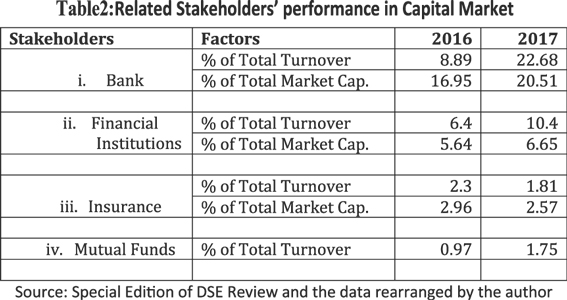

The Table 2 shows that the banks' dominance in the capital market in terms of turnover and market capitalization, compared to the other sectors in the market.

The Table 2 shows that the banks' dominance in the capital market in terms of turnover and market capitalization, compared to the other sectors in the market.

Over thirty banks are listed in the capital market and the stock market rises when the banks' share prices literally increase.

In a nutshell, Bangladesh has qualified for graduating from the least developed country status to a middle income one and there is no alternative to ensuring an investment-friendly environment. Banks have no ethical right to invest the depositors' money in the capital market without their consent. It seems to be more appropriate to invest in a productive sector. On the other hand, banks' excessive investment in the capital market does not always solidify the market as well as the economy. In order to take the economy forward in the long term, the stock market should be considered as a long-term investment ground.

Author is a finance & Economics researcher and NGO Development activist. He is the author of the book on ‘Bangladesh Share Market: Looking ahead after two big crashes’.

toufique2010@gmail.com