For the first time in living memory, Asia's growth is expected to contract by 1.60 per cent-a downgrade to the April projection of zero growth. While Asia's economic growth in the first quarter of 2020 was better than projected in the April World Economic Outlook (WEO)-partly owing to early stabilisation of the virus in some-projections for 2020 have been revised down for most of the countries in the region due to weaker global conditions and more protracted containment measures in several emerging economies.

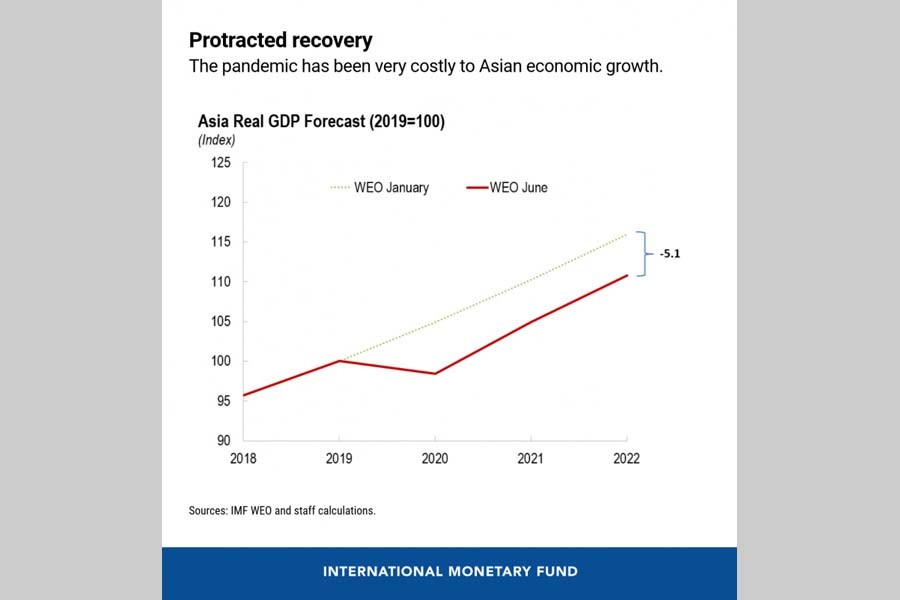

In the absence of a second wave of infections and with unprecedented policy stimulus to support the recovery, growth in Asia is projected to rebound strongly to 6.60 per cent in 2021. But even with this fast pickup in economic activity, output losses due to Covid-19 are likely to persist. We project Asia's economic output in 2022 to be about 5.0 per cent lower compared with the level predicted before the crisis; and this gap will be much larger if we exclude China, where economic activity has already started to rebound.

CLOUDS ON THE HORIZON: Our (IMF) projections for 2021 and beyond assume a strong rebound in private demand; however, this may be optimistic for several reasons as mentioned below.

Slower growth in trade. Asia is heavily dependent on global supply chains and cannot grow while the whole world is suffering. Asia's trade is expected to contract significantly due to weaker external demand, with total trade (exports plus imports) projected to decline by about 20.0 per cent in 2020 in Japan, India, and the Philippines. Reorienting Asia's growth model toward domestic demand and away from a heavy reliance on exports has begun but will take more time to be completed.

Longer than expected lockdowns. Even when lockdown measures are fully relaxed, economic activity is not likely to return to full capacity, due to changes in individual behaviours and measures put in place to maintain physical distancing and reduce contagion. Our recent study shows that while a lockdown may lead to a contraction in economic activity-as measured by industrial production-of about 12.0 per cent a month, a full reversal in containment measures may increase economic activity by only about 7.0 per cent. In addition, many Asian economies-especially Pacific Islands countries-depend on tourism, remittances, and other services that require in-person contact, which will take a lot longer to recover.

Rising inequality. Inequality had already been rising in Asia, and our recent research shows how past pandemics led to higher income inequality and hurt employment prospects of those with limited education. These effects are likely to be exacerbated in Asia due to the large proportion of informal workers, making the recovery more protracted.

Weak balance sheets and geopolitical tensions. Weakened household and corporate balance sheets in many Asian countries can weigh negatively on investor sentiment and amplify the effect of increasing uncertainties associated with geopolitical tensions.

But not all recent developments have been negative. Many Asian countries have been able to provide significant monetary and fiscal policy support-often in the form of guarantees and loans to households and firms. And lower oil prices and improved market sentiment and financial conditions are helping the recovery.

However, these factors may not last. For example, our recent update on global financial stability cautions that a sharp adjustment in financial conditions-correcting the current disconnect between financial markets and other parts of the economy-could exacerbate already high borrowing costs for many Asian frontier markets and low-income countries, notably Pacific island countries.

POLICIES FOR THE RECOVERY: Asian countries are experimenting re-opening, and policies must be geared toward supporting the nascent recovery without exacerbating vulnerabilities. They must use fiscal stimulus wisely and complement it with economic reforms. The priorities include:

Close coordination between monetary and fiscal policy. Monetary policy should help ensure the flow of credit to households and business. Countries facing higher fiscal constraints could also use the central bank's balance sheet more flexibly, aggressively, and transparently to support bank lending to smaller firms. In the face of large outflows, balance sheet mismatches and limited scope for macroeconomic policy manoeuvre, temporary capital outflow measures may be needed.

Resource reallocation. A robust recovery hinges on exiting the current phase of support and transitioning to new policies that help ensure resources are reallocated appropriately beyond the initial focus on preventing bankruptcies of incumbent firms, and thereby strengthen the solvency of firms. For example, flattening the bankruptcy curve by streamlining the restructuring and insolvency frameworks; ensuring that banks are adequately capitalized; and facilitating equity injections into viable firms and risk capital for new firms.

Addressing inequalities. Access to health and basic services, finance, and the digital economy should be broadened. Social safety nets should be expanded to extend unemployment insurance coverage to informal workers. Addressing pervasive informality will also require comprehensive labour and product market reforms to improve the business environment and removing onerous legal and regulatory obstacles (especially for start-ups), and policies to rationale the tax system.

IMF SUPPORT: Since the outbreak of the pandemic, the IMF has offered policy advice, financial assistance, and other support-including virtual initiatives to enhance skills and develop capacity among government officials-to all its member countries. To date, the Fund has provided emergency support to seven countries across the Asia-Pacific region, with others expressing interest in our emergency financing instruments. Given the large and looming uncertainties at this moment, countries with sound fundamentals may want also to consider use of the Fund's precautionary credit lines such as the Flexible Credit Line and the Short-Term Liquidity Line to insure against an abrupt tightening in external liquidity. Indeed, S&P Global and Fitch have both published notes stating that facilities like the Fund's precautionary credit lines could, by cushioning economies, support ratings.

Chang Yong Rhee is the Director of the IMF's Asia and Pacific Department.

[Source: https://blogs.imf.org/2020/06/30/reopening-asia-how-the-right-policies-can-help-economic-recovery/