The financial sector of Bangladesh and the banking sector, in particular, did not perform well during 2018. Dividends declared in 2018 by many publicly listed banks were significantly lower than those declared in 2017. Some publicly listed banks even did not declare any dividend. A similar picture is seen in the case of the state-owned commercial banks (SCBs). All four top SCBs, Sonali, Janata, Agrani and Rupali, suffered significant decline in their net profit in 2018 compared to the level in 2017.

The proximate cause behind this declining net profit situation includes (a) fall in the rate of interest, (b) slower growth in credit (c) poor recovery from classified loans, and (d) rising volume of non-performing loans. A detailed analysis of these causes and possible remedies are outside the scope of this write up. Instead, the attempt here is to highlight some silver linings in the performance of the SCBs within this overall picture of poor financial performance of the banks in 2018.

GROWTH IN DEPOSITS AND LOANS & ADVANCES: Private sector banks were in frantic search for deposits in 2018. The problem was largely their own creation. They indulged in aggressive lending in the latter half of 2017 and by January 2018, more than 20 private sector banks had their Advance-Deposit (AD) ratio way above 85 per cent, which was, at that time, the prevailing limit set by Bangladesh Bank. In fact, some of these banks had their AD ratio way above 90 per cent putting at great risk the interest of the depositors. This situation did not emerge suddenly. It grew over time. Unfortunately, Bangladesh Bank did not deal with the delinquent private banks strictly at the initial stage which encouraged other private banks to behave in the same manner. Finally, at the end of January 2018, Bangladesh Bank lowered the AD ratio limit to 83.5 per cent and asked all banks to roll back their AD ratios within the new limit by June 30, 2018.

The only way the private banks could comply with this Bangladesh Bank directive was by increasing their deposits. So a mad rush started for collecting deposits and rate of interest experienced sharp rise.

A lot of water has flown through the river Buriganga since then. Private sector banks extracted important concessions from the government in the form of (a) 1.0 per cent lower Cash Reserve Requirement (CRR), (b) extension of time limit to roll back AD ratio within the new Bangladesh Bank limit (c) lower corporate tax for banks, and (d) provision of increased government deposits in private banks, against commitment to bring down deposit interest rate to 6.0 per cent and lending interest rate to 9.0 per cent.

Unfortunately, none of these concessions seem to have worked. Despite repeated extension of time limits, a sizeable number of private banks still have their AD ratios way above the approved limit. Just a few days ago, a private bank in its publication of Financial Statement for 2018 in the newspapers prominently highlighted the size of their deposit as Tk 231.97 billion (23,197 crore) and loans & advances as Tk 224.23 billion (22,423 crore) which implies an AD ratio of 96.66 per cent! - a clear violation of Bangladesh Bank regulation.

While almost all the SCBs have restricted their interest rates at single-digit level, recent Bangladesh Bank reports have confirmed that nearly 28 private banks have been charging more than 10 per cent lending rates. Despite all this, growth of both deposit and loans & advances has been quite low in the private sector banks. Private banks continue to complain about liquidity shortage which they claim is restricting their ability to make advances.

In sharp contrast, the SCBs seem to be enjoying a healthy situation with respect to growth in deposits and advances. Although some deposits of the SCBs have been lured away by higher interest rate in the private banks, as shown in Table 1, Agrani and Rupali achieved significant growth in both deposits and advances. Except Sonali, all other three SCB's have respectable AD ratios and except Rupali, the other three SCBs experienced growth in their AD ratios. This suggests that both depositors and borrowers turned towards SCBs away from private sector banks in 2018. Notwithstanding higher deposit rates offered by private banks, the Farmers Bank scandal and failure of private banks to honour their commitment regarding interest rates caused depositors and borrowers to attach higher confidence in SCBs.

Agrani Bank experienced highest growth of 24 per cent in loans and advances. A recent newspaper report blamed Agrani for exceeding the ceiling of 20 per cent growth in loans & advances set in the MOU (memorandum of understanding) with Bangladesh Bank and termed this as aggressive lending by Agrani. However, the newspaper overlooked the fact that the ceiling on growth of lending by individual bank is set by Bangladesh Bank in the light of macro target on credit growth. As it happened, the target growth of credit to the private sector at the end of December 2018 was set by Bangladesh Bank at 16.5 per cent while in reality the actual growth was about 13.2 per cent. The ceiling on Agrani's credit growth, therefore, became less binding in the light of the shortfall in macro credit growth. Lumpy advances made to the vital power sector also contributed to this additional growth in loans & advances by Agrani in 2018.

NET INTEREST INCOME AND OPERATING PROFIT: Recent Bangladesh Bank report has shown that private banks are not only applying higher interest rates but their interest rate spreads are also significantly higher than the 4.0 per cent limit set by the regulator. In contrast, the SCBs restricted themselves to single-digit interest rate and their interest spread remained well within the stipulated 4.0 per cent limit. It is interesting to note that during 2018, except Sonali, all other SCBs earned quite high net interest income even in the face of such uneven interest rate competition from private sector banks (Table 2). Agrani bank, in particular, earned spectacular level of interest income (Tk 8.92 billion or 892 crore) registering 105.2 per cent growth. This was possible because of Agrani's success in mobilising low cost deposits. Agrani management deserves kudos for this achievement.

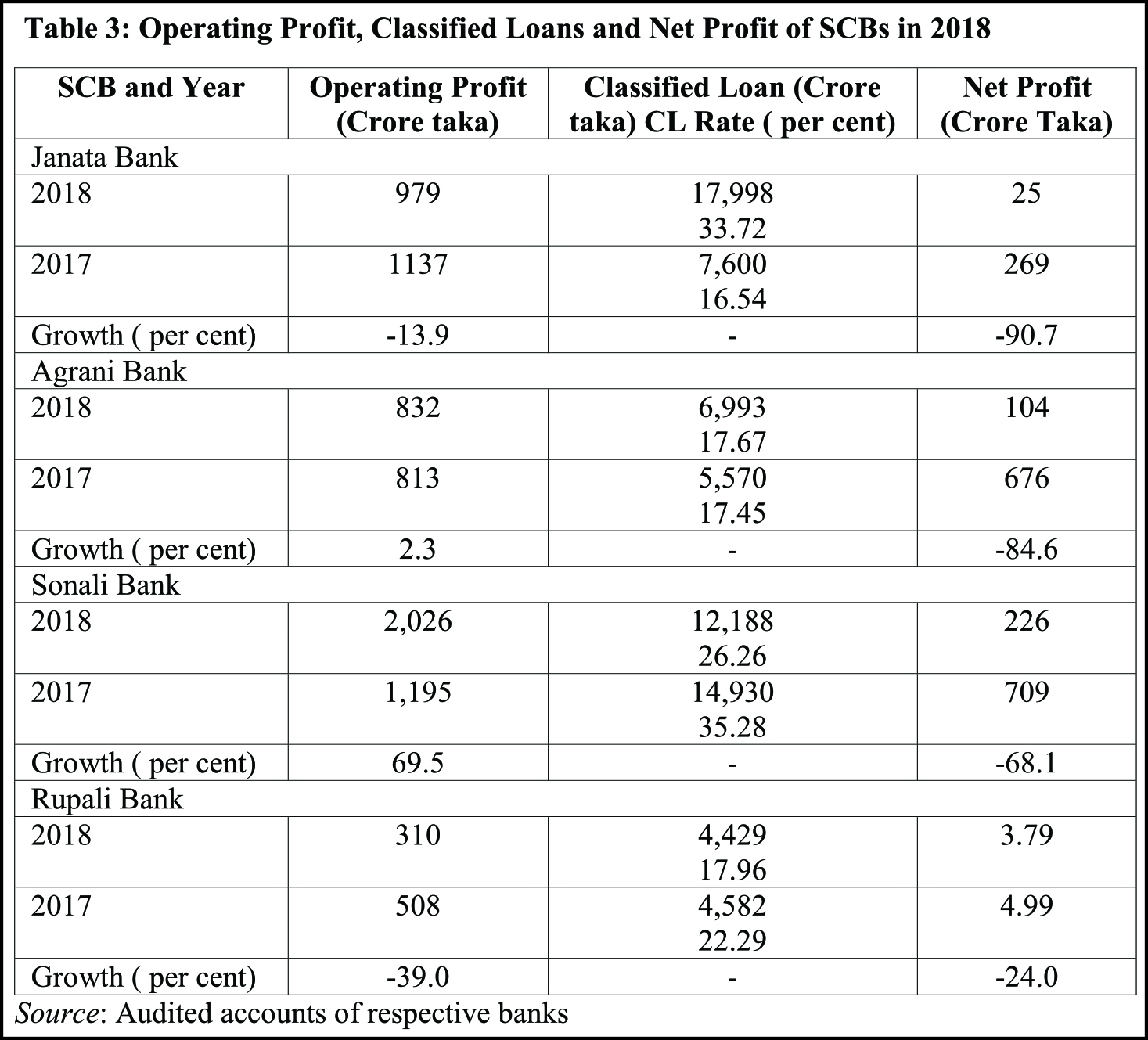

OPERATING PROFIT, CLASSIFIED LOANS AND NET PROFIT: Sonali Bank earned a spectacular operating profit of Tk 20.26 billion (2,026 crore). This was possible because of nearly Tk 34 billion (3,400 crore) earned as investment income. But this achievement of Sonali has been largely overshadowed by its extremely low AD ratio of only 42.4 per cent. The bank is also heavily burdened with classified loan to the tune of Tk 121.88 billion (12,188 crore). Although Sonali has succeeded in bringing down CL rate from 35.28 per cent in 2017 to 26.26 per cent in 2018, the huge provision requirement ate up its large operating profit reducing net profit to Tk 2.26 billion (226 crore), down from Tk 7.09 billion (709 crore) in 2017.

Janata had a surge in their classified loan from Tk 76 billion (7600 crore) in 2017 to Tk 179.98 billion (17,998 crore) in 2018, raising the CL rate from 16.54 per cent to 33.72 per cent. This caused huge erosion in their operating profit of Tk 9.79 billion (979 crore) and net profit came down to only Tk 250 million (25 crore) from a level of Tk 2.69 billion (269 crore) in 2017.

The level of classified loan remained more or less stable in Agrani and Rupali. Amongst all the four SCBs, Agrani registered the lowest CL rate of 17.67 per cent. Agrani earned the second highest level of net profit of Tk 1.04 billion (104 crore), though significantly lower than Tk 6.76 billion (676 crore) earned in 2017.

To sum up, the SCBs performed reasonably well in 2018 in terms of growth in deposits, loans & advances, net income and operating profit even in the face of unfair competition from private banks. In particular, Agrani bank was highly successful in mobilising low-cost deposit and earned highest level of net interest income to the tune of Tk 8.92 billion (892 crores) registering 105 per cent growth. The bank also earned respectable operating profit (Tk 8.32 billion or 832 crore) and posted second highest net profit (Tk 1.04 billion or 104 crores) and lowest CL rate. However, these achievements of the SCBs were largely marred by their limited success in effectively containing the level of classified loans. Addressing this problem head-on, therefore has to be the top priority of the SCBs in 2019.

Dr Zaid Bakht is Chairman, Agrani Bank. zaidbakht@gmail.com