[The second of a three-part article titled Global Trade Turmoil]

Although both the world gross domestic product (GDP) and exports suffered from the 2008 global financial crisis, followed by some recovery during 2009-2012, the export-GDP ratio seems to have stalled and has actually been gradually declining over the past few years. The declining export orientation is most prominent for the group of small states. Small states, because of their nature, are more dependent on international trade, having relatively high export-GDP ratios.

However, the global trade slowdown of the recent past means that this group of countries' average export orientation fell from 61 per cent in 2012 to just 46 per cent in 2017 - that is, a decline of 15 percentage points over just a five-year period. For the least developed countries (LDCs) and sub-Saharan Africa (SSA), average export-GDP ratios fell from around 30 per cent to just 20 per cent during the same period. During the 1980s and 1990s, there was a strong relationship between world GDP and exports. Because of such factors as weak import demand, structural changes in major economies and trade slowdown, the trade-GDP nexus has weakened substantially since the 2008 global financial crisis.

World exports grew on average at 12 per cent during the pre-financial crisis period of 2000-08 accompanied by a 3.3 per cent average economic growth. However, during the most recent period of trade slowdown (2013-17), export growth was just 0.5 per cent, as against economic growth of 2.7 per cent. This weakened trade-GDP association has been highlighted in the post-global financial crisis literature. Several studies suggest that, while a significant part of the sluggish global trade may be attributed to a temporary cycle, a 'new normal' is emerging in which trade growth is unlikely to regain its pre-crisis strength.

The World Bank (2015) analysed the dynamics of trade and income relationship. The study suggested that the declining long-run response of trade to income was affected by several factors including changes in the composition of world trade, particularly the relative importance of goods and service trade; changes in the structure of trade that is associated with the international fragmentation of production; changes in the composition of GDP, particularly the share of investment in aggregate demand; and changes in the trade regimes, especially the rise in protectionism. According to the analysis, the high long-run trade elasticity of the previous decades was supported by the expansion of the global value chain, which decelerated from the 2000s because of the factors mentioned above. Data analysis reveals that GDP and export growth rates were lower during 2012-17 than during the pre-crisis period 2000-08. Moreover, GDP association in developing economies has weakened substantially from 1.72 during 2000- 08 to 0.87 per cent during 2013-17. The slowdown since the global financial crisis of 2008 has received a lot of attention. One important question is whether the slower trade growth and its weaker relationship with GDP is a structural change or a temporary phenomenon. Estimates presented by the World Bank (2015) show that in the period 1986-2000, a 1.0 per cent increase in global GDP was associated with a 2.2 per cent increase in the volume of trade. This elasticity declined to just 1.3 per cent in the subsequent period of 2000-2013. On the other hand, the short-run elasticity estimates increased over time from 2.8 per cent for the 1986-2000 period to 3.4 per cent for the period 2000-2013. The speed of convergence to the long-run equilibrium trade-GDP relationship was much higher in the 1990s than in the 2000s.

Another way of ascertaining export-GDP linkages is to consider the contribution of the export sector in a country's overall economic growth through the national income accounting process. This is likely to be a better approach than just focusing on the export-GDP ratio, in which exports are measured in gross terms (thus include raw materials and imported inputs) while GDP is a measure of value added (after excluding raw materials). In national income accounting exercises, GDP from the expenditure side is decomposed into five macroeconomic components viz. household consumption, government expenditure, investment, exports and imports. It allows for the assessment of the relative contribution of any of these components and its evolution overtime.

For small states, economic growth in the most recent period of 2012-16 was lower than that of any period since the 1990s. Given the size of the overall growth, the contribution to exports remains prominent. For instance, during 2001-07 about 70 per cent of GDP growth was attributed to exports. The comparable figure for 2012-16 was almost identical. This suggests that small states continue to depend on exports for their overall economic activities despite falling global trade. Therefore, a sustained deceleration in global trade flows will seriously undermine their growth prospects irrespective of a relatively high contribution of the export sector. Sub-Saharan African countries exhibit an interesting evolution in the contribution of exports to their economic growth. It is found that export contribution to GDP growth for the period 2001-07 was about 23 per cent, which plummeted to only 2.5 per cent in 2012-16 owing to the trade collapse of 2015 and 2016.

The relative contribution of exports was most prominent during 2008-11 when overall economic growth fell but exports were aided by still-buoyant commodity prices. However, as economic growth declined and commodity prices fell, export contribution to growth became almost non-existent. During 2012-16, SSA's growth was largely due to growth in consumption expenditure. For LDCs, export contribution to growth was just about 20 per cent during the growth boom of 2001-07. The falling growth during 2008-2011 actually resulted in a higher export contribution of about 25 per cent. However, in the subsequent period lower growth accompanied by weak exports resulted in export contribution falling to less than 19 per cent. The above results are generally in line with the results of long-run elasticity estimation. For small states, export has a slightly declining contribution in GDP growth from 2008, implying a weakening export-GDP association but only by a small extent. Therefore, it can be inferred that, although small states are being marginalised in world trade, only a part of their lower export growth is due to the structural changes. Most of its decline in export growth is caused by cyclical effects. However, for SSA the decline in export expansion is due to a greater extent to structural changes. Because of the rebalancing and weakened import demand, SSA's income elasticity of export has declined substantially. As for LDCs, the more or less similar contribution of exports to GDP growth is maintained during high-growth and low-growth periods.

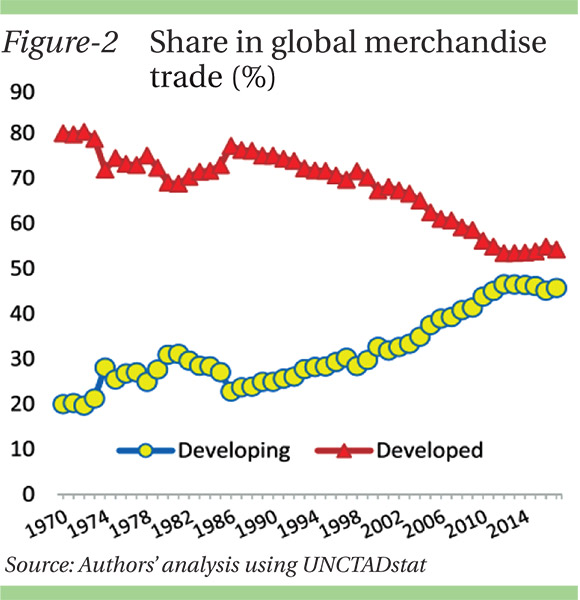

SOUTH-SOUTH TRADE AND GLOBAL TRADE CRISIS: One of the major developments in the world economy over the past three decades or so has been the rapidly growing share of the developing countries. Indeed, the rise of developing countries as significant drivers of global growth and trade has been recognised as the defining features of globalisation. Another important related trend is that increasingly more trade is taking place between developing countries. While traditional developed country markets remain important, developed countries' markets are also becoming prominent sources for developing countries. It is of interest whether or not these developments have been affected by recent global trade turmoil, with any implications for small states, LDCs and sub-Saharan African countries. The data provided by UNCTAD (United Nations Conference on Trade and Development) show that since the early 1970s developing countries have on average grown at a faster rate than developed countries. There has been a secular decline in the relative significance of developed economies in world GDP from close to 82 per cent in the early 1970s to just 61 per cent in 2017 (Figure 1). During the 37 years between 1971 and 2008, developed countries' share declined by 13 percentage points, and in the nine years after the global financial crisis it fell by another 7.0 percentage points. That is, since the global financial crisis in 2008, developing countries' share in world output has risen from 31.6 per cent to about 39 per cent in 2017. The prolonged recession in Europe and the USA in the aftermath of the financial crisis contributed to the apparent acceleration of the diminishing relative significance of developed countries. This is despite China's slowing down to a much lower rate of economic growth and other large developing countries such as Brazil and South Africa also demonstrating dismal growth performances. Asian developing countries have shown consistently strong growth performance, and SSA demonstrated impressive growth performance from the late 1990s through the 2000s before slowing down to a very low level during 2012-17. Buoyant economic growth in many developing countries from the mid-1990s until relatively recently resulted in their remarkable export expansion. In fact, developing countries' share in global merchandise exports grew faster than their share in GDP. Between the mid-1990s and 2008 the Global South's share increased from around 25 per cent to 40 per cent (Figure 2). Even after the global financial crisis their share continued to rise and reached 46 per cent by 2014. However, the trade slowdown during 2015 and 2016 has clearly affected this trend in the developing countries' share, as is obvious in Figure 18. Falling commodity prices, weakened import demand from some emerging economies including China, uncertainty in trade policy environment at the global level, etc., have all contributed to this. In 2017, the aggregate merchandise export of developing economies stood at US$7.8 trillion, which was still lower than the pre-slowdown (2014) level of $8.5 trillion. Along with the rapid growth in GDP and export volume over the past two decades or so, trade between developing countries (South-South trade) has seen a phenomenal rise. Between 2000 and 2008, trade between developing countries' share of total global trade rose from 13.5 per cent to more than 21 per cent (Figure 3). This was a period in which trade between developing countries expanded much faster owing to the buoyant economic growth of large developing countries such as the BRICS (Brazil, Russia, India, China and South Africa) nations as well as many other developing countries including those in SSA. The rising significance of the Global South in world trade continued despite the global financial crisis of 2008. However, after 2012 the share of South-South trade became stagnant before registering a slight fall in 2016. The relative significance of the trade between developed countries in world trade, however, steadily declined from more than 50 per cent in 2000 to about 37 per cent in 2012, and since then it has been stable around this level. Interestingly, the South-North share of the global merchandise export has remained almost at the same level of around 35 per cent over the past three decades.

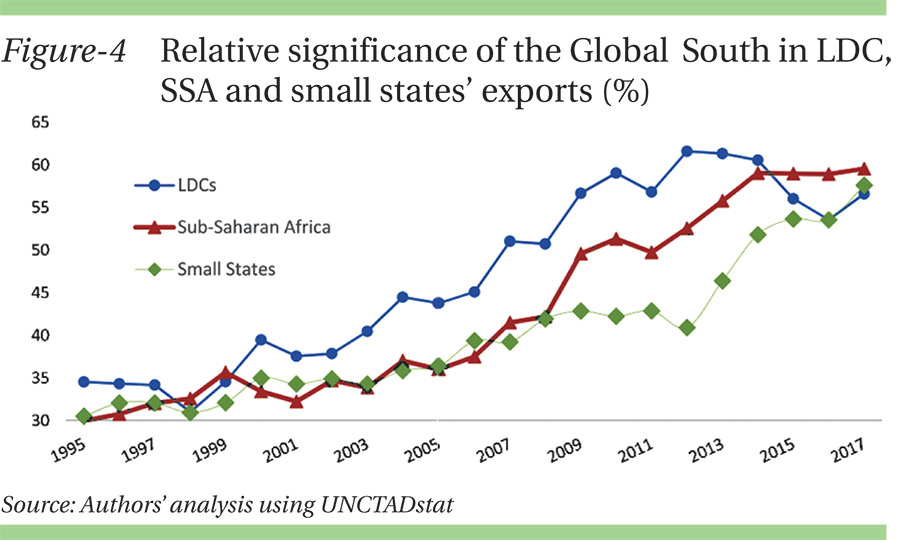

As can be seen from Figure 20, in the late 1990s South-South trade grew on average by less than 3 per cent per year, whereas during 2000-08 it expanded rapidly at a rate of close to 20 per cent per annum against the corresponding growth of 12 per cent for global trade. In the immediate post-financial crisis period of 2009-2011, South-South trade growth was 13.5 per cent, largely aided by a major recovery in 2011. However, from 2012, in the years of trade slowdown, South-South merchandise trade remained almost stagnant at less than a 1.0 per cent annual average growth rate. The role of South-South trade in relation to trade flows involving LDCs, small states and sub-Saharan African countries is also important. In 2017, the proportions of SSA, small states and LDC merchandise exports destined for the Global South were 61 per cent, 59 per cent and 57 per cent respectively (Figure 4). Therefore, the world's poorest, smallest, most vulnerable economies are substantially dependent on the Global South for their export revenues. Since the early 2000s, these shares have been steadily increasing, unaltered by the 2008 global financial crisis. Even during 2012-17 the significance of developing countries in SSA's and small states' exports continued to rise from 52.5 per cent to 60 per cent and from 41 per cent to 58 per cent respectively. For LDCs, the export share of the Global South in 2017 increased to 57 per cent from 53 per cent in 2016, although there was some decline in this share during the trade slowdown period of 2015-16.

In 2017, of US$294 billion SSA exports, $180 billion (61 per cent) was destined to developing countries. Exports from the Global South to SSA stood at $236 billion, as against the $111 billion exports of developed countries. Similarly, 58 per cent of all small states' exports went to the developing world and their import sources (in terms of absolute value) were almost equally divided between developed and developing countries. For LDCs, their trade (exports plus imports) with developing countries was $315 billion in comparison with their trade of $125 billion with developed economies.

Dr Mohammad A Razzaque, is Senior Fellow for International Trade and Globalisation at Bloomsbury Institute London, UK, and Director, Policy Research Institute of Bangladesh (PRI).

Dr Syed Mortuza Ehsan is Assistant Professor, Department of Economics, North South University, Dhaka.

Excerpted and slightly abridged from The Commonwealth International Trade Working Paper titled ''Global Trade Turmoil: Implications for LDCs, Small States and Sub-Saharan Africa' written by the authors.