Bangladesh and India saw manufacturing revival in the third quarter of 2021, thanks to the western brands' search for alternative sourcing to offset the capacity losses due to lockdowns in Southeast Asia and China's manufacturing slowdown, according to a latest report.

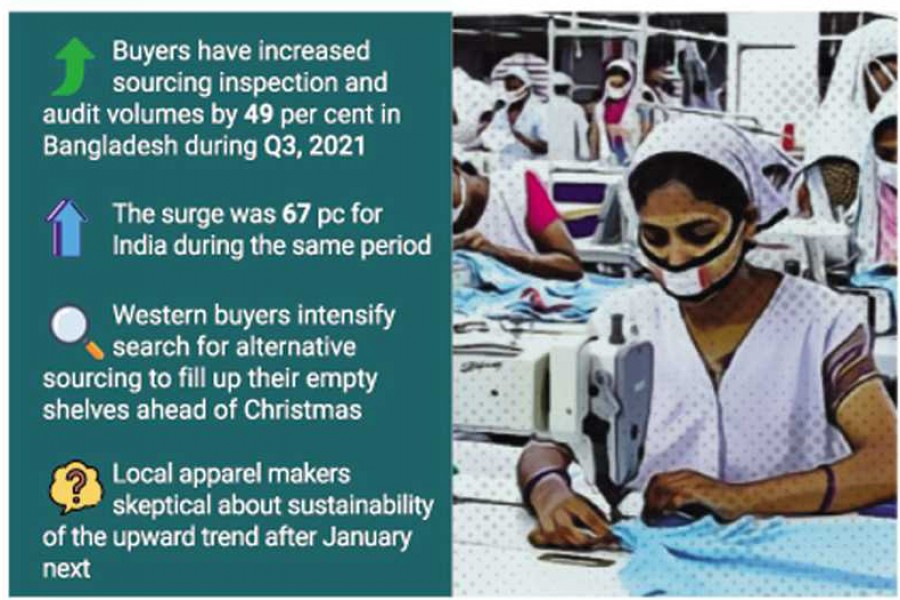

Buyers have increased their garment sourcing inspection and audit volumes by 49 per cent in Bangladesh during Q3 of 2021 compared to the pre-pandemic period of Q3 in 2019, according to QIMA quarterly report published on Friday.

The surge was 67 per cent for India during the same period.

QIMA, operating in 85 countries, is a quality control, supplier auditor, and product testing and inspection provider and helps more than 15,000 global brands, retailers, manufacturers, and food growers achieve quality excellence.

The QIMA report showed that the demand was particularly strong among the US-based buyers.

"Bangladesh also saw demand for inspections and audits expand in Q3 2021, with orders from US-based brands up by 88 per cent in August and 108 per cent in September, compared to the corresponding month of 2019."

With the double whammy of lockdowns in Southeast Asia and China's manufacturing slowdown, the buyers have been hard pressed to seek alternative production capacities in Q3, 2021. South Asia's sourcing hubs have proven vital in their search, it explained.

Notably, while South Asia is a time-tested sourcing hub for textiles and apparel, demand for its manufacturing capacities was not limited to this product category.

QIMA data for Q3, 2021 showed growth across a wide variety of consumer products, including homeware and gardenware, food containers and toys.

Despite the temporary turnaround, China's relative share in the sourcing portfolios of the US and European brands remains lower than in 2019, suggesting that even given a renewed interest in China, brands continue to diversify their buying between other high-priority geographies, the report added.

Compared to pre-pandemic 2019, inspection and audit demands in Vietnam contracted 36.5 per cent in Q3, 2021, it said, adding that in a country where garment and footwear make up the majority of the exports, over one third of apparel factories temporarily closed in recent weeks due to Covid-19.

"As we rapidly approach a peak holiday season hindered by unprecedented supply chain chaos, it will be interesting to see if India and Bangladesh can continue to pick up the sourcing shortfall to meet growing demand as Western economies emerge from retail hibernation," the report added.

Talking to the FE, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) president Faruque Hassan said the demand for apparels have increased in recent months with the improved global Covid-19 situation that also pushed the buyers to fill up their retail shelves those remained almost empty for the last one and a half years due to Covid-19 pandemic.

He expected a further rise in work orders by apparel brands here in Bangladesh due to electricity cuts in China and factory closure in Vietnam.

Local spinners also predicted that cotton import might reach 9.0 million bales in the current fiscal year (FY), buoyed by the increase in apparel orders from the global buyers.

More than 75 per cent of the country's exportable readymade garments are cotton based. Bangladesh imported 8.2 million bales of cotton in the last FY, up from 7.5 million bales in 2019-20, according to Bangladesh Textile Mills Association (BTMA).

Echoing the BGMEA president, SM Khaled, managing director of Snowtex Outwear Ltd, informed that some orders were also shifting from Myanmar to Bangladesh.

"They (buyers) are sourcing from us to cater the growing demand ahead of Christmas," he said, adding for a close eye as to whether the trend would sustain after the eve of Christmas. He noted that the trend of placing orders might witness a fall after January next.

The country fetched US$9.05 billion from RMG exports during July-September period of FY 2021-22, recording a 11.48 per cent growth over the $8.12 billion earnings during the corresponding period of last FY, according to the Export Promotion Bureau data.

RMG exports recorded a 41.66 per cent year-on-year growth in September last with the highest $3.41 billion earnings.