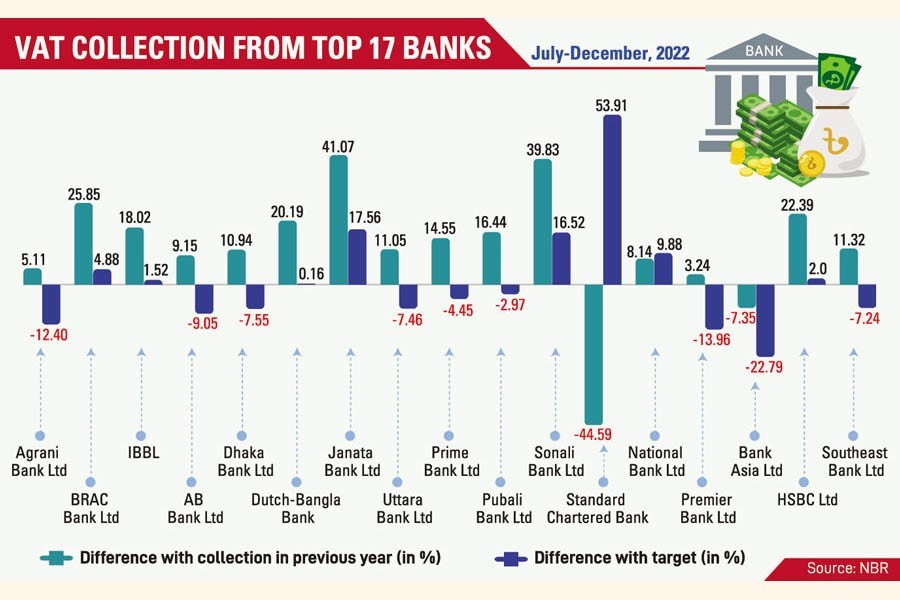

Collection of value added tax (VAT) from 17 large banks fell nearly 7.0 per cent or Tk 1.53 billion short of target for the first half of the current fiscal year (FY2022-23).

Until December 2022, the large taxpayers unit (LTU) under the VAT wing of the National Board of Revenue (NBR) collected Tk 20.87 billion during July-December period of FY '23 against the period's target of Tk 22.41 billion.

In the same period last year, the collection stood at Tk 18.76 billion, according to latest data from the NBR.

Officials attributed the less-than-expected earnings to a sort of uncomfortable situation in the banking sector amid allegations of irregularities that eroded depositors' confidence and discouraged people to seek services from the banks.

However, the collection of consumers' tax grew by 11.25 per cent in the H1 compared to that of the corresponding period last year.

Agrani Bank, AB Bank, Dhaka Bank, Uttara Bank, Prime Bank, Pubali Bank, Standard Chartered Bank, National Bank, Premier Bank, Bank Asia and Southeast Bank paid less than what the NBR expected from these banks in H1.

Standard Chartered Bank and Bank Asia paid 44.59 per cent and 7.35 per cent less than the amount of VAT they paid in the same period last year.

Islami Bank Bangladesh Limited paid the highest amount of VAT worth Tk 3.34 billion, followed by Sonali Bank Tk 2.99 billion.

Dutchbangla Bank paid Tk 1.80 billion, Brac Bank Tk 1.59 billion, Pubali Bank Tk 1.45 billion, Agrani Bank Tk 1.29 billion, Janata Bank Tk 1.11 billion, and Standard Chartered Bank Tk 1.16 billion.

A senior revenue board official said the VAT wing usually receives a significant amount of revenue from the core banking services, including opening of Letters of Credit (LCs).

As opening of the LCs declined in the recent past, the banks got less commission, resulting in less-than-expected amount of VAT, he added.

In H1 of the current FY, LC opening dropped by 14 per cent year-on-year while settlements declined by 9 per cent, according to the Bangladesh Bank (BB) data.

The NBR official said the austerity measure on promotional expenses of banks is another reason for not achieving the target of VAT collection in the H1.

He, however, said the LTU achieved a moderate growth in H1 compared to that of last FY's H1 as the collection of excise duty jumped sharply.

In the current budget, the government has revised up the excise duty on bank deposits.

VAT officials said that the fall in LC opening was mainly due to the shortage of US dollars in the country and the BB's restrictions on import of non-essential items.

Also, import of intermediate goods, capital machinery and industrial raw materials also dipped in the H1, when LC opening for importing industrial raw materials declined by 27 per cent to $12 billion, according to BB data. The BB's instruction to commercial banks to cut operational and promotional expenses also left an adverse impact on the desired level of VAT collection, the NBR official said.

From July 2022, the commercial banks started reducing the use of electricity and energy consumption as part of the austerity measures.

The BB asked the banks to cut back allocations for the use of petrol, diesel, gas and lubricant by at least 20 per cent within FY '23.