After a seven-month pause, the government is all set to resume importing liquefied natural gas (LNG) from global spot market anytime soon with the fund crunch cushioned by the latest gas-tariff hike.

"We've initiated talks to resume LNG import from the spot market," Petrobangla Chairman Zanendra Nath Sarker told the FE Thursday, a day after the natural-gas rates were jacked up by executive order.

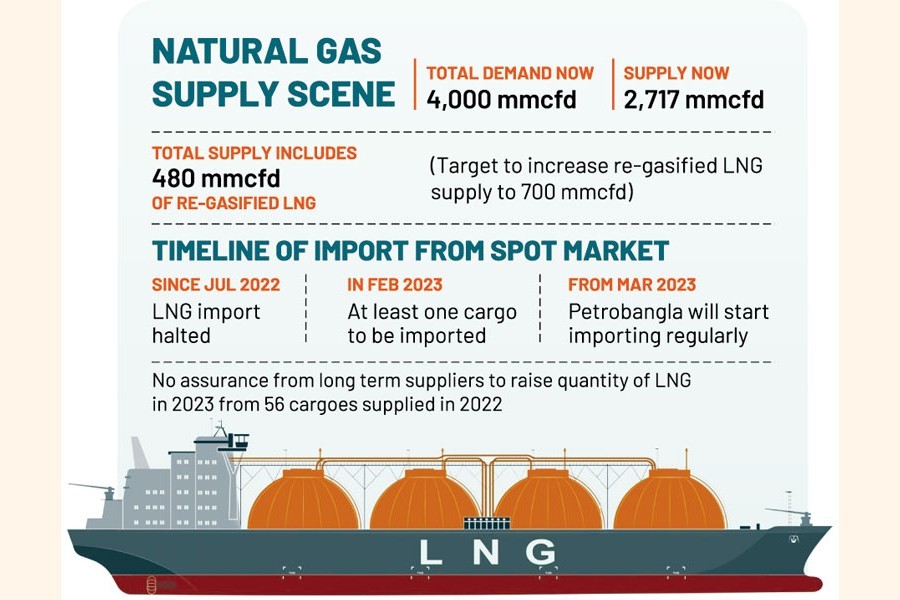

"Efforts are there to import at least one LNG cargo from the spot market in February," he said, adding that the petroleum corporation would start importing the liquid gas regularly from the spot market in March.

The target is to ramp up the country's overall natural-gas output to more than 3,000 million cubic feet per day (mmcfd) from the current level of around 2,670mmcfd -- as industries seek uninterrupted gas supply to keep the wheel rolling on a full scale in the process of a rebound.

"We'll increase the supply of re-gasified LNG by around 45.83 per cent to around 700mmcfd from the current level of 480mmcfd," he said.

LNG re-gasification, however, increased by 14.21 per cent to 480mmcfd on Wednesday compared to previous day's 422mmcd, according to Petrobangla.

The government raised the natural gas tariffs by up to 178.88% through an executive order on Wednesday, only six months after the previous hike, apparently to secure funds for importing increased quantities of LNG and to meet the domestic demand.

The Energy and Mineral Resources Division (EMRD) under the Ministry of Power, Energy and Mineral Resources (MPEMR), after issuing a gazette notification on new gas tariffs, clarified that the rates had been increased to ensure uninterrupted supply of gas to the consumers.

The tariffs were raised to adjust the government subsidies, said the gazette notification.

Bangladesh has ceased importing LNG from the spot market since July 2022 amid its price volatility and fund constraints in the wake of a global crisis.

Despite repeated attempts, the country could not win assurance of getting increased quantity of LNG in 2023 either from two of its existing long-term suppliers -- Qatargas, and Oman Trading International, or OTI, which is now renamed OQ Trading - as both stood 'rigid' to provide a total of 56 LNG cargoes this year as they supplied in the past year during January to December 2022, the official added.

Worsening woes of the gas consumers, Bangladesh's natural gas supplies from local gas fields are also on the wane, the Petrobangla official added.

The country's new increased gas-tariff rates came weeks after the businesses had expressed willingness to pay more for gas, the official noted.

Sources said a twin-shock from the Ukraine war -- energy blockade and dollar dearth for high commodity prices -- forced Bangladesh to cease LNG buy from the volatile spot market last year.

The government also initiated austerity measures shutting all shops and shopping malls after 8.0pm every day from July last year after putting the moratorium on import of expensive spot LNG. Countrywide power outage was also initiated in early July as an immediate outcome of the government's austerity measure coupled with less energy supply to industries and power plants.

The state-run Petrobangla, the country's parent gas company, is importing five LNG cargoes in January from two long-term suppliers,

Bangladesh's purchasing cost of LNG from the OQ currently hovers around $12 per million British thermal unit (MMBtu).

The country's overall natural gas supply now hovers around 2,717mmcfd with re-gasified LNG of around 480mmcfd, against total demand for around 4,000mmcfd, according to Petrobangla data.