Bangladesh's syndication-loan market remains almost stagnant in the last few years despite having long been recognised as a good tool to ease lending risks, sources said.

Syndication finance is one in which two or more banks or financial institutions-the syndicate of lenders-contract with a borrower to provide a loan on common terms and conditions governed by a common document or set of documents.

According to a report published by Allied Market Research, the global syndicated-loan market generated $1018.7 billion in 2021, and is projected to reach $3798.4 billion by 2031, growing at a compound annual rate (CAGR) of 14.2 per cent from 2022 to 2031.

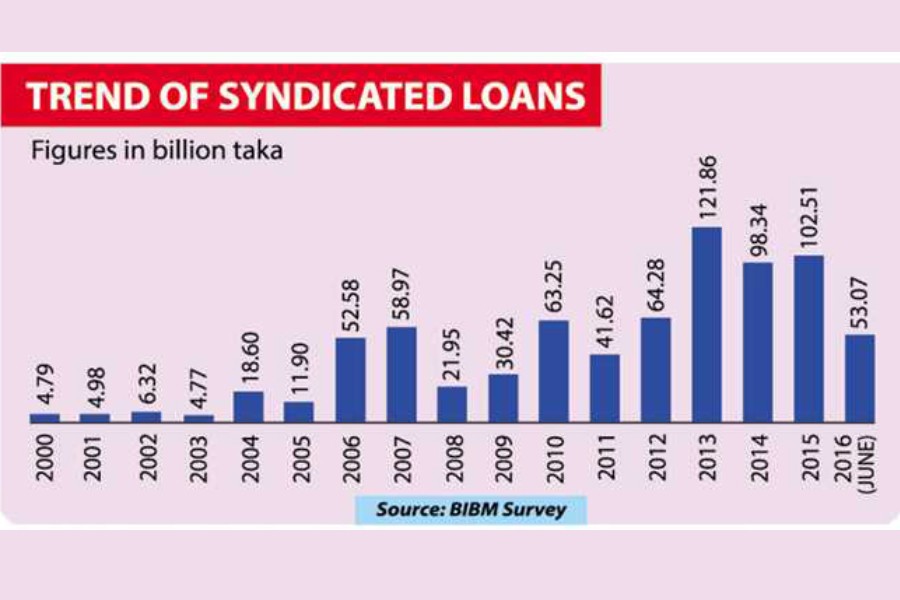

On the home front, a recent survey conducted by Bangladesh Institute of Bank Management (BIBM) revealed, the syndicated loans were over Tk 4.79 billion in 2000, wherefrom it had climbed up to Tk 53.07 billion in June 2016.

The highest such loan growth stood at Tk 121.86 billion in 2013. Thereafter it saw a falling trend in 2014 and 2015. The syndicated loan remained over Tk 98.34 billion in 2014 and Tk 102.51 billion in 2015.

"Since 2000, the trend in such loans has experienced ups and downs," says the study report.

People familiar with the developments listed political and infrastructural problems, cumbersome and time-consuming processes, lack of skilled human resources and proper ease-of-doing- business atmosphere as some of key bottlenecks banks and non-bank financial institutions (NBFIs) are facing in loan syndication.

Foreign commercial banks are directly providing loans to the private sector which may affect, to some extent, their attributes.

They too identified key person- dependency and lack of corporate governance as some major blows to popularising the financing method.

In Bangladesh, most of the syndication deals have been undertaken for raising term loans for project financing.

A few of the syndication deals have also been undertaken to raise fund as preference shares/quasi-equity.

The BIBM study says a total of Tk 765.29 billion was invested by 47 commercial banks and non-banking financial instructions through loan syndication against 398 projects during the period starting from 1995 to June 2016.

The survey data, as reported by the sample banks, show that only 0.64 per cent of the total syndicated loans disbursed are classified compared to 10.06 per cent of all loans of scheduled banks.

"Our regulatory bodies still need to simplify processes for private- and public-sector entities to take up large-scale projects requiring syndication financing," it says.

They also stressed a specific regulatory guideline for syndication loans in greater interest of the financial sector.

There are no latest data available with the Bangladesh Bank (BB).

They also put emphasis on the formation of a data centre soon in this regard.

They suggest building a common platform amongst the stakeholders of loan syndication to improve its process and creating more opportunities for large-scale financing.

Talking to the FE, Kazi Farhan Zahir, managing director & CEO of NDB Capital Limited, said introduction of policies supporting investment in infrastructure, manufacturing industries and synergy among the policies delivered by regulatory bodies would help the growth of syndication financing in Bangladesh.

"Knowledge-sharing sessions engaging corporate bodies, financiers, regulatory bodies would be key to creating a supportive ecosystem," he added.

There is an increasing trend in loan syndication at this bank, says Professor Dr Md. Salim Uddin, Chairman of the Executive Committee of Islami Bank Bangladesh Ltd.

IBBL promotes and prefers participating in syndicated loan disbursement, he said.

The central bank should make a separate policy on the crucial product of the banks and give a directive to the banks and nonbank financial institutions issuing some conditions such single bank can invest Tk 1000 but it will involve in the loan syndication within two years, said Dr Salim Uddin, who is also Chairman of Bangladesh House Building Finance Corporation.

The central bank should take required actions to make it more popular among the banks and non-bank financial institutions, according to the Chairman of the Executive Committee of Islami Bank Bangladesh Ltd, and Professor, Accounting Department, the University of Chittagong.

Zafar Alam, Managing Director& CEO of Social Islami Bank Limited (SIBL), said the growth of such loans has been slow in recent times mainly due to the Russia-Ukraine war.

"The recent negative news stories on the banking sector may be one of chief reasons for slower growth of the large- loan facility," Mr Zafar told the FE.

Saying that his bank got involved with some large projects through such financing, Alam hopes the scenario will be over soon as export and inflow of remittance are growing faster.

Deposit in different banks is also witnessing a rise, the SIBL MD added.

Dr Khondaker Golam Moazzem, research director, Centre for Policy Dialogue (CPD), noted that the limited companies were taking large projects which could impede the growth of such loans.

Describing the stagnant state of such large loans, Dr Moazzem said the central bank recently relaxed conditions on single-borrower loans in order to support industrial growth, which may affect it.

With a view to containing the concentration of loans among a small group of people, the BB reduced the single-borrower- exposure limit to 25 per cent of a bank's capital from 35 per cent recently.

"Our country is yet to ensure the infrastructure development fully," he also explains.

Foreign commercial banks are providing loans to local companies that might also have hurdles on the financing, the CPD research director told the FE.

Mentioning that such financing remains in a lull in the last few years, Selim R. F. Hussain, managing director & CEO of BRAC Bank, said he did not see such big deals for many days as the customers are not expressing their interest to this end.

Describing that the country's private- sector -credit growth stands at 13 to 14 per cent, Selim, who is also vice president, the Association of Bankers, Bangladesh (ABB), said the Covid-19, Ukraine-Russia war and present economic situation might have an effect for its sluggish growth.

However, Hussain hopes the situation will be over and such financing will grow further in the coming days.