Now the regulator intervenes to tame Bangladesh's volatile foreign-exchange market as the taka kept tumbling down in exchange with the US dollar lately put on a free float.

Bankers said the central bank reversed its stance through intervening unofficially in the country's foreign-exchange market Tuesday as the value of the local currency kept falling almost continuously in the last couple of days.

Under the Bangladesh Bank (BB)'s latest moves, all the authorized dealer (AD) banks have been advised to quote their exchange rates uniformly instead of individually as allowed earlier.

The AD banks quoted the US currency at maximum Tk 93.00 for the sale of bills for collection, generally known as BC, for settling import payments on Tuesday in line with the BB advice.

Earlier on Monday, majority banks quoted the greenback at maximum Tk 93.00 for the BC selling while a few quoted maximum at Tk 93.95 for their customers, according to market operators.

On the other hand, the banks also quoted dollars at maximum at Tk 92.00 on the day to remitters as well as realised export proceeds or telegraphic transfer (TT) clean of their funds.

"We're asked by the central bank verbally in the morning today (Tuesday) not to fix the BC selling rate above Tk 93.00," a senior treasury official at a leading private commercial bank (PCB) told the FE while explaining the latest situation on the market.

When contacted, a senior BB official told the FE that the central bank officials only communicated top bankers' commitment at a meeting for fixation of BC selling rate.

"We need to do that for keeping the market stable," another central banker said while replying to a query.

Earlier on June 02, the BB allowed the AD banks to fix their exchange rates individually in response to their appeal aiming to restore stability on the country's foreign-exchange market.

"We've been maintaining managed floating exchange-rate regime since 2003," Toufic Ahmed Chowdhury, former director-general of Bangladesh Institute of Bank Management (BIBM), told the FE.

"It's a floating-rate regime but the central bank may intervene into the market," Dr Chowdhury notes.

Exchange-rate fixation is not a matter of hiding, Md Nurul Amin, former chairman of the Bangladesh Foreign Exchange Dealers' Association (BAFEDA), said, adding that everybody has the right to know about the exchange rate.

"The central bank should be more open about fixation of exchange rate," the senior banker said while replying to a quarry.

The market operators expressed their worry over the uniform exchange rate, saying that it would divert the flow of inward remittances to the informal channels.

The exchange rate of cash dollar against the local currency on the open market, known as kerb market, stood at around Tk 97 Tuesday mainly due to lower supply of the greenback.

"The flow of inward remittances may switch to informal channels from official ones if the gap continues over a longer term," a senior official of a leading private commercial bank told the FE.

He also urges the policymakers to take effective measures to minimise the gap between the two rates for maintaining the existing trend in remittance.

Meanwhile, the Bangladesh Taka (BDT) depreciated further against the US dollar mainly due to higher demand for the greenback for settling import-payment obligations.

The local currency lost its value by 30 paisa on the inter-bank foreign-exchange market on the day, according to market operators.

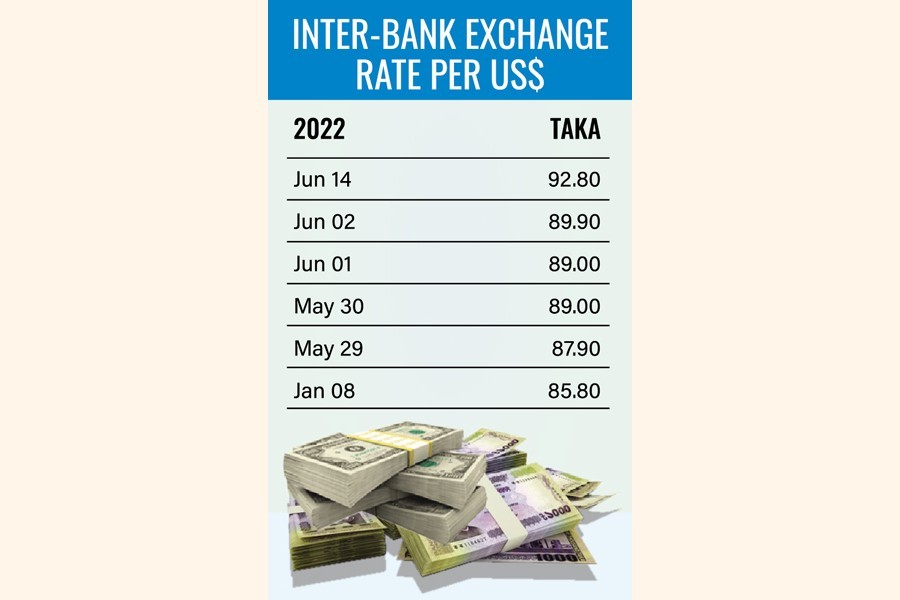

The US currency was quoted at Tk 92.80 each on the day against Tk 92.50 on the previous working day. It was Tk 89.90 on June 02.

In the meantime, the local currency has lost its value worth Tk 7.0 or more than 8.0 cent since January 2022. The dollar was traded at Tk 85.80 on January 08 last.

The BDT, however, has depreciated by Tk 3.80 or 4.27 per cent from June 02 till June 14.

However, the central bank continued providing its foreign-currency support to the scheduled banks in a bigger way for managing the forex- market volatility.

It sold $64 million directly to three banks on Tuesday to help them meet the growing demand for the greenback.

Earlier on Monday, the central bank sold $105 million to banks on the same ground.

The BB has so far injected $6.86 billion from the reserves directly into commercial banks as liquidity support for settling their import-payment obligations in the current fiscal year, FY 2021-22.

Bangladesh's forex reserves came down to $41.53 billion on Tuesday from $41.55 billion of the previous day - following higher sales of the greenback from the reserves.

The local currency is maintaining a depreciating trend - mainly due to higher outflow of foreign exchange - following a hefty growth in import payments amid global price rises compared to the inflow in the last few months.

The mismatch has resulted in widening current-account deficit in a macroeconomic imbalance that prompts the government to adopt some thrift measures and put baits on offer for netting foreign exchange to secure the depleting reserves.